How Annuities Affect My Taxes

Annuities are often sold as "tax-advantaged," but what do taxes actually look like when you’re in retirement? It’s important to understand the "wait now, pay later" nature of tax-deferred growth and annuity taxation. Retirement isn’t the time to get caught off guard by tax surprises.

The name of the game is keeping more of your retirement check and not overpaying Uncle Sam. The first step in maximizing your tax strategy is understanding what you have and how your investments are taxed. This is an essential part of a comprehensive financial plan to make the most of your retirement savings.

Table of Contents

The "Where" Matters: Qualified vs. Non-Qualified Annuities

The first step to understanding how an annuity is taxed is deciphering what type of annuity you’re talking about. In other words, what tax "bucket" is your money in? Annuities are classified into two main categories for tax purposes: qualified and non-qualified.

Qualified Annuities (The Pre-Tax Bucket)

The term "qualified" simply means the annuity was funded with pre-tax dollars (such as an IRA or 401(k)). The catch? The money you pull out is taxed as ordinary income.

These annuities are either purchased inside your employer plan or funded with a rollover from a qualified (pre-tax) plan. In these instances, the IRS typically counts your cost basis (the amount you paid for the asset) as zero.

Non-Qualified Annuities (The After-Tax Bucket)

A non-qualified annuity is purchased with after-tax money. In other words, these are funded with money outside a qualified plan. In most cases, only the earnings are taxed when you withdraw them.

There are some overly complicated rules on exactly how to calculate the taxable portion of a non-qualified annuity. We’ll go over this in more depth below.

Ordinary Income vs. Capital Gains

Remember, annuity gains are taxed at your regular income rate, not the lower capital gains rate. This can be confusing because exclusion ratios and other annuity tax considerations depend on several distinct factors.

Bottom line, annuities don’t function like a regular investment asset. These are often extraordinarily complex, with sometimes circular language in the contracts themselves. Even seasoned professionals have difficulty decoding the legalese and the interplay among various riders and if/then rules.

Annuity Withdrawal Rules and Strategies

For a non-qualified annuity, there are specific rules based on how and when you choose to receive your money. In other words, a single lump-sum distribution or one-off withdrawal changes how the IRS views it. The “normal” way to receive annuity payouts is through regular, usually monthly, payments.

The Exclusion Ratio

If you "annuitize" and start receiving monthly distributions, each payment from the annuity is part return of principal (tax-free) and part earnings (taxed). This spreads the tax bill over your (theoretical) lifetime or the specific contract length. For a qualified annuity, your cost basis is generally considered $0 for tax purposes.

The IRS uses one of two established methods to determine how much of your annuity payment is taxable: The General Rule or the Simplified Method.

