Navigating Pension Payout Options with Confidence

Deciding what pension payout option to choose is a momentous decision with huge impacts on your financial future. There may be several different options – and you don’t want to choose the wrong one. Your company’s plan documents can also be confusing, which makes things more stressful.

Deciding what pension payout option to choose is a momentous decision with huge impacts on your financial future. There may be several different options – and you don’t want to choose the wrong one. Your company’s plan documents can also be confusing, which makes things more stressful.

However, with the right education and planning, you can navigate this important decision with confidence. The biggest challenge is understanding how each payout option can help work in concert with the other pieces of your life. We hope to give you the tools to make informed comparisons to make the best decision for you and your family.

Table of Contents

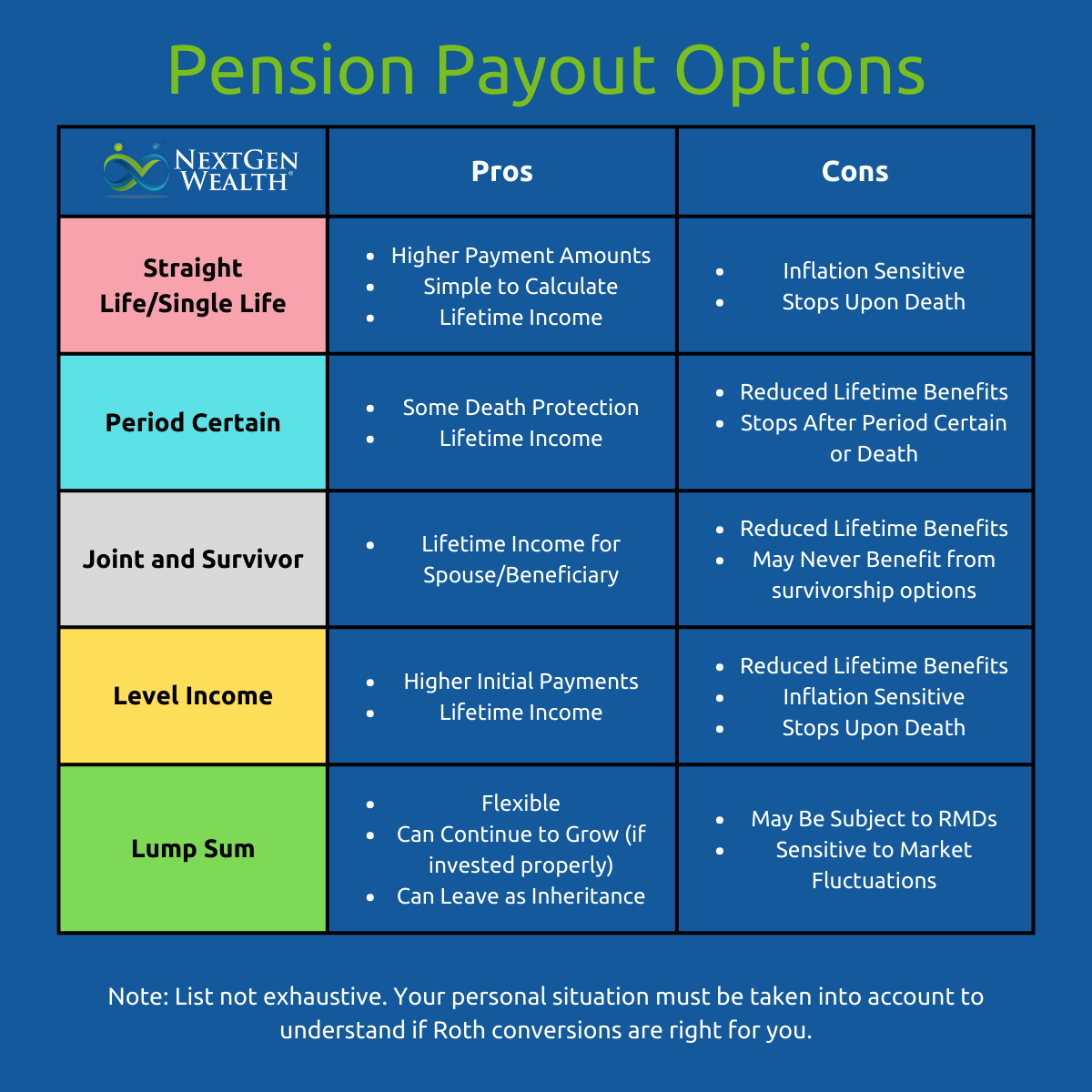

Overview of Pension Payout Options

You’ve been grinding it out and staying loyal to your company for years, probably decades. Now you’re nearing retirement and ready to start drawing your pension. There are probably many different options and variations, but we’ll try to cover the most common ones you may see.

Need help navigating your retirement income options? Get your retirement income plan today!

Straight-Life and Single-Life Pension Payouts

A straight-life or single-life payout option gives you level payments (the same amount each month) for your lifetime. This ensures you’ll receive pension income as long as you live. However, once you pass away, the payments stop.

There are some risks associated with this payout option, such as inflation, premature death, or pension program failure. The biggest benefit is this payout option will likely have a higher monthly payment than most other options.

Period Certain Pension Payout

A period certain annuity payout will pay a guaranteed benefit for a certain time period, say 10 years. These plans may also be referred to by the time period's number of years. For example, your plan may be called a “ten-year certain” pension payout.

