Final IRS Rules For Inherited IRAs

Receiving an inherited IRA is a significant and emotional event. Sadly, inheriting a retirement account means someone close to you has passed away. The last thing anyone wants to think about is having to avoid tax penalties on the account they inherited, but it’s a real concern.

Unfortunately, the IRS has created additional considerations you must navigate on top of grieving the loss of a loved one. If you ignore the rules for inherited IRAs, you could end up with a major tax issue. To complicate this further, the rules have been left to interpretation for some time.

However, the IRS recently clarified the who, what, and when surrounding distribution rules for inherited IRAs.

Table of Contents

Key Changes to Inherited IRA Rules

Not too long ago, inherited IRAs could be withdrawn over the course of the beneficiary’s lifetime. However, Uncle Sam caught onto this. Long story short, the government wanted to collect taxes on tax-deferred accounts like 401ks and IRAs a bit sooner. Changes were made, starting with the original SECURE Act.

The Original SECURE Act

The original Setting Every Community Up for Retirement Enhancement (SECURE) Act introduced the 10-year rule for inherited accounts for most beneficiaries. This eliminated the "stretch IRA" for most non-spouse beneficiaries.

However, there was still some confusion about what the IRS meant. The need to withdraw all money from the IRA within ten years was easy to understand. However, there was some confusion on whether the beneficiary needed to take annual required minimum distributions (RMDs) or just have the whole balance withdrawn within 10 years.

In other words, waiting until the last year possible to withdraw the entire amount seemed perfectly acceptable. Clarification was needed.

A Quick Note on SECURE Act 2.0 Overview

Although SECURE Act 2.0 didn’t change the 10-year rule, it did change the rules for RMDs. This is important because if RMDs have already started, it could affect the rules for continued RMDs on inherited IRAs.

SECURE 2.0 also allows a surviving spouse to take RMDs using the same schedule as their late spouse or treat the account as if they owned it. More on this later.

Lower Penalties for Not Taking RMDs

Another key thing to note is SECURE 2.0 lowered the “excise tax” (often called a penalty) for required amounts not distributed. It dropped from 50% to 25%. This is still a huge chunk of money, but it’s better than paying half.

These are just more variables to consider. In other words, it can get complicated to figure out the rules.

Final IRS Regulations

It only took the IRS five years to clarify precisely what they meant. In July of 2024, we finally received clarification in the form of Final Regulations from the IRS. You can get a summary in IRS notice 2024-35. The final regulations contain a ton of information, but much of it pertains to very specific circumstances.

