Can Capital Gains Push Me Into a Higher Tax Bracket?

This post was last updated on February 24, 2026, to reflect all updated information and best serve your needs.

Getting taxed at the capital gains rate is usually considered better, but what if those gains affect your ordinary income taxes? Understanding when capital gains can push you into a higher tax bracket is very important. The final step of investing success is keeping your hard-earned cash where it belongs – in your bank account!

The first thing to consider is exactly what assets are capital gains and when they are taxed. For the most part, anything you own and later sell for a profit can be considered a capital gain.

Table of Contents

- What The IRS Says About Capital Gains and Tax Rates

- Short-Term Capital Gains

- Long-Term Capital Gains

- My Investments Did Really Well, Now What?

- What Tax Rate Will My Money Be Taxed At?

- How Do I Avoid Paying Short-Term Capital Gains?

- A Note on Dividends

- How Can I Reduce My Short-Term Capital Gains?

- The Bottom Line on Capital Gains and Your Tax Bracket

What The IRS Says About Capital Gains and Tax Rates

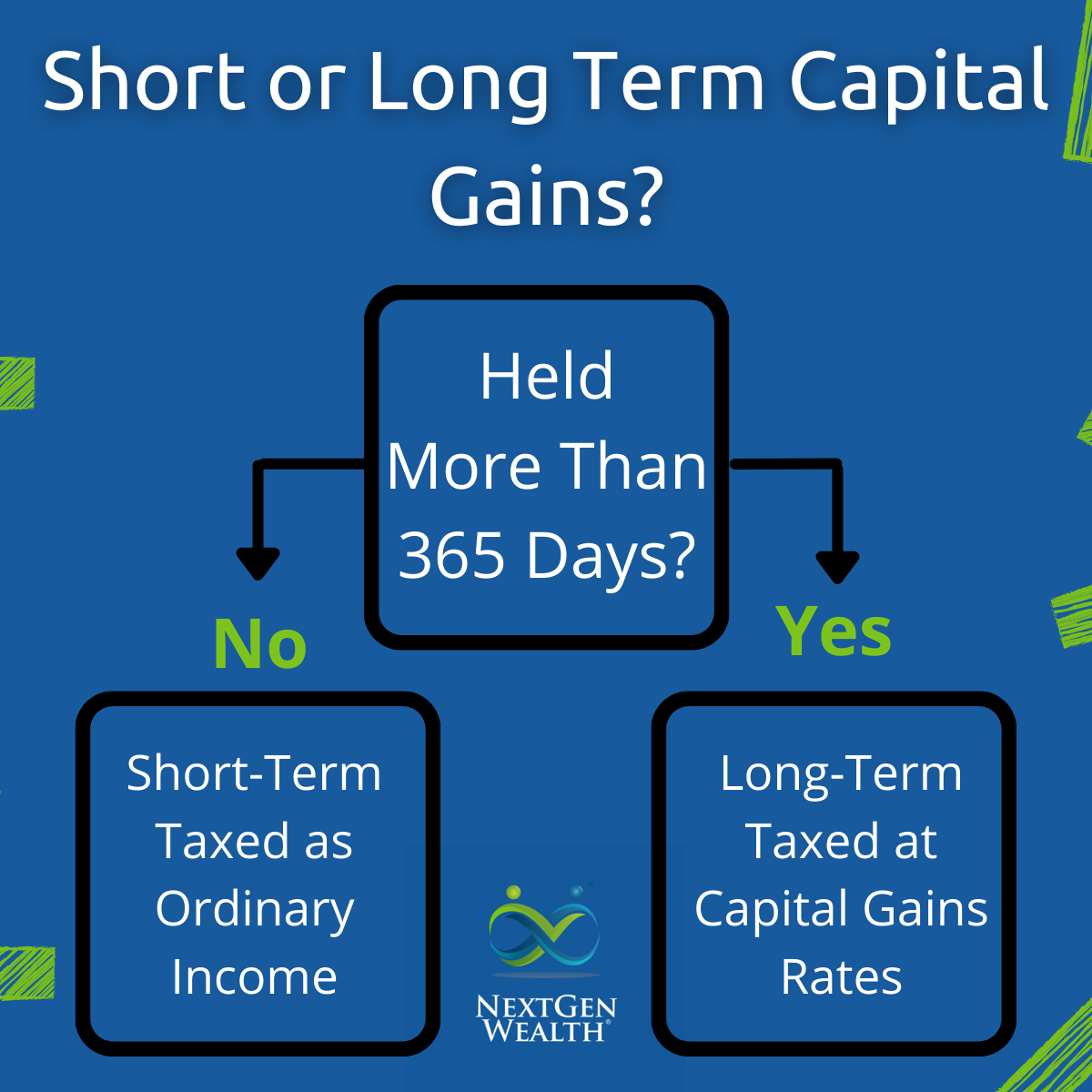

The IRS taxes capital gains as regular taxable income or at a special capital gains rate, depending on how long you’ve held the underlying asset. There are always exceptions too, so it's important to know the rules.

Many investors learn the hard way. A set-it-and-forget-it approach can lead to major tax consequences if you don’t understand how the underlying asset works. Understanding the mechanics of capital gains tax is important.

Short-Term Capital Gains

Gains from assets held for 1 year or less are Short-Term Capital Gains. That’s 365 days or fewer.

Just a note, don’t let leap years fool you. You have to count the days. As an example, if you buy a share of stock in XYZ Company on February 1st and then sell it on February 15th the same year, you will incur a short-term capital gain.

