Will Required Minimum Distributions Affect My Retirement?

This post was last updated on April 28th, 2023, to reflect all updated information and best serve your needs.

If you have a retirement account like a 401(k) or IRA, Required Minimum Distributions (RMDs) can be a real drag in retirement. Knowing if RMDs will affect your retirement is critical so you can make the right adjustments now and moving forward.

RMDs have the potential to affect your tax rates, Social Security benefits, Medicare premiums, and more. Don’t worry though, there are several strategies financial planners, investment advisors, and individuals alike can use to minimize, and hopefully avoid, the impact of RMDs.

What are Required Minimum Distributions (RMDs)

Required Minimum Distributions (RMDs) are exactly what they sound like – distributions you are required to take when you turn 73 or incur a steep penalty (25% of the amount not withdrawn!). The Internal Revenue Service (IRS) doesn’t want you to keep your money in a retirement account forever. Those funds received special tax treatment to help you save for retirement, now the IRS is ready to collect some taxes on those funds.

Think about it this way. The IRS gives you a temporary pass on paying taxes when you put money into a qualified account. In return, the IRS expects to eventually collect those taxes. This is probably why RMDs exist and why they are based on your life expectancy – there’s no free lunch from the IRS.

Note: In 2033, the beginning age for RMDs will become age 75 - also due to the changes in Secure Act 2.0. Also, the penalty for not taking the RMDs can be reduced to 10% if the error is fixed within the "correction window."

The correction window starts on the day the tax is incurred and ends the date you're mailed a notification of the deficiency, the date the tax is assessed, or the end of the second calendar year following when you incurred the tax. It's a little complicated, but it's a lot easier to figure out if this actually applies.

Need help navigating your retirement income options? Get your free retirement income plan today!

Accounts Subject to RMDs

All qualified or “traditional” retirement accounts are subject to RMDs. This includes traditional 401(k)s and IRAs. If you started your working life before the early 2000’s, there’s a high probability some or all your retirement savings are in qualified accounts.

The only retirement accounts currently not subject to RMDs are Roth accounts such as Roth IRAs and Roth 401(k)s. An important distinction, Roth 401(k)s are not equal to Roth IRAs, but they are no longer subject to RMDs. Per SECURE Act 2.0, starting 01 January, 2024, Roth designated employer accounts like Roth 401k's will no longer be subject to RMDs.

