How A 1035 Exchange Can Help You

If you’re nearing retirement, you might have life insurance or an annuity you no longer need. If so, you should be aware of what’s called a 1035 exchange.

A 1035 exchange can help you if you’re unsure about what to do with an old life insurance policy or an annuity.

In short, a 1035 exchange allows you to trade a life insurance contract, annuity, qualified long-term care, or endowment contract for a different policy. The 1035 exchange allows you to do this without creating any tax consequences.

Table of Contents

- Why Pre-Retirees Should Care About a 1035 Exchange

- Eligible Products for a 1035 Exchange

- Common Reasons to Use a 1035 Exchange Before Retirement

- When a 1035 Exchange Might Be a Bad Idea

- Putting It into Practice

- The Pros and Cons of a 1035 Exchange

- How a Financial Planner Can Help You Decide

- Next Steps: Is a 1035 Exchange Right for You?

Why Pre-Retirees Should Care About a 1035 Exchange

Insurance products are often oversold by pushy salespeople. This can leave you with insurance products which may not be the best for you. In other cases, newer insurance rates or annuities could be more favorable.

Over time, your insurance needs will change. Life insurance is incredibly important for the breadwinner of a growing family. However, a retired couple with an empty nest and a fully funded retirement might not need life insurance at all. Your risk of not being able to provide for your family will generally be replaced by the risk of outliving your money and long-term care costs.

What Is A 1035 Exchange

Enter the 1035 exchange. A 1035 exchange could allow you to exchange your old, possibly unnecessary life insurance products for other life insurance products that would make more sense.

Typically, if you cash out a life insurance policy or annuity contract, you’ll have to pay taxes on any gains inside the policy. The IRS allows you to complete an “in-kind” exchange and avoid creating a taxable event. This ensures you aren’t trapped in an insurance contract due to taxes.

Why Taxes Can Become a Problem

When you pay premiums into an annuity or permanent life insurance policy, you accrue a certain amount of cash value. Technically, permanent life insurance, like whole life, is partly “pure” insurance, or a death benefit, and the rest is accumulated cash value, which can accrue interest and grow. If you surrender the policy, then you’ll be taxed on all the gains and dividends used to pay premiums.

Depending on the size of the insurance policy or annuity, you might have a large amount of gains. Since life insurance surrender proceeds are taxed as ordinary income, not capital gains, you could push yourself into a higher tax bracket. If you complete a 1035 exchange, you can continue to defer those gains.

What a 1035 Allows You to Do

Tax planning is especially important if you have an annuity or cash-value life insurance contract. If you’re coming up on Medicare eligibility, you want to be very careful with your total income for the two years before you turn 65. You don’t want to get hit with additional Medicare surcharges if you can help it.

In other words, a 1035 exchange allows you to replace insurance and annuity policies so you can make the most of the premiums you’ve already paid and avoid a tax bill now. It gives you more flexibility to implement your financial plan.

Eligible Products for a 1035 Exchange

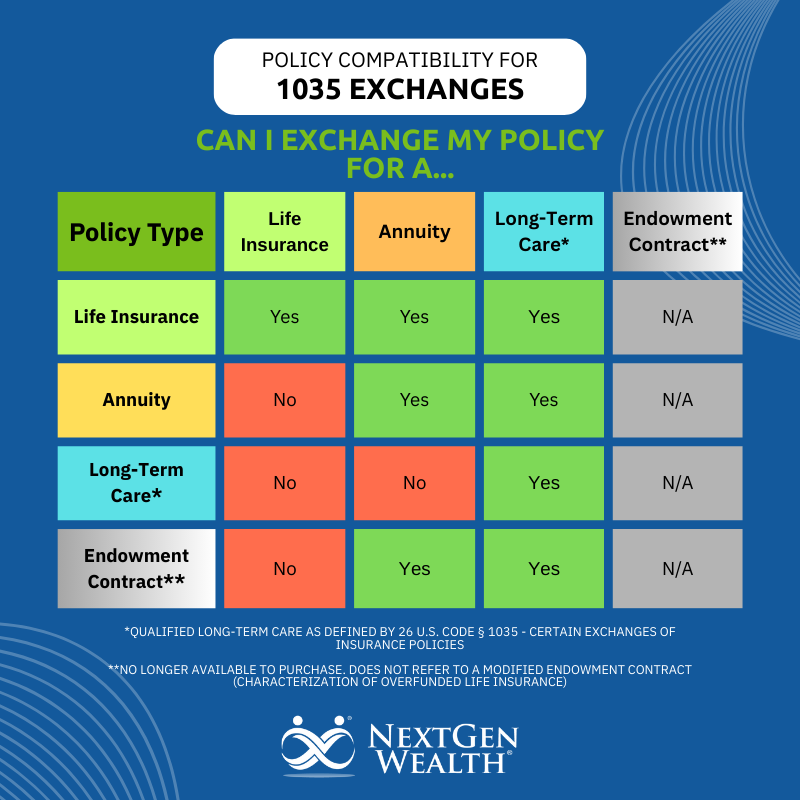

The law allows you to exchange life insurance, annuities, and qualified long-term care insurance. However, not all can be exchanged for one another. Technically, you can also use a 1035 exchange from an endowment contract, but these aren’t sold anymore and aren’t very common.