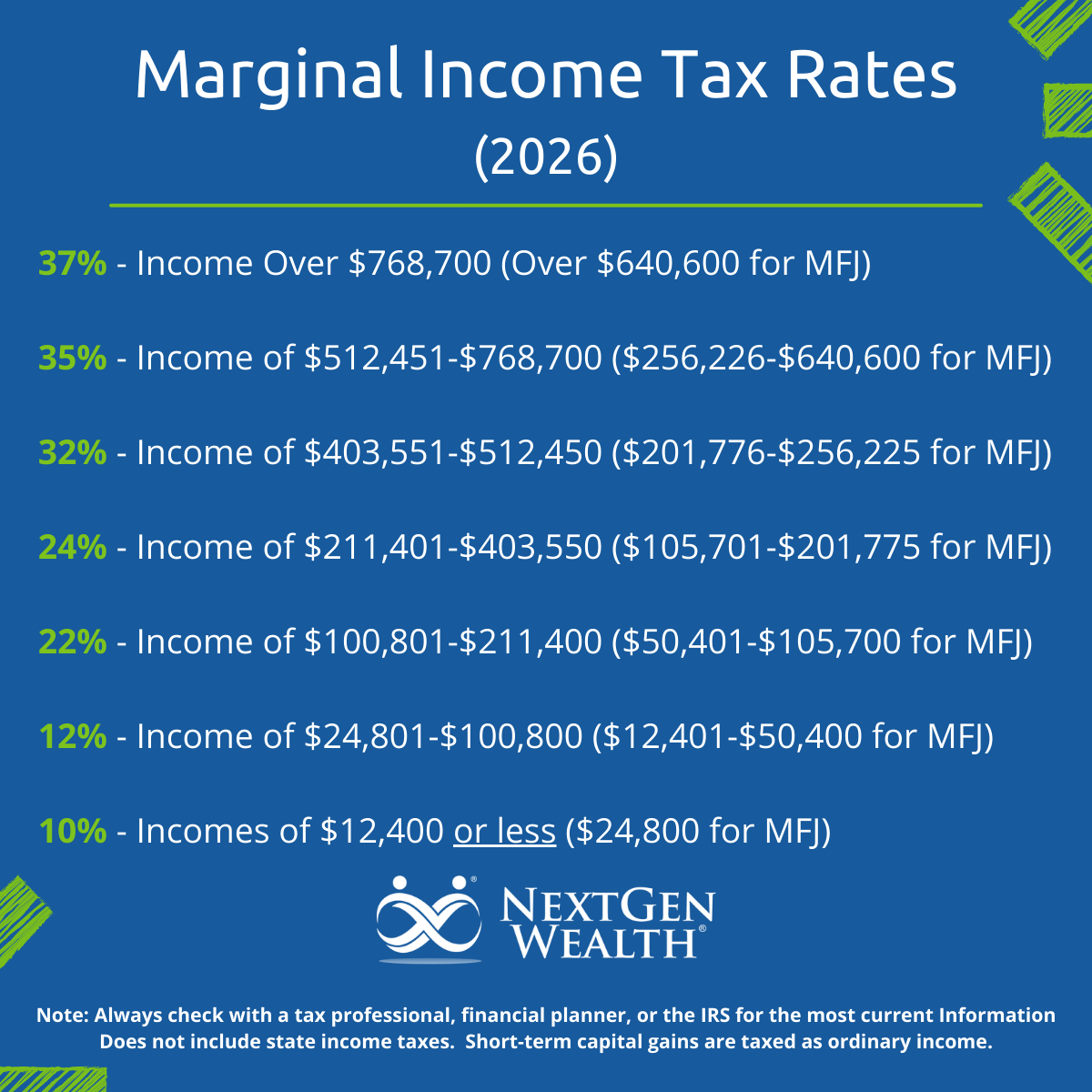

Short-term capital gains are taxed at ordinary income tax rates. Keep in mind that in our progressive tax system, only the income within the “brackets” is taxed at the set rate. The current tax brackets are listed below.