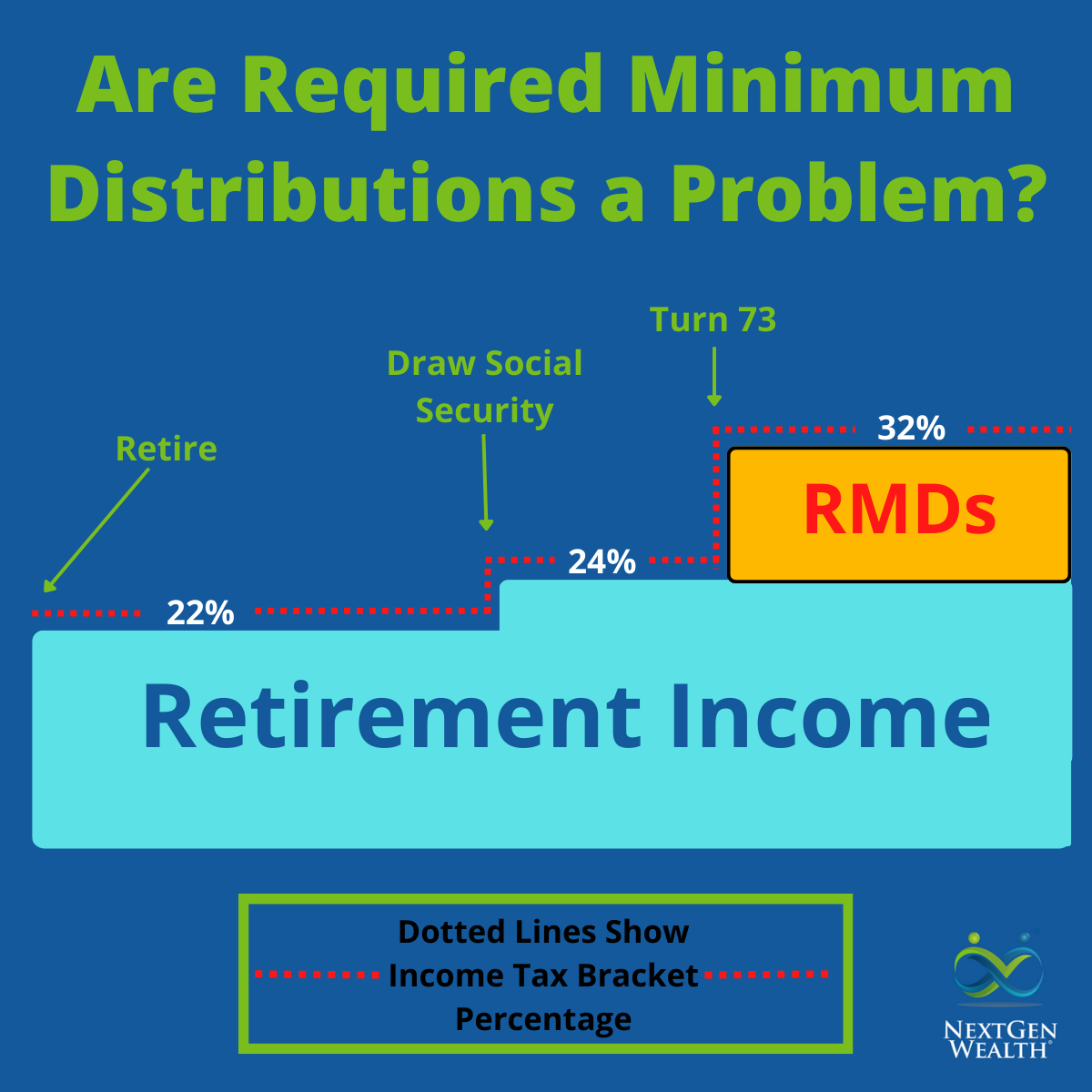

Why are RMDs a Problem

You might be wondering, “What’s wrong with more money?” Two main factors come into play – taxes and fees. RMDs could accelerate your withdrawal rates and push your adjusted gross income (AGI) or modified adjusted gross income (MAGI) over important thresholds.

The name of the game is to create the right income stream for your lifestyle in retirement without paying extra taxes, having your Social Security benefits taxed, or increasing your Medicare premiums.