This means your pension will pay out 10 years of benefits even if you pass away before then. This comes with reduced payments but guarantees payments for the time period specified. This plan could be good if you need reliable income for a specific time period (until the house is paid off, kids through college, etc.), but don’t need the maximum monthly benefit.

Joint and Survivor Pension Payout

Some pension plans allow you to select a joint and survivor plan. Depending on the plan, these will typically range from 50% to 100% (often 50%, 75%, or 100%). When you pass away, your spouse or other designated beneficiary will receive a percentage of your pension for their lifetime.

This can start to get a little complicated because the age of your spouse or beneficiary may affect the cost and monthly payments you’ll receive. For instance, if your spouse is much older than you, the payout may be higher than if your spouse is much younger than you.

There are a few different factors at play in this decision. You’ll need to think about how your spouse’s expenses may change, life insurance eligibility, and how much of your pension is actually needed. Maybe there’s a more cost-effective solution if you only need to bridge a short time gap if something happens to you.

Need help navigating your retirement income options? Get your retirement income plan today!

Level Income Options

Your pension may also offer what’s called a “level income” option as well. This option gives you a higher payout initially and then reduces the benefit when you are anticipated to draw Social Security. This would only apply if you were retiring before Social Security eligibility.

These payout options may be offered as a straight life or joint and survivor program. The idea would be to keep the same income before and after you start drawing Social Security. However, you may not want to draw Social Security when the plan reduces your benefit (maybe as early as 62).

This may be a useful strategy if you want to retire early. This may also offer some flexibility if you’re forced to retire earlier than planned.

Lump Sum Pension Payout

A lump sum payout is exactly like it sounds – you get one payment, a lump sum, paid to you. This allows you to invest the money as you wish. Investing this money gives you the ability to continue growing your money through retirement.

Typically, you’d want to roll this into your 401k or IRA so you can continue to defer paying taxes. Many plans offer the option to get a distribution in cash – either partial or full. Be careful on how you have this distributed because you’ll have to pay taxes or have taxes withheld for cash distributions.

There are many factors affecting exactly what your lump sum amount will be. There’s a significant amount of variation depending on what current interest rates are.

Factors to Consider in Your Decision

Just knowing what the payout options are won’t get you all the way to a decision. There are a lot of different factors to consider. Do you have other income (rentals, spouse, small business, etc.)? When will you draw Social Security?

These can all factor in on top of our guess about what inflation will look like throughout your retirement. We want to figure out how to achieve your goals throughout your retirement. We’ll talk about some of the more common variables we discuss with our clients.

Your Financial Situation

Understanding your financial situation is the foundation for every decision moving forward. Do you have other savings? Are you expecting an inheritance or caring for your parents?

At the most basic level, we have to look at current and anticipated cash flow. If you just refinanced your home on a 30-year mortgage, your situation would look different than if you had a paid-off house. If you have a significant balance in your 401k, you may feel differently about how you receive your pension.

Health and Life Expectancy

Unfortunately, not all of us are blessed with amazing health in retirement. Joints and muscles just don’t work the same as they did 20 years ago. We only have best guesses as to how long we’ll live.

Our family history can give us clues, but we just never know. If you think you’ll have a longer lifespan, having additional stable income is best.

Risk Tolerance

Your tolerance or appetite for risk is important to consider as well. If the thought of seeing your portfolio value dip (temporarily) by 10-40% keeps you up at night, maybe a lump sum is lower on the list than an annuity payout option.

On the other hand, if you’re in constant fear of your pension defaulting, maybe the lump sum would be higher on the list of options. Although there are protections for this, your total payout will be smaller. If having the lump sum makes you feel more in control and helps you sleep at night, then it’s a significant consideration.

Need help navigating your retirement income options? Get your retirement income plan today!

Spouse or Beneficiary's Needs

There are many different family dynamics that affect our pension payout options as well. We won’t get into all the nuance of those here. Bottom line, you want to ensure your family is taken care of no matter what.

Thinking about the what-ifs and how to protect your loved ones is really important. Other factors to consider here are your ability to get affordable life insurance (if needed), any special needs family members, and natural tendencies toward spending and saving.

Tax Implications

On top of all this, we have to think about all the potential tax consequences. There are many things to consider around what your taxable income will be in retirement, state tax benefits, and potential tax changes.

Also, if you’re looking to utilize more advanced tax-saving strategies, you may want to lean more toward a lump sum versus an annuity payout. These include strategies such as Roth conversions and qualified charitable distributions (QCDs). You’ll also have to consider the impact of required minimum distributions with a lump sum as well.

Seeking Professional Advice

Sometimes there are so many different nuances, it’s hard to decide what’s best. Like many things in life, it’s impossible to know the perfect answer until after the fact. However, with expert guidance and careful planning, you rest easy knowing you picked the best option based on the information you had at the time.

How NextGen Wealth Approaches Pensions

At NextGen Wealth, we walk our clients through our COLLAB™ Financial Planning Process. We look at your entire financial picture and help you understand how each pension option may affect your goals. As a matter of fact, we specialize in the transition phase of retirement just for this reason.

We believe the five years leading up to retirement are when some of the most critical decisions are made. This includes deciding on the right pension options. Contact us today for your retirement checkup and learn how we can help you make the right decision for your family.