Long-Term Capital Gains

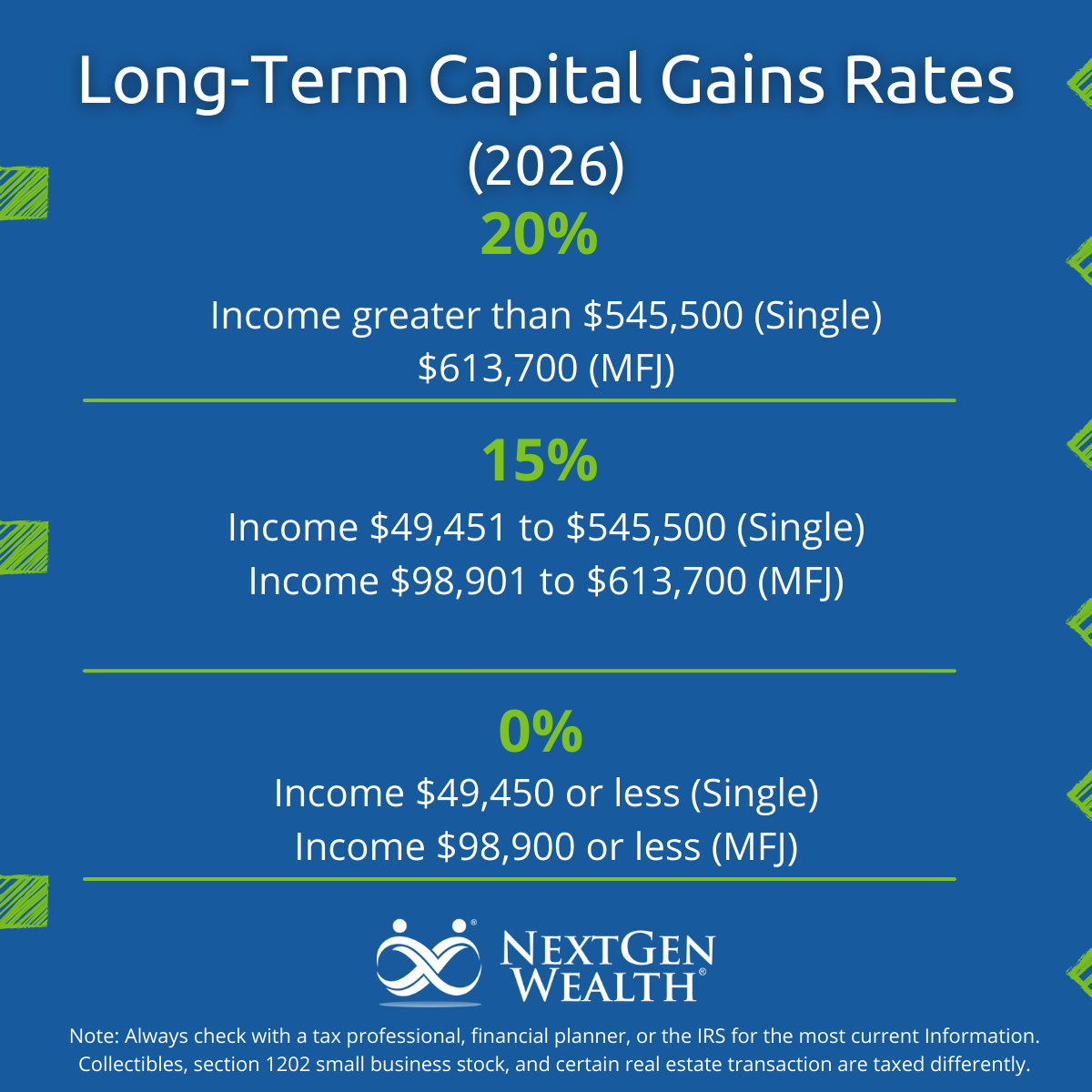

For any asset held over 1-year, that’s 366 days or more, the gain is taxed at a separate rate from your ordinary income. If your ordinary income falls into the highest 5 income tax brackets, then long-term capital gains treatment is especially helpful.

Always check with the IRScheck with the IRS, but the current rates for 2026 are:

It’s important to note that these tax brackets are based on your total Adjusted Gross Income (AGI). If this sounds confusing, it’s because it really can be.

Let’s say you made $100,000 last year and also sold $25,000 of stock you've had for two years in your taxable brokerage account with a total gain of $5,000. Your AGI would be $105,000. However, $100,000 would be taxed at your ordinary income rates, and then $5,000 would be taxed at your long-term capital gains rate.