Main Clarifications for Discussion on Inherited IRAs

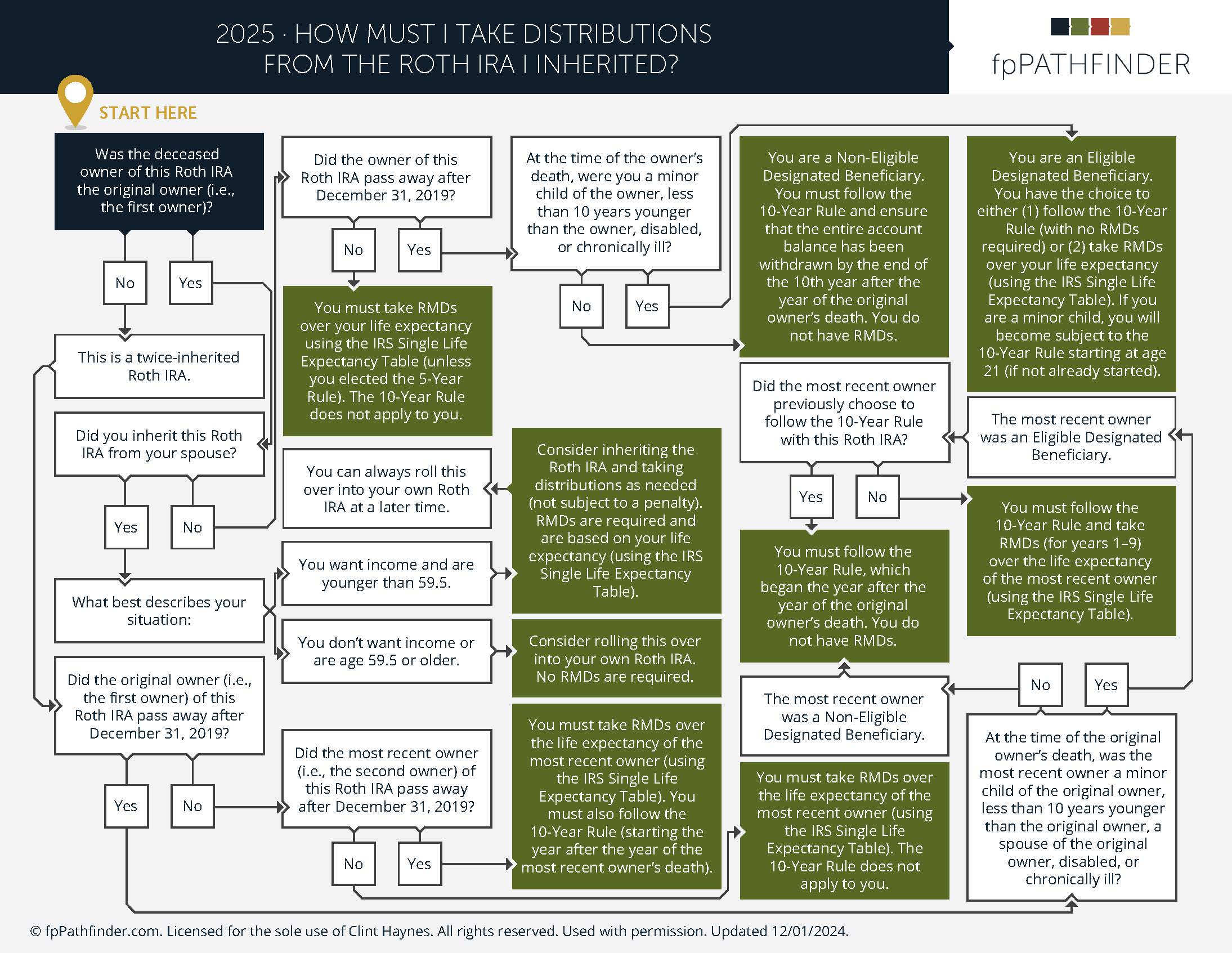

There are two main clarifications from the final regulations we’ll discuss. The first is the requirement for annual distributions from certain inherited accounts. The next is the list of exemptions to the 10-year rule based on how each type of beneficiary was classified.

Annual Required Minimum Distributions (RMDs)

Before the final regulations, it was open to interpretation on whether you needed to take annual distributions or not. In other words, if the entire account balance was distributed during the 10-year period following the account owner's (employee’s) death, then it didn’t matter exactly when those distributions occurred. This could allow for more tax and income planning opportunities.

However, the clarification stating distributions must happen annually makes things less flexible. Fortunately, the IRS said there are no penalties through 2024 for anyone who was required to take distributions and didn’t. Anyone subject to annual distributions under the new rules needs to make the proper distribution each year starting in 2025.

Exceptions for Eligible Designated Beneficiaries

There are, of course, always exceptions to the rules. The main exceptions are for “eligible designated beneficiaries.” This category of beneficiaries includes spouses, minor children, individuals with disabilities, and beneficiaries who are no more than 10 years younger than the original account owner (employee).

Spouses of the Employee

For the spouse, there are more favorable options, as there should be. In general, the surviving spouse who inherits a qualified retirement account can treat it as if it were their own. They can then take RMDs on their schedule per the most recent guidance.

The surviving spouse beneficiary may also elect to take RMDs based on the original employee’s required distribution start date. In other words, if the deceased would have been required to start RMDs in 5 years, the eligible beneficiary spouse could wait until then to begin taking distributions.

Finally, if the spouse who inherited the account dies before distributions begin, their beneficiaries are treated as the original account owner’s beneficiaries. Once again, there is significant nuance to each situation.

Minor Children

Minor children are exempt from taking RMDs from an inherited account until they reach the age of majority (age 21). However, once they reach the age of majority, their 10-year distribution period begins. Considering the effects on college planning and other situations where having a higher income might be less helpful is extremely important.

It’s essential to understand the exemption for children ends when they reach the age of majority in the statute, not your state. To determine an eligible beneficiary, use age 21.

Disabled Eligible Beneficiaries

For disabled eligible designated beneficiaries, as defined in the final regulations, their eligibility is based on activities of daily living. This is like the definition of disability determination for Social Security. In fact, there is a safe harbor test stating if the beneficiary is considered disabled by the Commissioner of Social Security at the date of death, then they are considered disabled and, therefore, an eligible designated beneficiary.

Caution is necessary when leaving any assets directly to a disabled beneficiary. There are several provisions and considerations to ensure the inherited account and associated income don’t affect other vital benefits available to them. Specifically, there are strict requirements for ABLE accounts and Social Security eligibility.

Other Eligible Designated Beneficiaries

Other beneficiaries who are not more than 10 years younger than the original account holder are also exempt from the 10-year rule. This is calculated using the birth dates of the employee the account came from and the beneficiary in question.

The New 10-Year Rule in a Nutshell

The bottom line is there are two main types of beneficiaries: eligible and non-eligible. Anyone who is a non-eligible beneficiary is subject to annual distributions until the account is fully depleted within 10 years. The eligible beneficiary can still elect to use the 10-year rule instead.

