Differences Between a Financial Advisor, Wealth Manager, and Financial Planner

Looking for financial advice can be confusing and overwhelming. But it doesn’t have to be. The financial industry uses ambiguous and overlapping terms, but what do they really mean?

If you’re like most people, you just need an honest answer to tough financial questions. Yet, when you start looking for help, you’re met with a variety of terms like adviser, advicer, manager, and planner – all with the words financial, wealth, fiduciary, and investment added to spice things up.

It feels like a bad Wizard of Oz parody, “Advisors and Managers and Planners. Oh, my!” So, let’s pull back the curtain and see what these terms mean, the real differences, and who you actually need to work with.

Table of Contents

- Why These Titles Are So Confusing

- What Does Registration as an Adviser Mean

- Common Terms: Advisor, Wealth Manager, Financial Planner

- What Is a Wealth Manager or Investment Manager?

- What Is a Financial Planner?

- Key Differences at a Glance

- How to Tell What Kind of Professional You’re Working With

- Which Professional Is Right for You?

- Clarity Leads to Confident Decisions

Why These Titles Are So Confusing

Part of the confusion stems from marketing, and part from regulation. Financial professionals want to highlight their expertise and customize their titles to attract potential clients. State and Federal regulators, like FINRA and the SEC, want to ensure consumers get what they pay for.

The title itself doesn’t matter as much as legal registration and professional designations. The first thing you need to check to see if a financial planner is “legit” is if they’re registered. You can check on the FINRA BrokerCheck site or the SEC Investment Adviser Public Disclosure website (both link to each other).

What Does Registration as an Adviser Mean

Just because someone is registered doesn’t mean they have a ton of expertise or knowledge. Being registered simply means the advisor has passed a test about investments and what they can legally do as an adviser. They also have to pass a background check.

What Are “Series” Licenses?

You’ll often see licenses with terms like Series 7, Series 65, etc. FINRA administers several securities exams. Each of these exams and accompanying licenses is required to trade financial products and/or to receive compensation for providing investment advice.

The Terms Broker, Dealer, and Broker-Dealer

Unfortunately, there are even more legal terms to muddy the waters. The series licenses are typically for people who buy and sell securities. If the advisor holds a Series 6, Series 7, Series 63, or Series 66 license, they can legally sell financial products.

If the person is registered with a broker-dealer, they’ll need these licenses. However, the Series 65 or equivalent designation is required to give advice. In short, if the person holds a Series 6, Series 7, Series 63, or Series 66, they probably have products to sell you and get paid, at least partially, on commission.

They are trained to advise on the purchase of investments and insurance products. Some offer more, but many do not.

What About Credentials and Designations Like the CFP® Marks?

In addition to actual legal licenses, advisors may have designations from one or more organizations. These are governed by the individual organizations or institutions who grant them. Most of these certifications require some form of education, an exam, and continuing education (and fees) to remain in good standing.

FINRA now recognizes hundreds of different professional designations. One of the most commonly sought-after is the CERTIFIED FINANCIAL PLANNER® certification, which the CFP Board administers. The founder of NextGen Wealth, Clint Haynes, is a CFP® professional.

The CFP® Designation

To become a CFP® professional, individuals must have a minimum of a bachelor's degree, complete the minimum financial planning courses (seven total college-level courses), have several thousand hours of experience, and pass a rigorous 6-hour test (65% pass rate). It’s not an easy process.

The “F-Word” – Fiduciary

The best financial advice is fiduciary in nature. A fiduciary simply means the person advising you is required to place your needs above their own and always recommend what’s best for you. Technically, all financial advisors are required to act as fiduciaries.

However, some advisors also wear another hat as a broker-dealer when they sell insurance or investment products. The standards of a broker-dealer are confusing. Someone who is licensed to sell insurance or investment products is supposed to be held to what’s called a “best interest” standard. This is like a fiduciary standard, but not as good.

Conflicts of Interest

All financial transactions have inherent conflicts of interest. Any time there’s an exchange between a person and another person or business, conflicts of interest can happen. By law, advisors and broker-dealers are required to disclose any “material conflicts of interest” when doing business with consumers.

