Income Related Monthly Adjustment Amounts (IRMAA) and Medicare Premiums

This post was last updated on February 26, 2026, to reflect all updated information and best serve your needs.

This post was last updated on February 26, 2026, to reflect all updated information and best serve your needs.

Interested in keeping your medical costs low in retirement? Failing to plan out key details could cost you if you’re not careful. Income Related Monthly Adjustment Amounts (IRMAA) for your Medicare Part B and Part D premiums are a prime example.

Let’s imagine that our good pal, Max Benny, doesn’t get along so well with his Aunt IRMAA. As a matter of fact, he tries to avoid her at all costs. Then one day, she shows up on the front porch, suitcase in hand, “My favorite nephew! Aren’t you glad to see me?” – I’ll take NO for 800, Alex.

Table of Contents

- What Are Income Related Monthly Adjustment Amounts (IRMAA)

- Aunt IRMAA Follows the Money

- Life Changed Over the Last Two Years

- Planning to Avoid Aunt IRMAA Entirely

- Required Minimum Distributions

- Roth Conversions: Right Time, Right Amount

- Calculating Modified Adjusted Gross Income (MAGI)

- How Much is Too Much?

- Significant Annual Increase

- Crossing Thresholds

- Proper Planning Goes a Long Way

- Final Thoughts About IRMAA

What Are Income Related Monthly Adjustment Amounts (IRMAA)

In short, IRMAAs will make your Medicare premiums go up. It goes without saying, we want to keep "Aunt IRMAA" as far away as possible. She can be a real drag on your wallet!

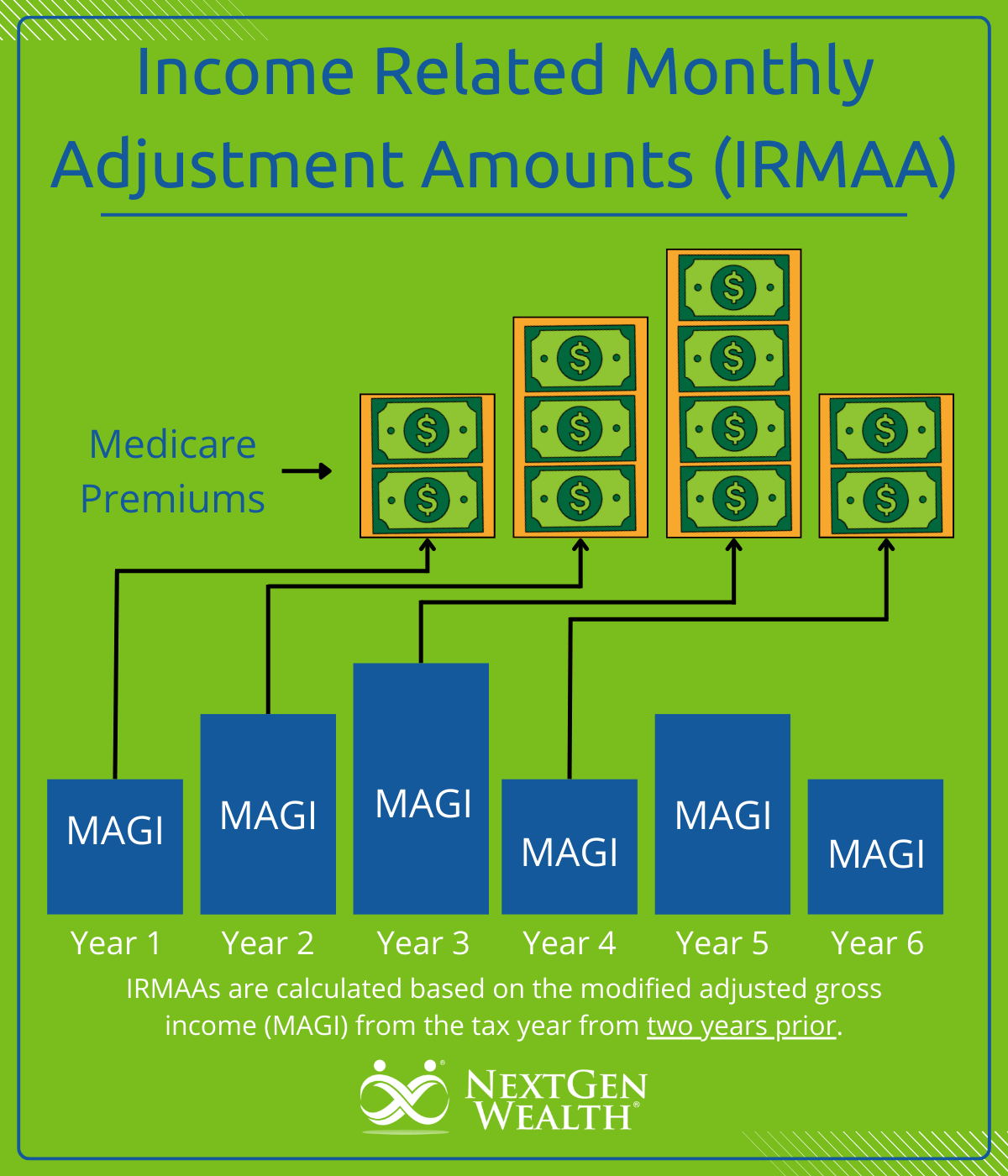

Determinations (initial and all subsequent) of IRMAA are based on your modified adjusted gross income (MAGI) from two years prior. In other words, the Social Security Administration (SSA) uses your MAGI for 2024 to determine your Medicare premiums for 2026. If your 2024 income was above certain thresholds, your premiums will be higher (Hello, Aunt IRMAA!).

