Tax Strategies Behind Roth IRA Conversions

This post was last updated on February 17, 2026, to reflect all updated information and best serve your needs.

Saving money for retirement is critical, but when it comes to the types of accounts you have, it can start to get a little confusing.

Individual retirement accounts (IRAs) are one of the most common savings vehicles, and there are two primary types: Roth and Traditional.

Assuming that you don’t want more of your money going to Uncle Sam, you may need to utilize various tax strategies. Specifically, we’ll review your options for converting a traditional IRA to a Roth.

Table of Contents

Roth vs. traditional IRAs: A Primer

Before you can understand the various advantages (and potential pitfalls) of a Roth IRA conversion, you need to know the primary differences between the two accounts. There's a little more than just taxes now versus taxes later.

Contribution Limits

Both IRA accounts limit the amount you can put in within a given tax year. In 2026, the maximum total is $7,500. However, if you’re over 50, you can add another $1,100 to “catch up” for retirement. Keep in mind that the total is across both kinds of accounts - you can’t do $7,500 per IRA. The total direct contribution between Roth and traditional IRAs is $7,500 ($8,600 with catch-up contributions).

Traditional IRAs - Tax Deductible

When you put money away in a conventional IRA, you can deduct the funds from your modified adjusted gross income (MAGI) as long as you qualify. This means that your tax bill for any given year could be reduced. You can use this to avoid paying more in taxes if you're close to entering a higher tax bracket.

Traditional Income Restrictions

There are no income restrictions to contribute to a traditional IRA. However, there are income restrictions on whether or not you can deduct the contributions from your taxes.

Roth IRAs - Taxes Today

Roth IRAs function in the opposite way from traditional IRAs. You contribute money after taxes are paid, then your money grows tax-free.

Roth Income Restrictions

There are income limits on direct contributions to a Roth IRA. For 2026, individuals with modified adjusted gross income (MAGI) of at least $153,000 will be subject to restrictions. Anyone earning over $168,000 cannot contribute directly to a Roth IRA. For couples, restrictions begin at $242,000 and phase out entirely at $252,000.

In both cases, you won't pay taxes while your money is growing. However, you'll have to pay income taxes on withdrawals from a traditional IRA in retirement.

Distributions

IRAs are designed to save money for retirement. The IRS will impose stiff penalties if you withdraw funds before you're allowed to. In most cases, a qualified withdrawal starts at age 59 1/2. For early or nonqualified withdrawals, you'll have to pay taxes on the income and a 10% penalty.

That being said, you can usually withdraw money from your IRA at a younger age for specific life events, such as buying a house or paying for medical bills. You'll need to speak with your financial advisor to determine if you qualify for penalty-free withdrawals.

Traditional Withdrawals

Traditional IRAs are subject to required minimum distributions (RMDs). Most tax-deferred (commonly known as "traditional") retirement accounts have RMDs, and they are calculated based on life expectancy. The rule used to be that anyone over age 70 1/2 had to start taking RMDs, but the law changed in 2019 and again in 2022. Individuals can now wait until 73 (75 starting in 2033) before they're subject to RMDs.

When you withdraw funds from your IRA in retirement, you will be taxed at your current ordinary income rate. For many retirees, taxable earnings are substantially less in retirement, so you could end up with significant tax savings. However, this could affect how your Social Security is taxed.

Roth Withdrawals

Roth IRAs are not subject to RMDs. The money in your account can continue to grow tax-free for as long as you live. This also means you can pass the funds to your heirs tax-free. However, there may be requirements for your spouse or other beneficiaries to withdraw the funds from the inherited Roth IRA.

In general, Roth IRA contributions can be withdrawn tax-free and penalty-free. Taxes and fees will apply only to earnings from the account. However, as with a traditional IRA, these penalties only happen if you’re younger than 59 1/2 or the account hasn't met the 5-year rule.

Qualified withdrawals from Roth IRAs aren't included in your income and won't affect things like Social Security or Medicare surcharges.

Why Convert to a Roth IRA?

As you can see, there may be a benefit to contributing more to a Roth IRA. Once you reach the required age, you can withdraw all your cash without incurring taxes or fees. Not only that, but you can let your money grow longer, as there are no RMDs.

However, not everyone can take advantage of these accounts. Let’s look at a few scenarios to help you understand when to convert to a Roth and when it might be a bad move financially.

How Much to Convert to Roth

There are also several options for how much to convert to Roth. In many cases, you'll want to spread Roth conversions out over several years by "filling" tax brackets in low-income years. We discuss this in more detail in our article on calculating the right amount of Roth conversions.