The General Rule

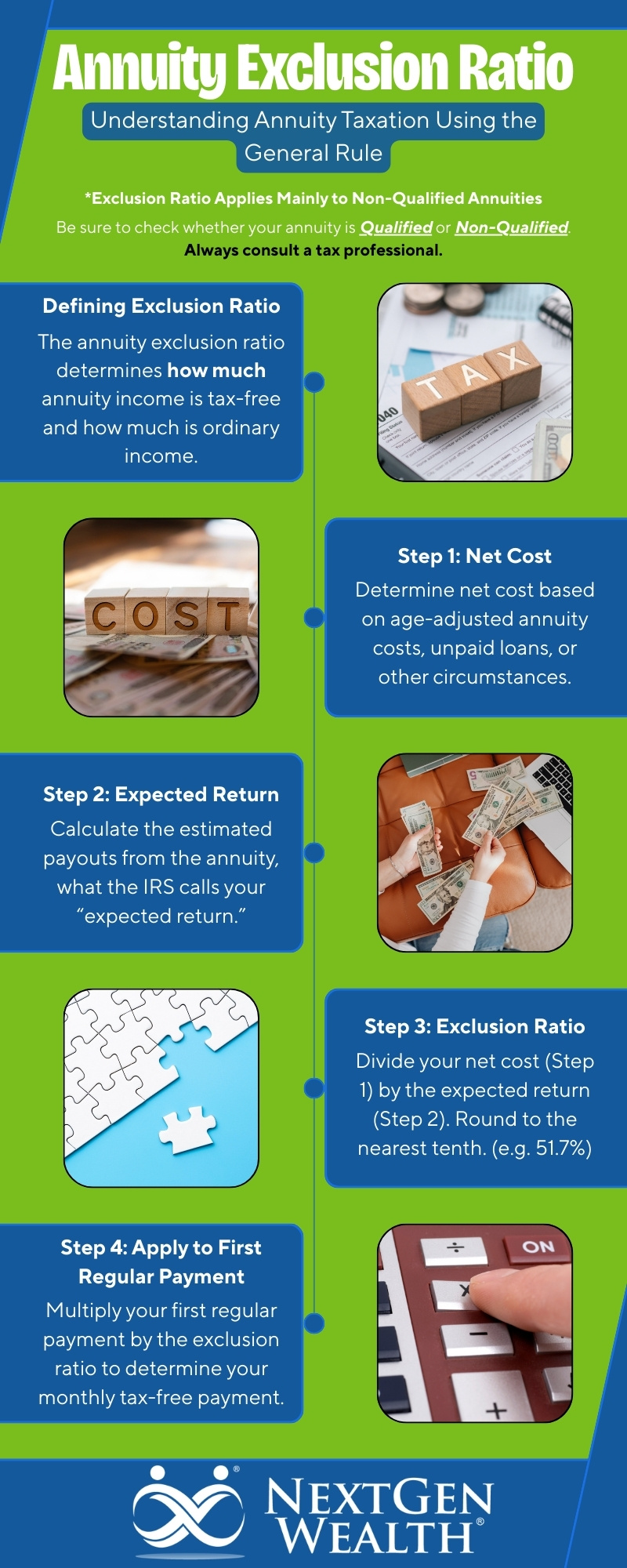

For most annuities, you’ll follow what’s called the general rule. In short, you’ll spread out the cost of the annuity over a certain period. This is based on your age and the chart in the Form 1040 instructions.

The specifics can be complex, but we’ll outline the “basic” process for calculating your exclusion ratio.

Step 1: Determine Net Cost

The first step is to determine your net cost in the annuity contract. This is based on your payments into the annuity contract adjusted for your age (life expectancy), any unpaid loans, or other special circumstances.

Step 2: Calculate Your Expected Return

Next, you’ll calculate the money you’re expected to receive from the annuity. This is what the IRS calls your expected return. Calculate the expected return using the normal monthly payment amount and the total number of payments.

This is also adjusted for your age and/or life expectancy. If you have a variable annuity, your actual returns may differ significantly. A fixed annuity will vary as well (check the contract for crediting rate calculations).

Step 3: Determine the Exclusion Ratio

Divide your net cost from step one by the expected return from step two. Round this number to the “nearest three decimal places,” which is the IRS’s confusing way of saying nearest tenth. If your exclusion ratio is 0.5174257425742574 (calculated using the IRS example), your actual percentage is 51.7%.

Step 4: Apply to First Regular Payment

Next, you’ll apply the exclusion ratio to your first regular periodic payment. For example, if your exclusion ratio is 40%, and your first payment of the year is $500, then $200 is a tax-free return of cost. Multiply that by 12, and your annual exclusion amount is $2,400.

Keep in mind, this is a simplified version of the general rule. There are other exceptions for the death of an annuitant and other factors. Your personal situation and annuity will be different.

Exceptions to the General Rule

If your annuity started after July 1, 1986, and before November 19, 1996, you could have chosen the Simplified Method or the General Rule. However, you can’t change your election. We’ll very briefly cover the simplified method.

The Simplified Method

The simplified method is covered in IRS Publication 575. This is the method used for qualified annuities. There are still exceptions, and some non-qualified annuities might use the simplified method to determine exclusion amounts.

In short, the simplified method divides your total cost by the estimated number of payments listed at the bottom of the simplified method worksheet. The number of payments is determined using your age.

The last section of the simplified method form tracks your total recovered costs from the annuity.

More Information on General Rule versus the Simplified Method

Refer to IRS Publication 939 for more information on whether your annuity is subject to the general rule or simplified method. It’s 85 pages of sleep-inducing specifics on annuity taxation.

Interestingly enough, you can actually pay to have the IRS calculate your exclusion ratio. The fee is $1,000 as of today. In return, you’d receive a “letter ruling” from the IRS explaining your exclusion ratio. The fact the IRS has this process should be a sign of how complicated annuity taxation can be.

This is why coordinating with your accountant can be so valuable. We highly recommend engaging a competent tax professional to ensure your taxes are prepared correctly.