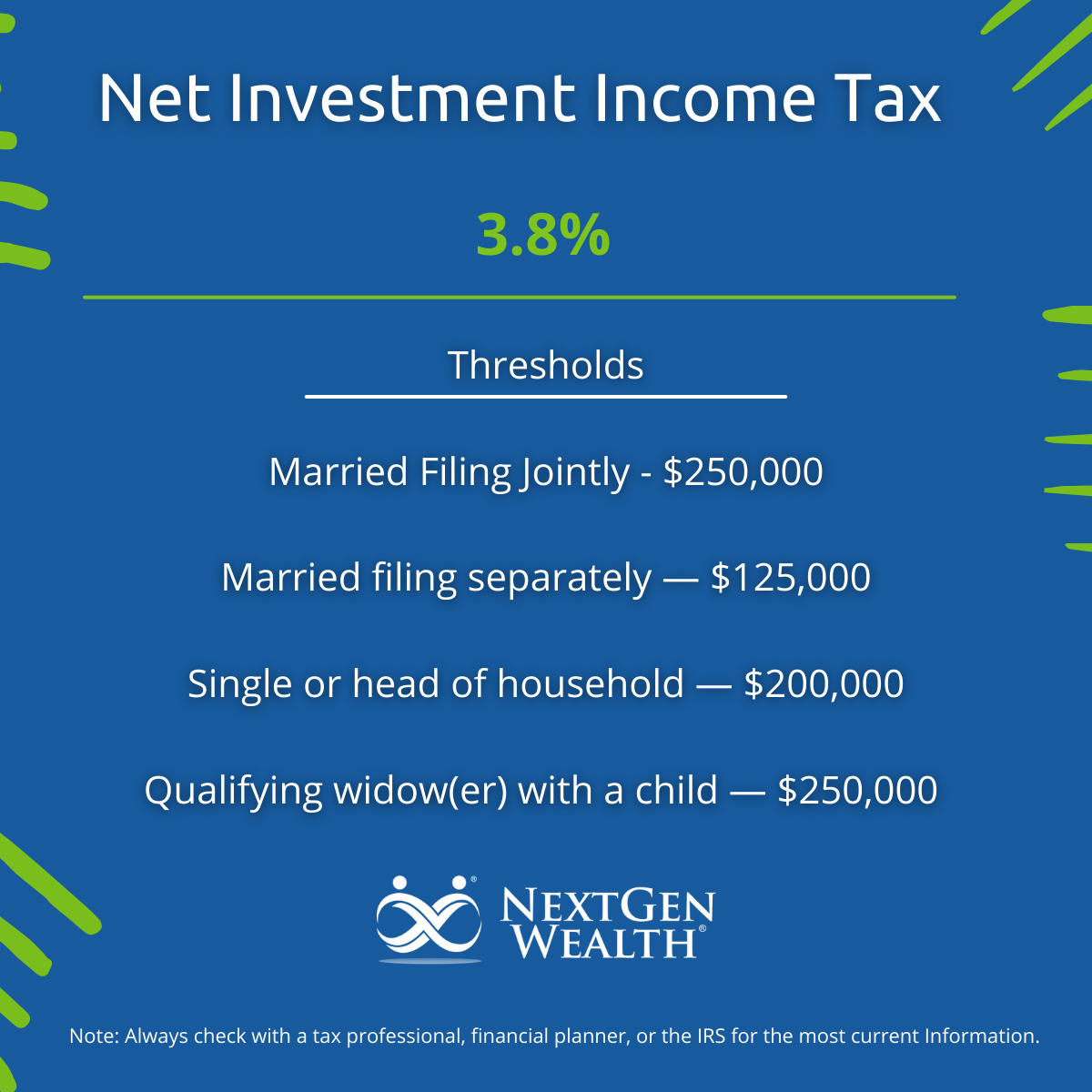

Net Investment Income Tax

If you have investment income, you may also be subject to the Net Investment Income Tax (NIIT). This is an additional tax on the lesser of the total investment income or income above the applicable adjusted gross income.

These thresholds are listed below.

My Investments Did Really Well, Now What?

Congratulations! Here’s where we start to get a little more serious. The main things you need to know are your cost basis, holding period, and sale price. With this information on hand, we can work through this together.

Understanding Your Cost Basis

Cost basis is the amount you paid to obtain an asset. In some cases, this may not be the exact amount you paid for the asset.

For instance, if there were a transaction fee, this could increase your basis. This treatment is advantageous to you because you have already paid the fee.

It wouldn’t be fair to tax you on the transaction fee amount as well. Who said the IRS couldn’t be nice every once in a while?

Looking Up Your Cost Basis

Fortunately, modern technology makes finding your cost basis much easier. You can view your holdings, cost basis, lot details, and other useful information by logging in to your account or contacting your brokerage directly.

It is important to look this up, especially if you've purchased the same asset more than once. If you have a financial planner, they will have access to this as well.

Adjustments to Basis

One thing you probably can't get from your account details is instances when a basis should differ from what you paid. In the case of a gift or inheritance, your account may only reflect certain details, such as the starting balance. For investment real estate, you'll also have depreciation recapture to contend with.