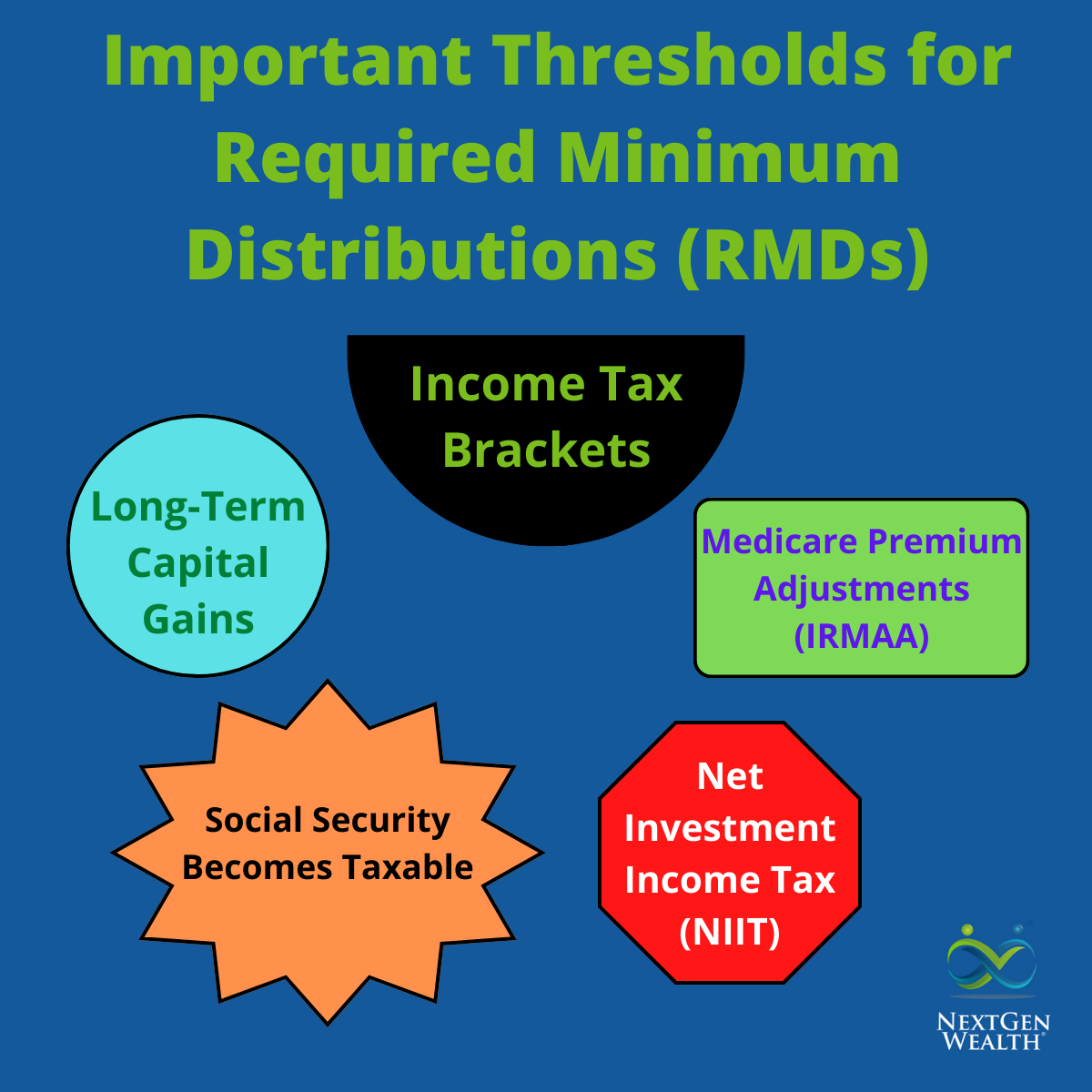

Pay Attention to Thresholds

There are several thresholds to pay attention to closely. Crossing one or more of these could become quite costly.

- Marginal Income Tax Brackets

- Capital Gains Tax Brackets

- Income Related Medicare Adjustment Amounts (IRMAA)

- Net Investment Income Tax (NIIT)

- Taxation of Social Security Benefits

Depending on when you identify if RMDs will be an issue, there’s always something you can do. Just like catching a leaky pipe early, catching an impending RMD issue earlier is always better.

Factors Affecting RMDs

Several factors affect RMDs in determining if they’ll really be an issue for you. These include where your money is held and additional income streams such as a pension or annuity.

Types of Accounts

The account type affects RMDs. In general, if the account enjoys special tax treatment and is not a Roth account like a Roth IRA, it’s subject to RMDs.

Income Streams

You need to know what your anticipated income streams will be. This includes pensions, Social Security, annuities, and any other money distributed to you. You also need to understand the tax treatment of those income streams.

For example, a qualified annuity from a pension plan will be taxed differently than an annuity you purchase on your own. Also, capital gains can affect your income as well – even if they’re taxed at long-term capital gains rates.

Inheritance

If you plan to inherit an IRA, Roth or otherwise, you’ll need to be aware of the specific RMDs relating to those too. In this article, we’re not covering those specific rules. Just know there is a separate, but similar set of rules governing RMDs for inherited retirement accounts.

Need help navigating your retirement income options? Get your free retirement income plan today!

Will RMDs Affect Me?

There are some key things to determine if RMDs will affect you or not. Let’s look at our pal, Max Benny to see if he’s going to run into RMD trouble or not.