We’ve made this chart to help you understand the basics of which type of policy can be exchanged for another kind of policy. This is very important to make sure you’re not accidentally creating an extra tax bill. It’s also best to consult your retirement team first.

Common Reasons to Use a 1035 Exchange Before Retirement

So, why would you need to exchange insurance or annuity contracts in the first place? There are several reasons, but we’ll focus on the most common ones here.

Replacing Old, Unneeded, or Expensive Policies

It’s very common for people to reach retirement and still have an “old” life insurance policy, a policy from work, or an annuity contract they may no longer need. In many cases, you may still be paying premiums as well. If you have plenty of retirement assets, your need for life insurance is much lower than when you were in the accumulation phase of retirement.

Instead of viewing these contracts as an annoying bill, a 1031 allows you to think of them as an asset that can be converted into something more valuable. You can use the cash value toward other insurance needs or restructure into better streams of income.

Annuity Exchanges

Annuities are often oversold using fear of loss as a motivating factor. However, if you’re already in retirement with other income sources, you might not need all the features of the annuity you were initially sold. On the other hand, it’s possible you could have a great product that still fits well into your financial plan.

You’ll want to carefully evaluate factors such as surrender charges, other products on the market, and any additional riders you may want to add or exclude this time around.

Consolidating Multiple Contracts for Simplicity

It may be beneficial to consolidate several life insurance or annuity contracts into a single policy. You may need to be careful with the timing of exchanging multiple contracts into one. We highly recommend seeking professional assistance with this if you believe it will benefit you.

Funding Long-term Care insurance

With the emergence of hybrid policies, which include life insurance and long-term care insurance, we now have a unique opportunity. Retirees should proactively plan for long-term care. This is an often-overlooked area of risk for retirees.

Addressing long-term care needs could be solved by converting a policy you no longer need. Regardless, don’t cash out your policy without considering other uses. It’s also best to obtain quotes for long-term care insurance on its own for comparison purposes.

When a 1035 Exchange Might Be a Bad Idea

There are also many cases where a 1035 exchange might be a bad idea. You need to take your time to weigh the potential pitfalls of exchanging insurance policies.

Already In a Low-Cost Annuity or Policy

You might already have the best insurance policy or annuity contract for your needs. It’s unlikely that you'll find the exact same policy you bought 20 years ago. In some cases, your accumulated death benefit might yield more money at the “end of your plan” than the payout of a newer or different type of policy.

However, it’s impossible to know what life will throw at you. We will always be using “best guesses” and information available to us, based on the most likely scenarios.

Your Current Policy’s Surrender Period Is Almost Over

If your current insurance or annuity contract’s surrender period is almost over, you might want to wait before switching to other coverage. Some surrender charges can be expensive, and a 1035 doesn’t remove surrender charges for you. You’ll need to weigh this against how quickly you need to implement a more suitable policy.

Lack Of a Clear Retirement Income Plan

If you’re unsure what your whole financial picture looks like, you can’t make a completely informed decision. We highly recommend taking the time to get a clear picture of your finances now, your goals, and how to maintain your lifestyle throughout retirement.

If not, you’re just taking shots in the dark. You want each investment, tax-saving strategy, and insurance product to fit your whole retirement picture first.

Putting It into Practice

For example, let’s say our friend Max Benny has an old whole life policy with a $20,000 cash value. He already has all the assets he needs for retirement income and no longer needs life insurance. He has the option to keep paying the premiums, cash out the policy, or roll it into a new policy.

However, Max does have concerns about long-term care, especially since Alzheimer's disease runs in his family. He looked into long-term care insurance, but the premiums were pretty high. Max got three different quotes for hybrid life/long-term care policies.

- Scenario 1: Max rolls his cash value over to the new policy and pays a one-time premium of $5,000 to get a $1,500/month long-term care policy with a guaranteed death benefit of $7,500.

- Scenario 2: Max rolls his cash value over to the new policy and starts paying an annual premium of $2,500 to get a $2,000/month long-term care policy with a guaranteed death benefit of $10,000.

- Scenario 3: Max rolls his cash value over to the new policy and starts paying an annual premium of $5,000 to get a $3,000/month long-term care policy with a guaranteed death benefit of $15,000.

In all cases, Max can apply his accumulated cash value in his old policy toward the new policy. In other words, he was able to take a policy that no longer fit him, avoid paying taxes on cashing out the policy, and get valuable long-term care insurance while maintaining a death benefit.

Note: This scenario was inspired by quotes we obtained for an actual client. Numbers and options have been altered and simplified, but these are real options from actual insurance quotes.