Aunt IRMAA Follows the Money

Don’t get us wrong, Max will be cordial with Aunt IRMAA, but he’s not going to be very happy. There's a solution. If she doesn’t think Max has much money, she’ll probably leave him alone.

The only way that Aunt IRMAA pops into town is if Max’s MAGI gets too high. This is determined when you file your taxes with the IRS. The name of the game is to make sure your MAGI is below the applicable thresholds.

Life Changed Over the Last Two Years

Your situation may have changed significantly in the last two years (ever been through a pandemic?). If that’s the case, then you can request to have your IRMAA determination reevaluated.

The SSA will send you a notice upon initial determination, outlining your costs and the process for appealing. You can appeal for things like a life changing event (LCE), such as a marriage, the death of a spouse, divorce, or even significant changes in your work status.

There are other reasons to appeal the decision as well. If the IRS information used was incorrect, then you can appeal for an adjustment. Regardless, if you think there has been a change or mistake in your IRMAA determination, reach out right away.

Planning to Avoid Aunt IRMAA Entirely

You’ll want to plan for Aunt IRMAA and keep her visits to a minimum (or avoid them altogether). Looking long-term and paying close attention to your MAGI is best. This is especially important starting the year you’ll turn 63. Some tax-saving strategies, like Roth conversions, can increase your income and affect your premiums.

In a perfect world, you’d have income and expenses that are even every year and never go above the threshold amounts. There are a couple of ways to think about this. Keeping expenses low reduces the need for more income. On the other hand, more income isn’t the worst thing either – except for the tax part.

Required Minimum Distributions

Required Minimum Distributions (RMDs) can really cause a lot of headaches. Max Benny knows how much Aunt IRMAA likes RMDs too. She loves them and can’t get enough.

RMDs push your income higher and therefore have the potential to raise your Medicare premiums. This can really stink because you see the reduction in your income every month. RMDs take a good thing (more money) and take the fun out by adding extra taxes and costs.

Roth Conversions: Right Time, Right Amount

Roth conversions are a very powerful antidote to RMDs. However, if you convert too much too close to age 65, you might end up with the same issues with Aunt IRMAA. For instance, if you complete a mega backdoor Roth conversion at age 63 or later, you’ll potentially increase your Medicare premiums. Then you’re trading tax savings to pay for Medicare premiums – not what we were hoping for.

However, the tax savings may far outweigh the higher Medicare premiums. Regardless, you'll want to avoid this if possible. We want to be intentional about what we’re doing and not get caught off guard.

In reality, you’ll probably want to spread Roth conversions over time. This is a great strategy to minimize your tax bill over your lifetime. You should take a comprehensive, long-term view of all the variables and develop a well-balanced plan.

Calculating Modified Adjusted Gross Income (MAGI)

It’s important to note how the SSA determines your modified adjusted gross income (MAGI) in the first place. In short, it’s calculated by adding your adjusted gross income (AGI) to any tax-exempt interest, such as income from municipal bonds. This means that maximizing “above the line” deductions from income is still helpful.

Above the Line Deductions

Above-the-line deductions reduce your taxable income before taxes are applied. In other words, your AGI is your total (gross) income minus above-the-line deductions. The IRS allows for many deductions (not to be confused with credits). Self-employment expenses or contributions to a 401(k), IRA, or HSA would be examples of above-the-line deductions.

How Much is Too Much?