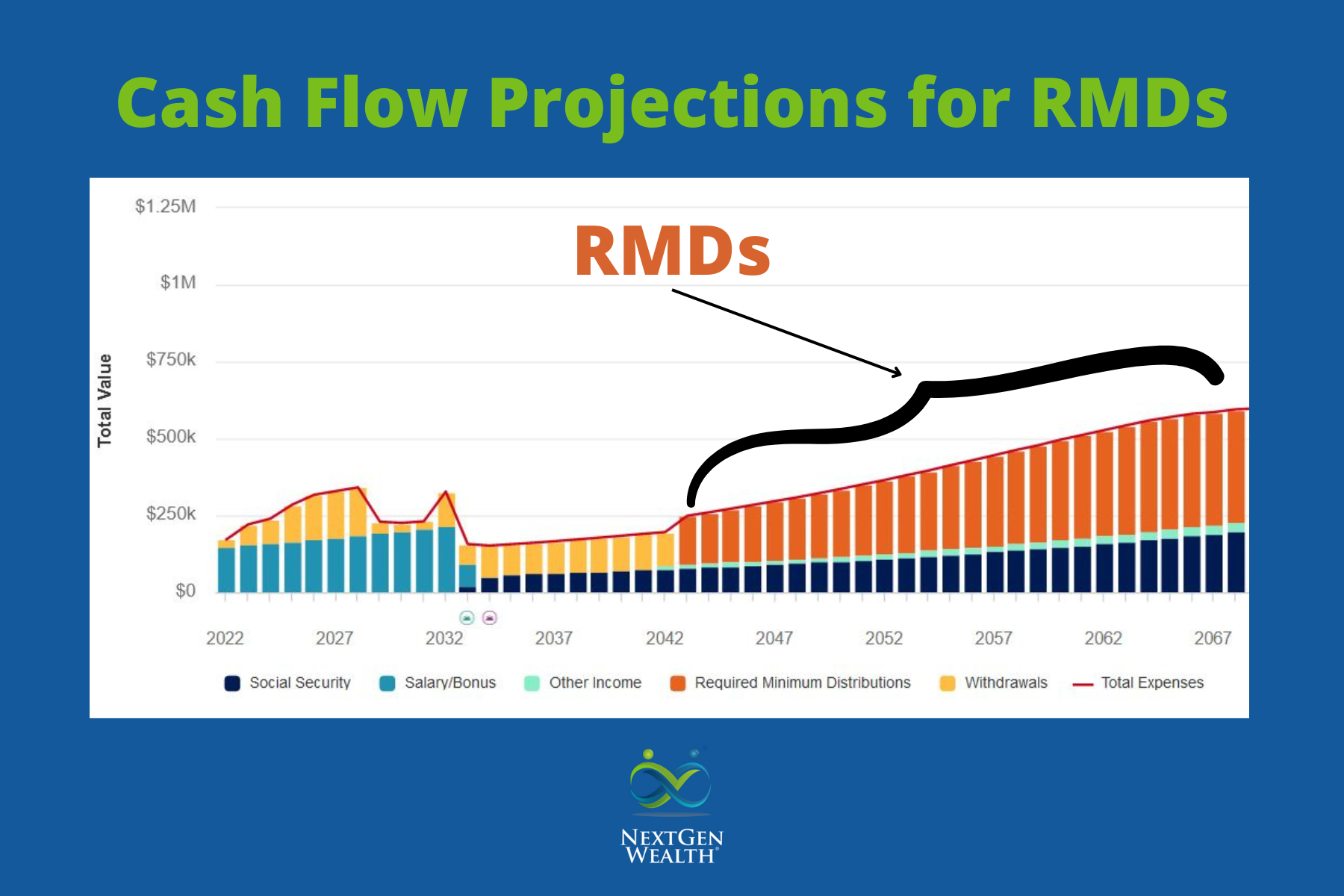

There aren’t any hard, fast rules if RMDs will be a problem or not. However, the more you have in a qualified retirement accounts at age 73, the more you will be subject to RMDs. We can run projections to see the impact of RMDs – check out the example below.

As you can see, RMDs end up making up a sizable portion of Max and Minny’s retirement income. Most of their retirement assets are in Max’s traditional 401(k). These distributions will push them into higher income brackets and other income thresholds too!

Income and Asset Levels

Our pal Max’s salary was $100,000 and Minny’s salary was $50,000. Keep in mind this isn’t necessarily your experience. Even if you earn a higher salary, you may or may not run into RMD issues in retirement.

The more important things to know are the accounts subject to RMDs and an estimate of your life expectancy. Once we calculate what your overall RMDs are for all accounts, then we can determine your total estimated retirement income. If this income is anticipated to fall in line with what you need to live off of, then there’s no issue.