The Pros and Cons of a 1035 Exchange

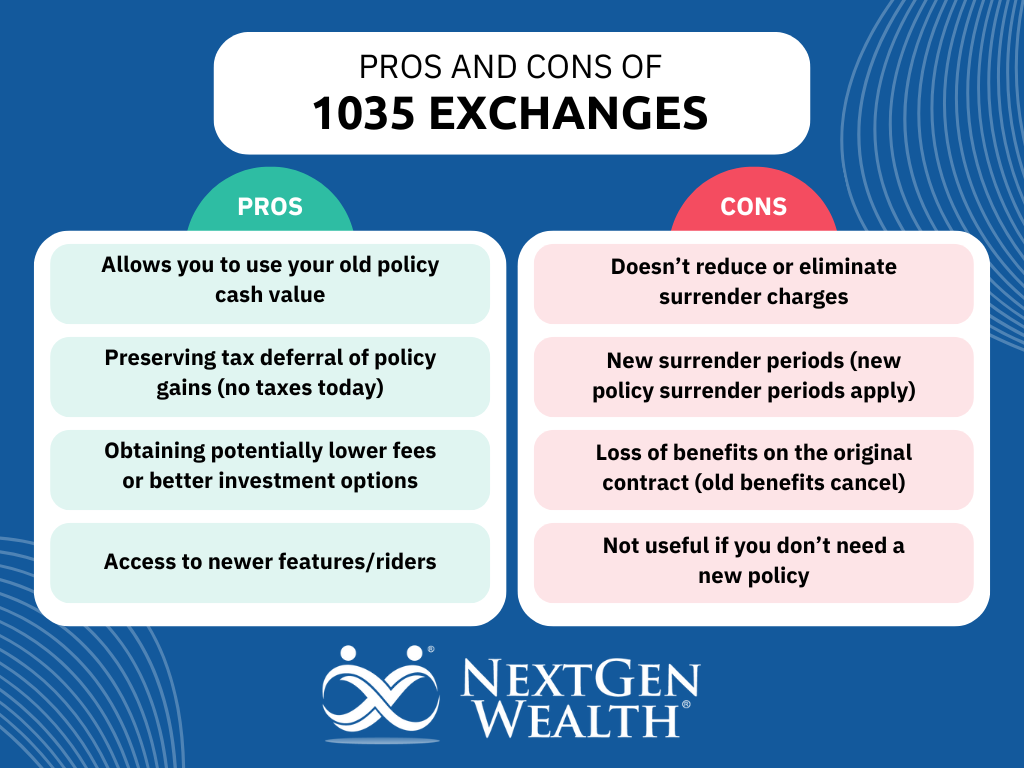

To summarize, here are some overall pros and cons of completing a 1035 exchange.

Pros of a 1035 Exchange

- Allows you to use your old policy cash value in unique ways: A 1035 exchange allows you to fund new policies by tapping your current policy’s cash value. This money might only be accessible via loans against the policy without incurring additional taxes.

- Preserving tax deferral of policy gains: You typically have to pay taxes on any realized gains (money you make) from the surrender of an insurance policy, but a 1035 exchange transfers your basis (money you’ve spent on the policy) to the new policy.

- Obtaining potentially lower fees or better investment options: Insurance companies compete on price just like any other industry. You may be able to obtain a similar policy to the one you currently have, but at a lower cost or with more favorable interest rates.

- Access to newer features/riders: Insurance products offer different rates and options (riders) frequently. In some cases, you may benefit from newer policy options you couldn’t get when you first purchased your current policy.

Cons of a 1035 Exchange

- Surrender charges: A 1035 exchange does not reduce or eliminate surrender charges. You’ll still be liable for any surrender charges outlined in your policy contract.

- New surrender periods: Although your old policy may not have had a surrender charge or your surrender period may have expired, your new policy might have a different surrender period.

- Loss of benefits on the original contract: You’ll no longer have the benefits of the original contract. Once you exchange/cancel your old policy, you can’t simply reinstate it.

- Not useful if you don’t need a new policy: It’s always important to check to see which products are best for you. Depending on your situation, you might not need any insurance at all. In which case, a 1035 exchange can’t help you.

Can you ace this basic tax literacy quiz? See what you know & don't know (& why it matters).

How a Financial Planner Can Help You Decide

We can’t overstress the importance of comprehensive retirement planning. There isn’t anything like a holistic financial plan incorporating all aspects of your life. A competent financial planner can help you analyze fees, benefits, break-even points, and complete income projections.

Better yet, modern financial planning software can help stress-test your plan to ensure your retirement strategy can weather the inevitable storms and changes ahead. Lastly, a fee-only, fiduciary planner can be your trusted advisor without pushy sales tactics. A good financial planner offers more than just wealth management – they’re your trusted partner with all your financial decisions and needs.

Next Steps: Is a 1035 Exchange Right for You?

We highly recommend collaborating with a team of financial experts before initiating a 1035 exchange. Your accountant and financial planner are invaluable in this process. It’s critical to ensure you don’t accidentally create a tax headache or have a lapse in coverage.

At NextGen Wealth, we help retirees and pre-retirees explore options and build a personalized retirement plan tailored to their lives. Contact us today to schedule your no-obligation Retirement Checkup. No pressure. Just smart, thoughtful advice.