You know all those long documents nobody reads? There are usually disclosures about conflicts of interest in there. However, just telling you they exist doesn’t eliminate them.

One Step Further

Some advisors take it a step further and actively work to eliminate as many conflicts of interest as possible. These advisors are transparent about fees, often don’t sell any investment or insurance products, and make recommendations to benefit the client, even if it means the advisor makes less money.

Common Terms: Advisor, Wealth Manager, Financial Planner

Separate from the legal terms and professional designations, financial professionals call themselves a variety of names. We’ll broadly discuss the more common uses of the terms financial advisor, financial planner, and wealth or investment manager.

What Is a Financial Advisor?

The most common is adviser or advisor, which is also the legal term for someone licensed to give advice for a fee (investment adviser). This term can be spelled either with an “er” or “or,” but they mean the same thing. To be even more confusing, some popular personalities in the financial planning space even use another variation, advicer.

In short, a financial advisor is simply someone who is in the business of providing investment advice. The minimum bar to call yourself an advisor is relatively low. As long as you are registered, you can legally charge for investment advice.

Typical Services Offered

Most advisors will make specific investment recommendations, help set up investment accounts, perform trades and rebalancing for clients, and potentially offer brokerage and trading services. Many will also give guidance on retirement accounts. Many will also sell insurance products such as life insurance and annuities.

How Financial Advisors Are Paid

Historically, most advisors are paid on commissions, advisory fees on assets under management (AUM), or hybrid compensation models. The exact compensation for an advisor will vary depending on whether they’re a solo practitioner, work for a larger firm or broker-dealer, or work for a Registered Investment Advisor (RIA).

Pros and Cons

The term advisor is very broad and can apply to just about anyone with a license. For advisors who are paid on commission, there are many inherent conflicts of interest. The term advisor doesn’t really tell you what service you’ll receive for the money you pay.

What Is a Wealth Manager or Investment Manager?

In many cases, a Wealth Manager or Investment Manager focuses on High-Net-Worth-Investors (HNWI). They are licensed the same as any other financial advisor (Series licenses), but try to market themselves as having some type of additional investing expertise.

Many who market themselves as wealth managers try to work with families who have $1 million or more in investable assets. They will typically focus more on market performance, overall returns, and accumulating more and more money.

Services Offered by Wealth Managers

Most wealth managers will offer similar services to the broader array of financial advisors, such as ongoing investment management and product recommendations. They may add some specialty offerings such as advanced tax planning strategies, estate planning, and business and succession planning.

They may have a larger team with a dedicated investment analyst (usually a Chartered Financial Analyst® (CFA®), Certified Public Accountant (CPA), and other “back office” staff.

How Wealth Managers Are Paid

Wealth managers may also be compensated in a variety of ways. It’s common to see commission-based compensation, but there is a shift to more ongoing investment management and charging a percentage of assets under management. You may also see some flat-fee models.

What Is a Financial Planner?

The term financial planner is often used for professionals who focus on comprehensive financial planning. They’ll offer a variety of niche specialties with a comprehensive suite of services. Most financial planners create detailed strategies covering retirement, cash flow, taxes, insurance, and estate planning.

Most financial planners use a structured planning process to help their clients stay on track and take a more comprehensive approach.

Common Qualifications

Most CFP® professionals fall into this category. It’s literally in the name of the designation. However, there may be other professionals and designations with similar attitudes toward financial planning.

How Financial Planners Are Paid

Financial planners have the widest variety of fee and compensation models. Many operate as fee-only planners for increased transparency. However, the world of fee-only is still broad. Fee-only models may include:

- Flat-fee or project-based planning (one-time or ongoing engagements)

- Hourly or subscription (flat fee per month or quarter)

- Assets Under Management (AUM)

- Advice only (no investment management)

Firm Structure and Service Delivery

Many financial planners work in independent Registered Investment Advisor (RIA) arrangements. They may be registered with their state or the SEC. They could work as solo practitioners or as a large team.