However, if it’s way more than you’ll need, then you’ll want to make some changes because you’ll simply be paying taxes on money you don’t need. Also, just because you’ll have some income taxed doesn’t necessarily mean it’s the end of the world either. Income brackets are progressive, so only the income above the threshold is taxed at the higher rate.

Crossing into RMD Trouble Territory

A common thing to wonder is, “What’s the “rule of thumb” for when RMDs become an issue?” This is a great question, but really there isn’t a one-size-fits-all answer to this. What may be a “problem” for one family may be a blessing for another.

Regardless, if RMDs are going to cause you stress, we want to address them. We want to get as close to mathematically optimal as possible. In theory, it is possible to avoid all RMDs through Roth conversions. However, there is a tax cost to Roth conversions, and we need to balance paying taxes now versus later when RMDs kick in.

However, we don’t want to create a huge tax burden now to avoid taxes later. We can, and should, balance income and expenses throughout retirement.

Need help navigating your retirement income options? Get your free retirement income plan today!

Strategies to Avoid RMDs

The most common strategies to avoid RMDs are Roth conversions, including mega backdoor Roth conversions, and Qualified Charitable Distributions. Most advisors should be able to run some basic projections to determine how effective different strategies would be.

Minor changes can have big impacts over the course of your retirement.

Roth Conversions

We’ve written about Roth conversions many times because they can be incredibly powerful! For our hypothetical scenario for Max and Minny Benny, completing $30,000 of Roth conversions for the first 8 years of Max’s retirement reduces RMDs by up to $34,131! At the same time, those Roth conversions increased their lifetime portfolio value by a whopping $1,181,675!

Frontloaded Spending

This might sound counterintuitive, but just spending down their portfolio more in the first 8 years of retirement makes a significant difference too. Let’s say Max and Minny decide they want to travel more or pay off their house their first years of retirement. If they withdraw an additional $30,000 per year for 8 years, they’ll trim up to $28,514 off their annual RMDs.

What’s even more interesting is although they are spending an additional $240,000 their first 8 years in retirement, their total portfolio value only fell by $186,875. So, they were able to spend an extra $53,125 just for spending their money sooner – pretty cool!

Combination: Roth Conversions and Extra Spending

When you combine the strategy of frontloaded spending and Roth conversions together, the results are even more amazing! Max and Minny reduced their highest year of RMDs by $67,674 and increased their lifetime portfolio value by $961,235! In other words, through deliberate planning, they were able to spend more AND keep more money over their lifetime – incredible!