There will always be nuance and limited exceptions. Laws could also change again. In all cases, we strongly encourage consulting an estate planning attorney to get the most accurate information based on your situation.

Tax Implications of Inherited IRAs

The real reason why all of this is vitally important is everyone’s favorite subject – taxes. Nobody likes taxes, but they’re a necessary evil of modern society. However, we can use the laws and tools available to pay only what we absolutely have to.

The biggest thing to remember is the tax treatment of withdrawals for retirement income is based on account type.

Traditional Retirement Accounts

Distributions withdrawn from a traditional IRA are taxed as ordinary income. In many cases, this is precisely what we expected. However, with the SECURE Act and SECURE Act 2.0, we have to contend with RMDs.

These RMDs can force some people to withdraw more than they need to live on. Excessive RMDs can push you into higher tax brackets and even increase your Medicare premiums. In short, RMDs limit your ability to control how much you withdraw.

Roth IRAs

On the other hand, Roth accounts offer tax-free withdrawals and, thanks to the SECURE Act 2.0, are exempt from distribution rules. Roth IRAs have always been exempted from Required Minimum Distributions (RMDs), but “designated Roth accounts,” such as Roth 401(k) s, were subject to RMDs until SECURE 2.0.

In essence, the money you pull from a Roth account doesn’t exist for tax purposes. You already paid the taxes when the money was put into the account. As long as you meet the rules for a qualified distribution, you will have no tax impact.

Strategies to Minimize Tax Burden

Saving money on taxes is one of our favorite ways to help our clients. We regularly run simulations to compare different tax-saving strategies to optimize your retirement. From Roth conversions to qualified charitable distributions, we recommend researching all options.

Not all strategies will apply to your situation. In fact, we believe understanding all aspects of your financial life is crucial. The perfect mathematical scenario is almost never the most optimal personal decision.

Considering Tax Strategy Before Drawing Social Security

In many cases, waiting to take Social Security can be the best strategy. Not only do you get a higher payout, but waiting a few extra years may give you the ability to implement a more aggressive Roth conversion strategy. Deciding when to start drawing Social Security requires careful consideration.

Roth Conversions

We regularly implement Roth conversion strategies. There are many benefits to Roth. In the case of leaving Roth vs traditional retirement accounts to your heirs, Roth accounts avoid all the worries of who must take what distribution and when.

When you inherit a Roth account, it doesn’t really matter when you withdraw the funds. The money comes out tax-free. One exception is gains will be taxed if the account hasn’t been open for 5 years or more.

Reducing IRA Account Balance

Since RMDs are calculated based on the total account balance, early withdrawals before you reach your RMD age can help. In other words, a lower balance could mean lower taxes. This can be accomplished in a few different ways.

Retiring Early

Although it’s not the first thing we think about, working with a financial planner sooner rather than later could help you retire earlier than you originally thought. If you run the numbers, you might find you already have enough money to live on now.

Obviously, retiring early isn’t for everyone, but it could be an option.

Qualified Charitable Contributions (QCDs)

If you’re charitably inclined, you could start making Qualified Charitable Contributions (QCDs) as early as age 70-1/2. This is a great way to achieve your philanthropic goals and save on taxes as well. You also don’t have to wait until you’re in your 70s to donate to charity.

Can you ace this basic tax literacy quiz? See what you know & don't know (& why it matters).

Common Pitfalls and How to Avoid Them

If you inherited anyone’s retirement account, check to see if your account is subject to RMDS. Starting this year (2025), penalties start for missing RMD deadlines. Make sure you’re in the clear.

Also, misunderstanding the beneficiary categories and their options could be an issue. As you can see from this lengthy article, you have to consider many factors. And we didn’t even talk about all the rules for trusts.

Withdrawing Large Sums at Once

You may also be tempted to immediately withdraw all the money in the account to avoid the hassle. Overlooking the tax implications when withdrawing large sums can be really painful. If possible, spreading income or frontloading in lower-income years may be helpful.

However, there may be unique planning opportunities for beneficiaries who can take a year off work for a sabbatical or pursue further education. Once again, personal details matter.

What’s the Bottom Line?

We can’t overstate the importance of understanding the final IRS rules for inherited IRAs and other retirement accounts. It’s a great idea to work with a financial planner, accountant, and estate attorney to navigate these types of complexities. Don’t go it alone.

How NextGen Wealth Can Help

At NextGen Wealth, we start with a free financial assessment to see if we’re a good fit. Then we’ll walk you through our COLLAB Financial Planning Process™, where we uncover your goals and develop a comprehensive retirement plan. Contact us today to see if we’re a good fit and get your free financial assessment.