There are very specific rules regarding your basis in these assets. For inherited assets, your holding period is often carried over or subject to specific IRS rules. It's important to keep track of these funds to ensure you get preferential treatment.

Holding Period for Capital Gains

First, did you hold each investment for 366 days or longer? If yes, it’s taxed at the long-term capital gains rate. If not, then it will be taxed as ordinary income, which is a major distinction.

Calculate your Total Gain

The next step is to figure out your total gain. You probably don’t need the explanation, but this is your sale price minus your cost basis. Most brokerage firms will automatically calculate your total gain based on your cost basis using a first in first out (FIFO) method.

Now you know exactly how much your gain is and whether you have short or long-term capital gains. Next, we can start figuring out how you’ll be taxed.

What Tax Rate Will My Money Be Taxed At?

The main variables we will need to finish the equation include your filing status and your Adjusted Gross Income (AGI). To give you an idea, you can estimate based on your AGI from your last tax return filed. If your situation is similar this year, then you can get a ballpark figure.

Add short-term and long-term capital gains to your estimated AGI and look at the federal income tax and capital gains brackets above. These change often, so be sure to get the most up-to-date rates on the IRS website.

Using Software or Professional Advice

We use tax planning software to help evaluate the impact of tax strategies, capital gains, and changes in marital status. If you don't have access to software like this, it's best to coordinate with your accountant to ensure you're not missing anything. There may even be some strategies you can use to offset the cost of capital gains taxes.