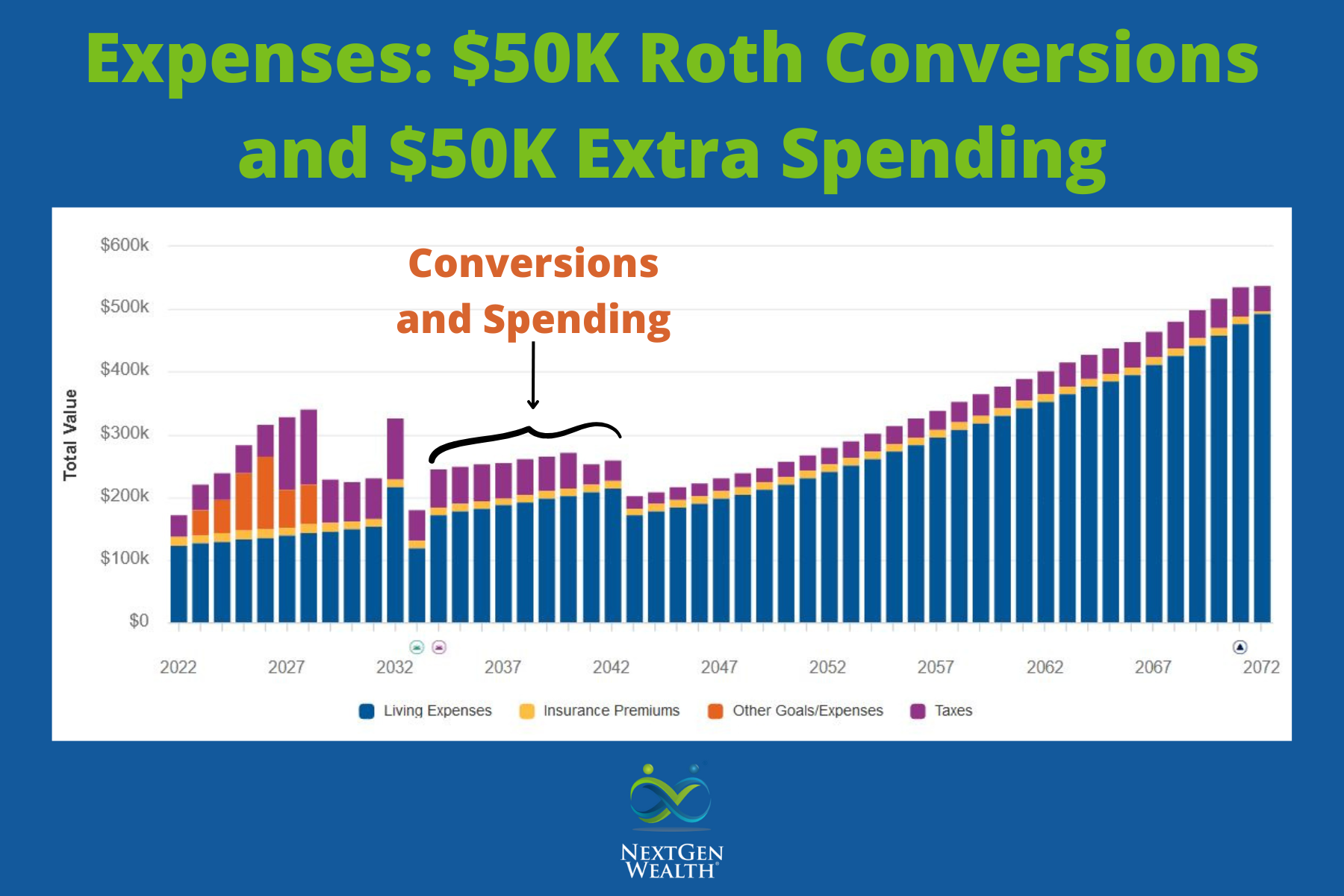

Just for fun, we ran the same scenario, but added $50,000 in Roth conversions and $50,000 of extra spending for the first 8 years of Max and Minny’s retirement. The result was even more dramatic with a reduction of RMDs up to $125,494 and a total portfolio value increase of $1,391,607!

After playing around a little more, anything above those amounts only reduced the portfolio value. The Roth conversions helped raise the portfolio value and reduce RMDs. The extra spending only helped in reducing RMDs – not raising the portfolio value.