Many financial planners will leverage outside professionals to offer a broader range of services such as asset management, tax planning, and estate planning. Some will even offer coaching or long-term care planning services. The services offered will vary by the individual firm.

When a Financial Planner Is Ideal

A financial planner may be best if you’re looking for a long-term relationship, ongoing management, accountability, efficient delegation, and proactive planning support. Many financial planners get most excited about being your lifelong guide into and throughout retirement.

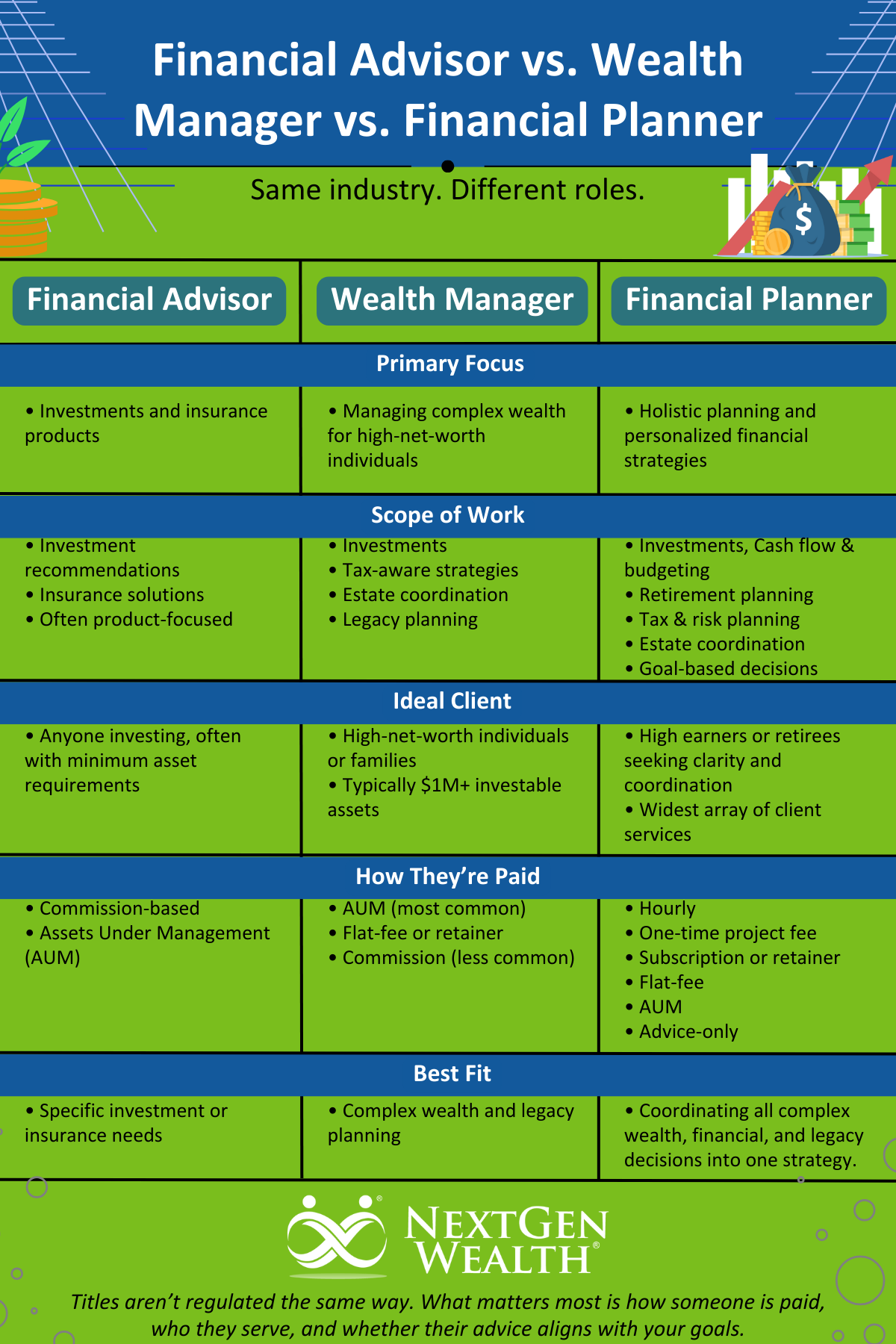

Key Differences at a Glance

We’ve done our best to help narrow down these broad categories, but it’s difficult to fit 15,000 different investment advisers into narrow categories. After all, there is a human behind each one of them. We’ll try to narrow it down by “typical” scope of work, typical clients, and fee structures.

