Do Annuities Make Sense for Me?

Annuities can be as confusing as any product on the market. However, they can be a handy tool for the right individuals. Don’t let all the ambiguous and confusing terms discourage you from learning about annuities.

A general understanding of how annuities work, the types of annuities available, and the tax implications is helpful. We’ll also analyze the costs and fees, how annuities can insure against longevity risk, and whether an annuity product might be right for you.

Table of Contents

Understanding Annuities

Insurance companies sell annuities, but they are not life insurance. Instead, they are like “longevity” insurance against outliving your money. Simply put, you pay a sum; the insurance company pays you a certain amount back over a specified period.

Types of Annuities

There are several different variables to consider for annuities and several different types. The basic variables you must understand are purchase (accumulation) type, payment period, payout calculation type, and tax treatment.

Purchase (Accumulation) Type

You can purchase an annuity with either a lump sum or periodic payments. Your contract sets the details of the accumulation phase (when you purchase/fund the annuity) and the payment or decumulation phase. Annuities can be immediate (start paying out now) or deferred (start at a later date).

Payment (Decumulation) Period

There are a few different options for annuity payment periods. You’ll have to decide when you need annuity income and for how long. You can be paid back for a certain number of years or your lifetime.

Life Annuities

Many annuities will be labeled as life, single-life, or straight-life annuities. Basically, these annuities pay a certain amount for your lifetime. You may also hear these referred to as “pure” annuities. You may also find some additional variables to this type of annuity, like a period certain or joint and survivor.

Period Certain Annuities

There may also be some “period-certain” annuities. If you pass away after signing the contract but before the end of the specified period, your beneficiaries will get payments for a “certain period” of time.

Joint and Survivor Annuities

Joint and survivor annuities cover both the person who is insured as well as their beneficiary. Normally, this is for a married couple. This type of annuity is essentially insuring two people instead of one.

Payout Calculation Types

There are three basic payout calculation annuity types: fixed, variable, and indexed. It’s also important to understand there are individual differences in each annuity contract with different insurance companies. You must analyze each one carefully to understand the costs and benefits associated with each one.

Fixed Annuities

Fixed annuities are exactly what they sound like – they offer a fixed amount based on the rates set by the insurance company. The nice thing about a fixed annuity is the guaranteed rate. It might be a slightly lower rate than other types of annuities, but it takes away any unknowns.

Variable Annuities

With a variable annuity, the rate of accumulation (and therefore payout) will vary based on an underlying investment portfolio, such as mutual funds. Therefore, you'll get a higher payout if the underlying investment portfolio is doing well. If it’s lower, then you’ll receive less.

Indexed Annuities

Indexed annuities grow based on a certain market index, such as the S&P 500 or Dow Jones Industrial Average. This is why they are often called indexed annuities. Once again, the contract will set the details.

Tax Treatments for Annuities

In general, annuities are considered either qualified or non-qualified for tax purposes. This distinction is crucial.

Qualified Annuities

Qualified annuities are purchased with pre-tax dollars. Normally, these are purchased using a 401(k) account. Qualified annuity payments are taxed as ordinary income, just like you would have paid taxes on qualified distributions.

Qualified annuities are subject to required minimum distributions (RMDs). However, SECURE 2.0 made some significant changes to what counts toward RMDs. You can count distributions from a qualified annuity toward your RMDs for the year in total with your RMDs for your IRA or 401k.

Non-Qualified Annuities

Non-qualified annuities are purchased with after-tax money. The taxes are treated a little bit differently. You can exclude a certain amount of annuity income as a return of your principal (purchase price).

Once your initial investment is returned, the remaining payments are considered fully taxable. This is very important to know.

Evaluating Annuities

There are many factors to think about when considering an annuity. The biggest decision point is whether you need one. You’ll often have a guaranteed income base through Social Security. If you have a pension as well, the need for an annuity drops further.

Disadvantages of Annuities

There are some disadvantages to annuities as well. An annuity’s not inherently bad, but they’re not all created equal.