Single Distributions and the "Earnings First" Rule

For random withdrawals, called “nonperiodic distributions” by the IRS, the IRS assumes you’re taking your gains out first. It’s "Last-In, First-Out," meaning you pay taxes upfront before you get to your tax-free principal.

Also, the IRS doesn’t deduct your assumed cost (basis) for surrender charges. The surrender charges are all on you to cover. Regardless, it’s generally best to follow the contract rather than take distributions at random, though there are some exceptions for hardship.

The "Survivor" Rule

Another rule to keep in mind is how annuity taxation applies if you outlive your life expectancy. It eventually becomes 100% taxable. This is because your tax exclusion is limited to the total cost you paid for the annuity.

Once you’ve received the cost back, you can’t claim an exclusion. Everything you receive after your maximum exclusion is fully taxable as income.

Avoiding IRS Penalties

In addition to the other complex annuity taxation rules, you still need to be mindful of specific ages and dates. Just like other retirement accounts, there are rules for when you can withdraw funds penalty-free.

The 59½ Line in the Sand

Like other qualified accounts, withdrawals from qualified annuities before age 59½ are subject to the 10% early withdrawal penalty. If you need to withdraw funds for early retirement, you may want to explore alternative early retirement options.

There are several exceptions to the 10% early withdrawal tax as well.

Required Minimum Distributions (RMDs)

Similar to other traditional retirement accounts, annuities are subject to required minimum distributions. However, there are rules (and exceptions) for your required beginning date as well. Your required beginning date is usually age 73 or the year you retire.

Furthermore, SECURE 2.0 enhanced the ability to count certain annuity payments as a portion of your RMDs. If you have an annuity within a qualified account, such as an IRA, your annuity payments count toward the total RMD for the account it’s held in. Before SECURE 2.0, the RMD would have to be taken from other investments inside the account.

In theory, your calculated payments for your annuity will meet your RMD because they’re both based on life expectancy. It’s always best to check so you don’t get hit with the 25% excise tax for failing to take your RMD.

On the other hand, non-qualified annuities aren’t subject to RMDs.

Rules for 1035 Exchanges and Annuities

In some cases, it might be a good idea to swap an old annuity for a new one without triggering a massive tax bill. You can use a 1035 exchange to switch to a different annuity. However, you must be careful not to trigger surrender charges, lose your mortality credits, or lose out on unique features you may need.

How an Annuity Affects Your Heirs

As with everything else, annuities have unique rules when the owner passes away. The type of annuity is important as well. In general, you’ll apply annuity taxation as if you were the original owner of the annuity.

Annuities don’t get the same "step-up in basis" as stocks or a home. It can be messy to close an estate which has an annuity.

Spousal Continuity

For joint-life annuities, the surviving spouse will continue to receive payments based on the contract terms. In some cases, their payments may be reduced, so ensure you understand what’s specified in the contract. There are additional rules for applying the exclusion ratio in this case.

Can you ace this basic tax literacy quiz? See what you know & don't know (& why it matters).

The Tax Bill for Non-Spouse Beneficiaries

The rules vary slightly depending on whether the original owner/annuitant had started receiving payments. In general, there is still a “return of basis” for the original cost of the contract.

If the annuity owner had started payments, the estate can deduct the portion of the estate tax attributable to the annuity. If the annuity payments had not begun, the death benefit would be treated as income, but the estate could still claim an estate tax deduction.

Annuities vs. Life Insurance

Although annuities are insurance products, they are taxed differently from the death benefits paid under a life insurance contract. Annuities are "tax-deferred," but death benefit payments from life insurance are generally "tax-free" for the designated beneficiary.

Making Taxes Part of Your Retirement Strategy

As the saying goes, don’t let the tax "tail" wag the investment "dog," but we don’t need to pay extra to the IRS either. Trust us, they’ll take what they’re owed. Don’t let taxes catch you by surprise.

Furthermore, make sure you understand the potential ongoing tax headaches you get with an annuity. It can get messy quickly, and the IRS doesn’t always care whether you understand everything before assessing a penalty.

Have a Plan

If you don’t already have a clear, written financial plan, you need one. Whether you think you have a complex situation or not, there’s a ton of value in having a game plan. This is especially important if you’re considering a complex financial product like an annuity.

If you’d like to see what it’s like to work with a fiduciary advisor like NextGen Wealth, contact us today to get your no-obligation financial assessment.