Scope of Work

- Financial Advisor: Focused on investments and insurance.

- Legal term for financial advisers.

- Wealth Manager: Focused on complex, high-net-worth individuals.

- May expand offerings beyond investments and insurance.

- Financial Planner: Focuses on a more holistic planning approach and complex, personalized strategies.

- Usually offers specialized advice with a narrow focus on a specific type of client.

Ideal Client Profile

A financial advisor can serve anyone, but will often focus on selling their own products and investment offerings. They may have a minimum level of investment assets to work with them.

Wealth managers are typically focused on high-net-worth individuals. They’re often looking for individuals or families with $1 million or more in investable assets.

Financial planners will offer the broadest range of service models for a wide range of people. They often work with high-earners or high-net-worth individuals.

Fee Structures

- Financial Advisor: Typically, commission-based or AUM.

- Could technically offer any number of compensation models.

- Wealth Manager: Typically, AUM, but could be flat-fee, retainer, or commission-based.

- Financial Planner: Broadest array of compensation models. May offer:

- Hourly

- One-Time Fee

- Recurring Subscription (typically monthly or quarterly)

- Advice-Only

- Fee-Only

- Flat-Fee

- AUM

- Some may still have insurance licenses and/or earn commissions from investments, but this is not as common.

How to Tell What Kind of Professional You’re Working With

The only way to be sure about who and what is behind the financial professional you’re talking to is to look at their regulatory paperwork. Many advisors list their fees and services directly on their websites. If they don’t, you can look up their “Form Adv Part 2A Brochure” or “Part 2 Brochures” document filed with the state (FINRA) or the SEC.

You’ll see a listing of the business structure, fees, types of clients they serve, if they’ve had any complaints or disciplinary actions taken against them, as well as a variety of other information.

Which Professional Is Right for You?

We highly recommend starting your search for a financial professional by thinking through exactly what you need help with.

- Do you only want investment management?

- Would you prefer to get financial planning included?

- Do you want ongoing support throughout retirement?

- What will you need as you age or have cognitive decline?

- What about support when one spouse passes away?

- Do you require tax or estate planning and coordination?

- Does your asset level necessitate a more specialized service model?

If you’re a do-it-yourself (DIY) investor and just want a second set of eyes and no ongoing support, maybe a one-time engagement is right for you. Or maybe you’ve done a great job as a DIY-er and are ready to delegate those responsibilities so you can spend time enjoying retirement instead.

Questions to Ask Any Financial Professional

Make sure you have a thorough list of questions to ask your potential financial professional. At a minimum, you’ll want to ask:

- How are you paid?

- What services do you offer?

- How often will we meet?

- How does your service compare to other services?

- How do you ensure you’re acting as a fiduciary?

- Do you sell financial products or earn commissions for recommendations?

In many cases, you’ll be paying ongoing fees for service, so it’s essential to know exactly what you’ll get in return. If you don’t feel comfortable, keep asking questions until you do. If you run out of questions and still don’t feel comfortable, follow your gut, and walk away; it’s just not a good fit.

Clarity Leads to Confident Decisions

The landscape of financial professionals can be confusing at best. Understanding the real difference between them will help you choose the right professional for your retirement team. Titles matter a whole lot less than the actual services offered, trust and transparency, and the professional's fiduciary commitment to you.

We recommend interviewing multiple professionals before deciding who to work with. This is why we offer a no-obligation financial assessment to see if we’re a good fit. We wish you the best of luck as you find the right financial professional for you!