Smoothing Expenses

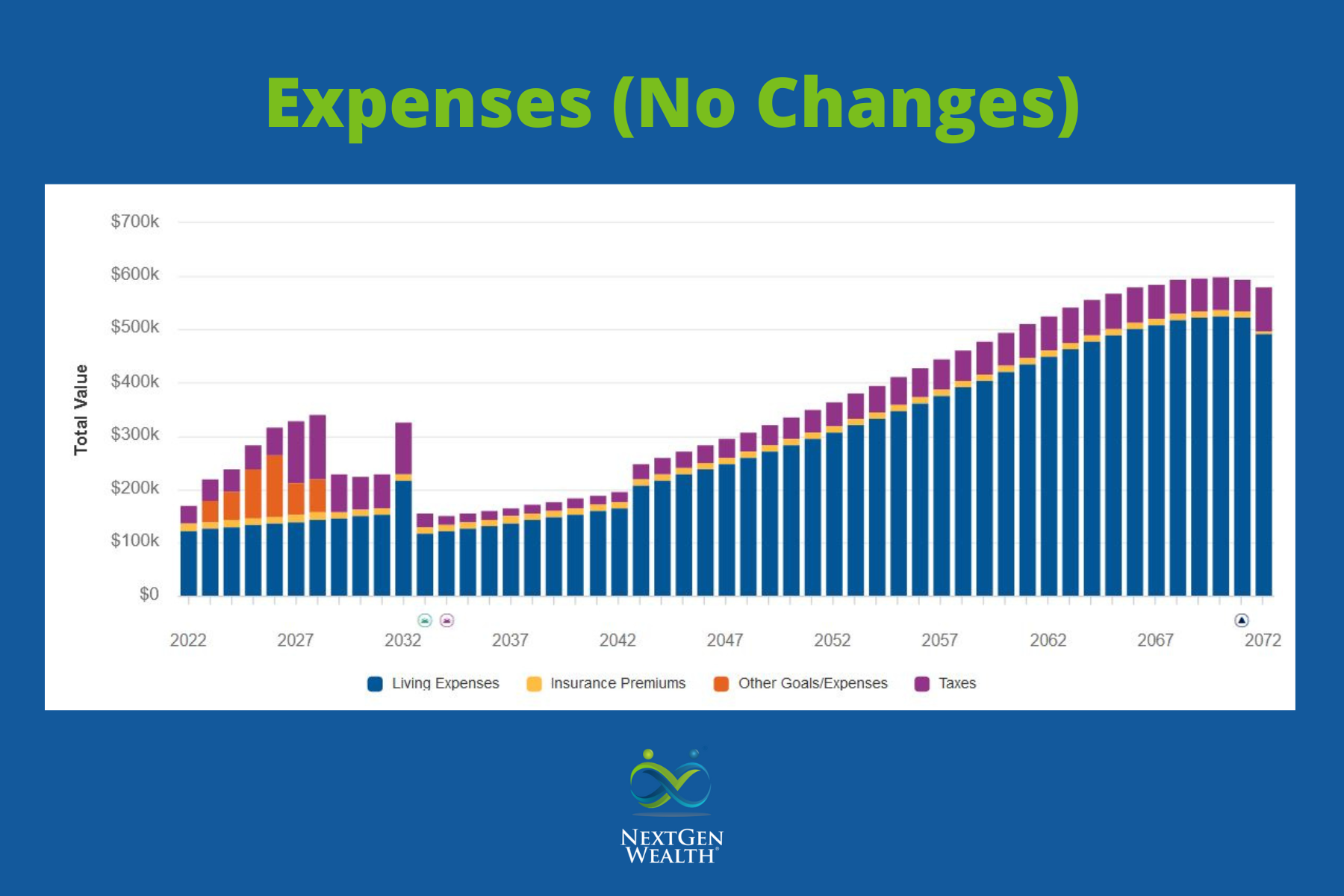

Another cool thing to see is the reduction and “smoothing” of expenses over their retirement. Look at this projection showing Max and Minny’s expenses (including taxes). You’ll see a dip in the initial stages of retirement and then a dramatic increase once RMDs kick in.

Now, after running the combo scenario of $50,000 of Roth conversions and $50,000 of extra spending, you can see the overall expenses starting to “smooth” a bit. It’s not perfect, but it does have the effect of having a more steady and overall lower level of expenses throughout retirement. As an example, the Benny’s highest tax bill was reduced from $27,762 to $18,747 for the year – a decrease of $9,015!

Keep in mind, these are hypothetical scenarios for imaginary characters, but these demonstrate real tactics.

You’ll notice both scenarios show an increase in expenses. These projections increase expenses for inflation over time. If we removed all inflation adjustments, it flattens out a bit. We didn’t show this because inflation is something we want to see and prepare for.

In all scenarios, Max and Minny would have been able to live a great life in retirement no matter what the RMD situation looked like.

What NextGen Wealth Does About RMDs

Each year, NextGen Wealth reviews your finances and determines if you need to take RMDs. Also, if we know you’re going to run into issues with RMDs in the future, we’ll look at implementing Roth conversions or other tactics. We do this at the end of the year so we know where your income and expenses are for the year (unless there is an opportunity earlier in the year such as if your account went down in value and we can convert at lower prices).

Before we get to all that though, we’ll take a look at the whole picture of what retirement the right way looks like for you. We’re trying to maximize the enjoyment you can squeeze out of the retirement you worked so hard to create for yourself.

We believe in solving for the life you want to lead first, and then we can adjust all the “money stuff.” Obviously, there are always tradeoffs, but that’s why we do what we do. We help get all the math right and guide you to the best decision given all the nuance and complexities surrounding your life and your finances.

What to Look for Moving Forward

If you’ll have to deal with RMDs in the future, start planning now. Look at where your retirement assets are and if they’ll be subject to RMDs.

Then you can decide if strategies like Roth conversions will benefit you. If you fail to plan, RMD issues can sneak up on you – let’s avoid those!