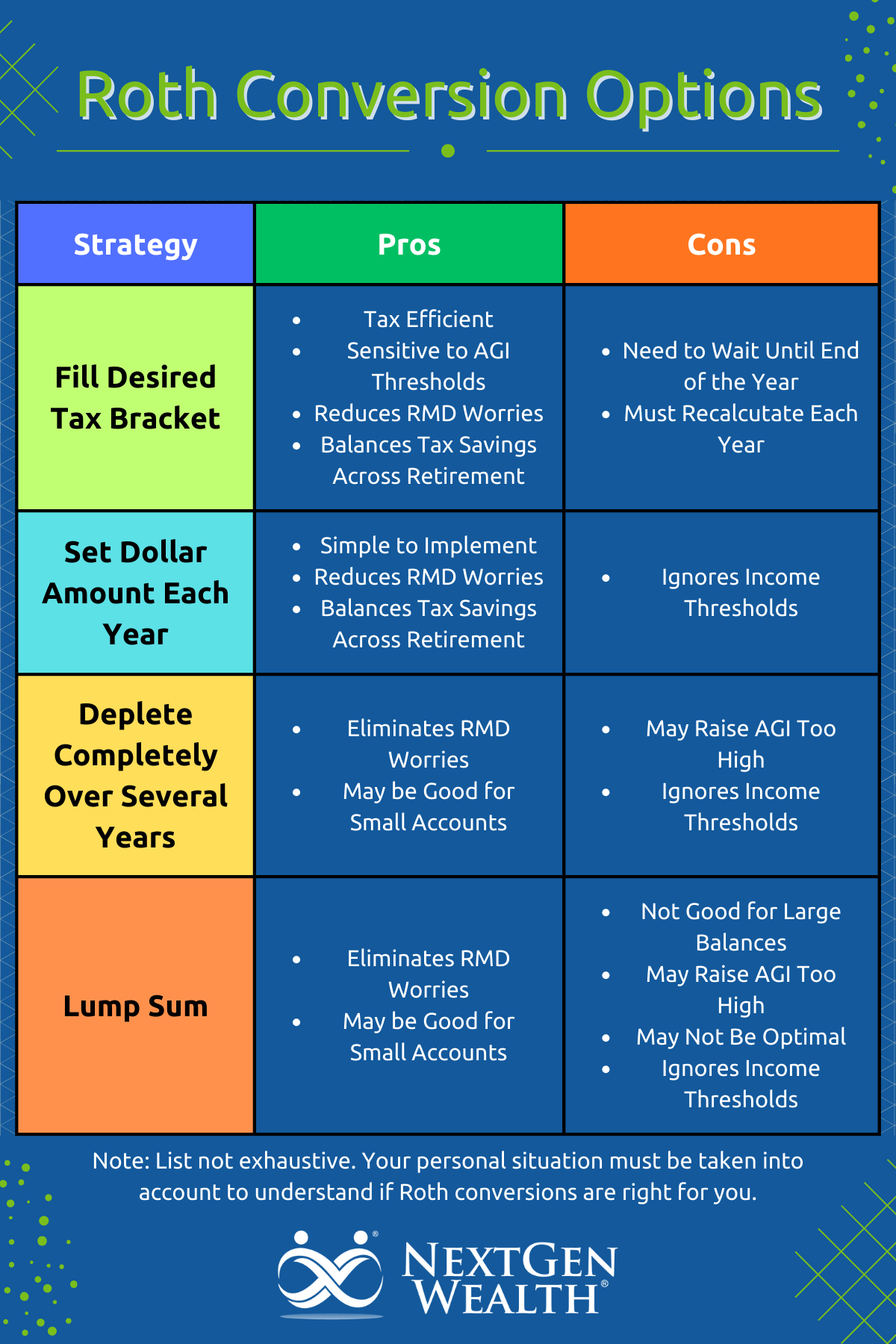

Here's a helpful chart for a quick rundown of the potential options, including:

- Filling a Specific Tax Bracket

- Set Dollar Amount

- Deplete Completely Over Several Years

- Lump Sum (All at Once)

How Roth Conversions Work

There are three options when converting a traditional IRA to a Roth IRA.

- 60-Day Rule - In this case, you withdraw funds from your IRA by check and then deposit them into a Roth IRA within 60 days. If you don’t, you'll have to pay taxes on it and incur a penalty (assuming you’re not 59 1/2).

- Trustee-to-Trustee - If you're using two financial institutions, initiate a funds transfer from your traditional IRA and rollover funds to your Roth IRA.

- Same Trustee Transfer - If both accounts are with the same financial institution, you can convert funds by transferring from one account to another.

Paying Taxes On Your Conversion

When you convert to Roth, the conversion amount will be added to your total income for the year. You'll pay taxes when converting money into a Roth IRA, so you need to keep that in mind.

It's a good idea to pay for the conversion using funds outside your retirement accounts. This allows you to keep more money in your retirement accounts to grow tax-deferred (traditional) or tax-free (Roth).

Current vs. Future Tax Rates

Another reason to consider converting money to a Roth IRA account is that you believe that your tax rate will be higher in the future. Even in retirement, your earnings could be substantial, as the IRS considers income from a variety of sources. Some examples of non-career-based earnings can include:

- Investment Income - if you have money in stocks and other investments, you will likely have to worry about capital gains.

- Rents and Royalties - owning a rental property creates ongoing income throughout retirement. This money is still part of your MAGI.

- Social Security - the government will start paying you once you file. A portion of this money may be considered income by the IRS.

- Pensions and Annuities - pension plans offer a guaranteed monthly income based on your earnings while you were working. Annuities can come from various sources, including life insurance policies.

- Inheritance - realistically, you'll only have to worry about inheritance for a single tax year. However, if you get disbursements from a trust fund, that income can still be counted for tax purposes.

Overall, if you believe that your tax burden will be higher in retirement, then converting to a Roth now will make sense, provided that you have enough money to pay the government at the time of conversion.

Alternatively, if you think that your tax rate will be lower in retirement, it might be better to keep money in a traditional IRA instead. Depending on the difference between your tax rates, you could potentially save thousands of dollars in the long run.

Contact NextGen Wealth Today

Moving money between retirement accounts is relatively straightforward, provided that you do it correctly. Roth conversions aren't a magical fix for poor planning. In fact, we'd argue long-term planning could even prevent the need to complete Roth conversions.

However, for many retirees today, contributing directly to a Roth plan wasn't even an option early in their careers. And then the IRS decided to impose RMDs and "flip the script" on today's retirees. If you'd like help navigating the complexities of retirement and understanding how Roth conversions might fit into your plan, contact us today for a no-obligation financial assessment to see if we're a good fit.