Can you ace this basic tax literacy quiz? See what you know & don't know (& why it matters).

How Do I Avoid Paying Short-Term Capital Gains?

The safest bet is to engage a tax or financial planning professional. Making a mistake or not catching a mistake might potentially cost you way more than a consultation with an experienced professional. This is even more important if you have capital gains on a recurring basis, such as employee stock options or deferred compensation plans.

A Note on Dividends

If you’re not paying attention, you might incur short-term capital gains if you have dividends in a taxable account. This can happen even if you elected to reinvest dividends. You're technically paid a dividend, and it's automatically used to purchase additional shares. Those holdings have a cost basis and holding period based on when the dividend was reinvested.

Avoiding Short-Term Capital Gains from Reinvested Dividends

To avoid the short-term capital gains, you will want to sell all except the shares purchased with dividends (equaling $500) to avoid having it taxed at the higher ordinary income rate. Make sure you leave at least the same amount of dividends paid during the last 365 days in the account. Otherwise, you may incur some short-term capital gains. In some cases, you may be able to select the exact shares you want to sell.

For example, assume you purchased $10,000 of stock 13 months ago and received $500 in dividends over the last 365 days. If you sold today for $15,000, you would have $500 in short-term capital gains and $4,500 in long-term capital gains.

How Can I Reduce My Short-Term Capital Gains?

It’s important to minimize short-term capital gains so that you pay the lower long-term capital gains rate. However, this may not always be possible depending on your individual circumstances.

Regardless, you can lower your overall tax bill by using tax-saving strategies allowed by the IRS. To be clear, not all tax strategies will apply to your situation. You should consider each option carefully.

Not All Tools Are Created Equal

The strategies to minimize capital gains vary in complexity. Some strategies include very complex and sometimes expensive products. Those typically feel a lot like a treadmill.

You do a whole lot of moving around (paying fees and commissions), but ultimately feel like you’re right where you started (same ending balance). This isn't what we want to do.

Common Strategies for Offsetting Capital Gains

Simply contributing to retirement (qualified) accounts and making charitable contributions can make a difference. These are allowed and encouraged by tax laws.

Making Additional Retirement Contributions or Other Qualified Accounts

Making additional contributions to qualified retirement accounts can lower your taxable income and offset your tax liabilities for the year. If you’re already maxing out your accounts, such as your 401(k) and IRA, there may still be other similar options.

Contributing to a Health Savings Account, if you qualify, can reduce your taxes. In some states, contributions to a 529 college savings account are tax-deductible, but only at the state level.

Making Charitable Contributions to Reduce Capital Gains

Charitable giving is a popular way to reduce taxes. Often, the tax benefits are not the primary reason for giving.

However, if you are charitably inclined, aligning your charitable giving with the tax-reduction methods available should be a consideration. Not only does planning around charitable giving reduce your taxes, but it also gets more money going to your charity of choice. That’s truly a win-win.

You may be aware of deductions for charitable giving, but additional tools such as a Donor Advised Fund (DAF) or bunching can be used to offset large one-time tax bills. If giving is something you want to do, then these are important things to consider.

Additional Strategies to Consider

Other considerations are Net Unrealized Appreciation (NUA) strategies, Tax Gain or Tax Loss Harvesting, and gifting or Income Shifting. These can be complicated and may not apply to your situation. Be sure to consult a professional before employing more advanced tax strategies.

The Bottom Line on Capital Gains and Your Tax Bracket

Overall, if you have a significant amount of taxable assets you're selling or exchanging in some way, you need to be aware of how those gains will be taxed. There are a variety of factors at play, and your specific situation will be unique. If you're not careful, capital gains can push you into a higher tax bracket and cost you more in taxes.

Getting tax projections wrong could be the difference between paying 0% to 20% or paying 10% to 37%. To put that in perspective, a 17% difference (top long-term capital gains rate vs top marginal tax rate) on $100,000 of income is $17,000. In other words, for every 1% error, you could potentially be paying your dear Uncle Sam an extra $1,000.

This is when paying for expert assistance really can make a big difference. If you're gearing up for retirement, contact NextGen Wealth today to get your no-obligation Financial Assessment and see if we're a good fit to work together.