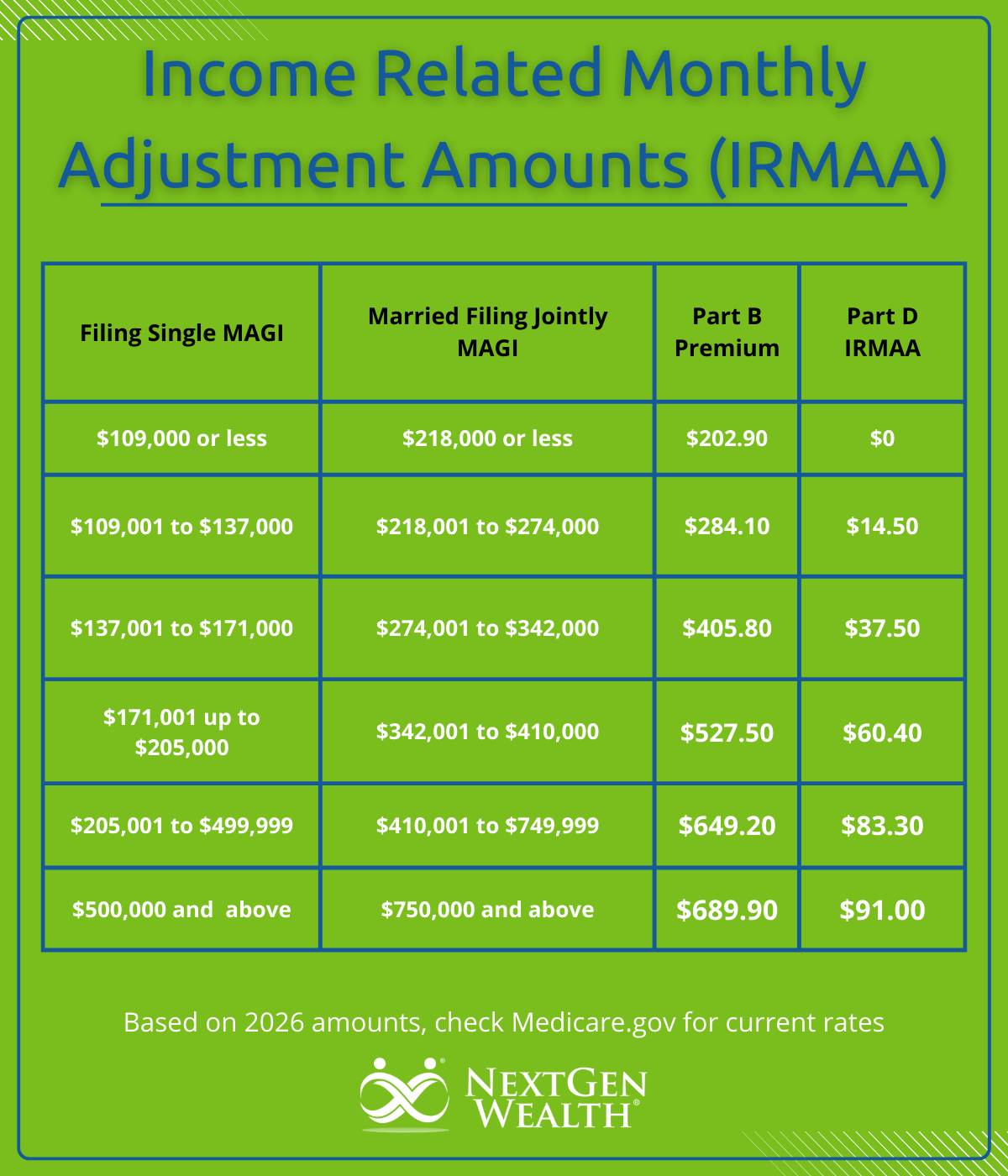

Knowing all the thresholds is helpful. If you know you’re going to make too much to avoid IRMAA altogether, then you can at least attempt to avoid the next higher premium increase. The chart below shows the 2026 Medicare premium increases.

Significant Annual Increase

If you were paying the minimum Part B and Part D premiums and get hit with the first level of IRMAA, you’ll pay an additional $1,148.40 in Part B and Part D premiums for that year. Ouch! If you cross the next threshold, your annual premium adjustment would be a total of $2,884.80 for the year!

It doesn’t take long to see that the pain of Aunt IRMAA increases the higher your income goes. This would be even more painful if you barely crossed one of the income thresholds and could have avoided it.

Crossing Thresholds

If you know that you’ll make more than the first threshold, then you don’t want to increase your income unnecessarily (selling shares in your brokerage account, selling an investment property, etc.). On the other hand, if you already know you’ll be over the first threshold, you can relax until you start getting closer to the next threshold.

If your taxable income is close to one of the thresholds already, avoiding RMDs or other taxable events becomes even more important. That’s why you want to look ahead to create a solid gameplan. Always coordinate with your accountant or other financial professionals to make sure you're not overpaying by accident.

Proper Planning Goes a Long Way

Bottom line, if you don’t plan for Aunt IRMAA, then she’ll show up at the worst possible time. Obviously, you can’t control everything. Knowing how to optimize your income and expenses in retirement is super helpful.

You’ll want to be intentional about how you accumulate income, apply prudent tax strategies, and implement well-planned retirement income tactics. Getting all the pieces to work in concert over the course of your lifetime is essential.

Final Thoughts About IRMAA

Getting hit with higher Medicare costs might not be the end of the world if you’ll be saving much more in taxes. However, it's better to avoid paying more for the same coverage. Increases in Medicare costs just stink.

If you're still unsure about how IRMAAs work and how to avoid them, feel free to reach out. At NextGen Wealth, we regularly check for things like this. Contact us today to get your no-obligation financial assessment and see how we can help you plan a fulfilling retirement!