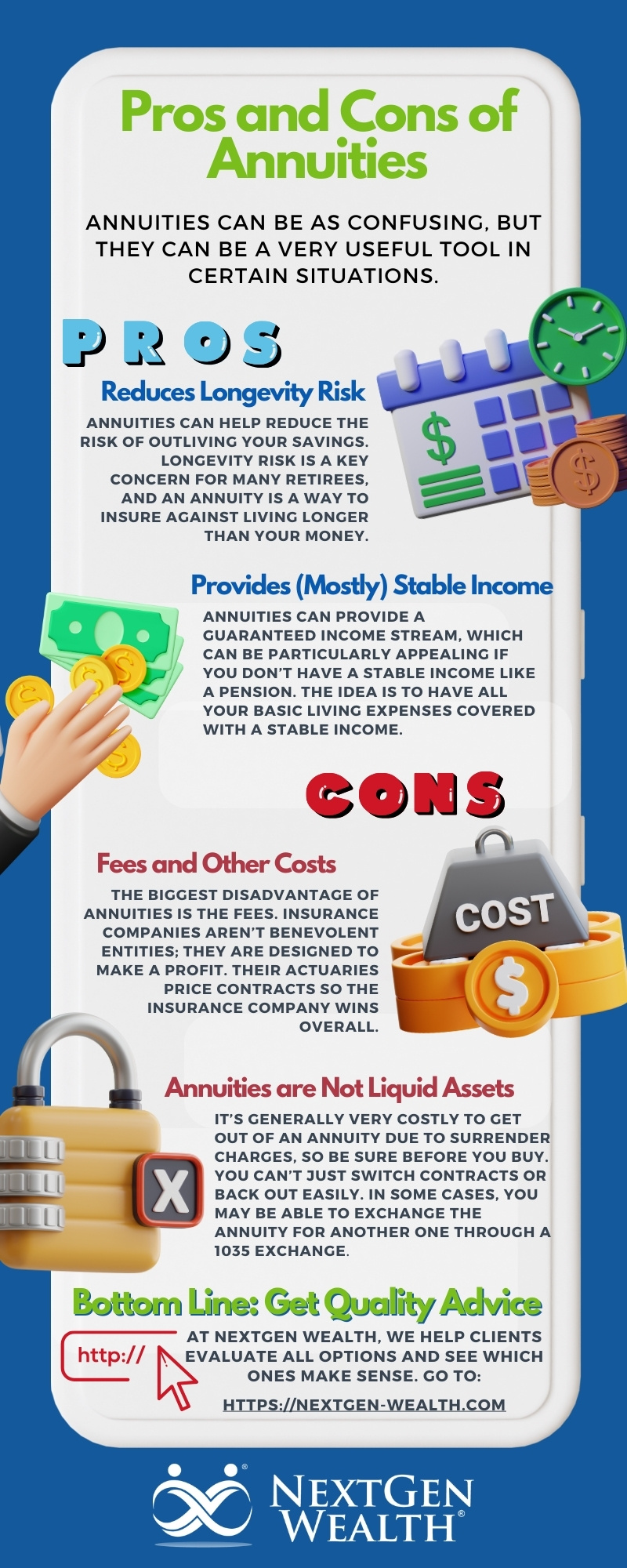

Fees for Annuities

The biggest disadvantage of annuities is the fees. Insurance companies aren’t benevolent entities; they are designed to make a profit. Their actuaries price contracts so the insurance company wins overall.

Annuities are also sold on commission. The person who earns a commission for selling you an annuity has a big incentive to get you to buy one. We recommend getting a disinterested third party to evaluate your situation.

An Annuity is an Illiquid Asset

It’s generally very costly to get out of an annuity due to surrender charges, so you need to be sure before you buy. You can’t just switch contracts or back out easily. In some cases, you may be able to exchange the annuity for another one through a 1035 exchange, but this isn’t always a simple process.

Benefits of Annuities

There are still plenty of benefits to annuities. If you don’t have any guaranteed income, it may be worth considering an annuity. Here are some of the benefits.

Income Stability

Annuities can provide a guaranteed income stream, which can be particularly appealing if you don’t have a stable income like a pension. The idea is to cover all your basic living expenses with a stable income.

The Role of Annuities in Longevity Risk

Annuities can help reduce the risk of outliving your savings. Longevity risk is a key concern for many retirees, and an annuity is a way to insure against living longer than your money.

You probably don’t need to convert all of your income into an annuity, but it could be a relatively safe option.

Other Considerations

The subject of annuities is quite large and complicated. There are many other factors to consider in your decision.

Investment Options and Growth Potential

The growth potential of annuities may be significantly different (usually lower) than other investment options. Variable and indexed annuities allow for a certain amount of growth, but it won’t be the same as investing on your own or with an investment advisor. The growth rates will likely be lower than what you could achieve in the market.

On the other hand, a diversified portfolio of stocks and bonds can also be converted into income in retirement. There is more than one way to generate retirement income.

Cost and Fees

The potential costs and fees associated with annuities can be expensive. There are sometimes many different types of fees you’ll encounter, such as administrative fees, surrender charges, and investment management fees. You need to read through the policy documents to make sure you understand all these fees.

Inflation Protection

Annuities offer limited protection against inflation. There may be options to purchase riders for protection against inflation. However, as mentioned above, the fees may outweigh the benefits. There may be better options available to protect your retirement from inflation.

Suitability for Your Financial Goals

Ultimately, you need to evaluate how annuities fit into your broader retirement strategy. You should consider your existing assets, personal financial goals, and risk tolerance. Most importantly, you must thoroughly understand exactly what you’re buying and why.

The long-term cost of annuities is generally pretty steep. Be cautious of pushy salespeople or “wine and dine” sales pitches. It’s perfectly okay, and encouraged, to sleep on this decision.

How NextGen Wealth Can Help

Whether you’re looking into annuity options or trying to decide how your current annuity fits into your financial plan, NextGen Wealth can help. We walk our clients through our COLLAB Financial Planning Process™ to uncover your goals and develop a comprehensive retirement plan.

Whether or not annuities make sense for your situation, we’ve got you covered. Contact us today to see if we’re a good fit and get your free financial assessment.