Crucial Aspects of Long-Term Care Planning

Long-term care is an overlooked yet crucial piece of your retirement plan. It’s too late to make any major adjustments when you need long-term care. This is why proactively planning what care you want and how to pay for it is essential.

If you want access to specialty care, you’ll need to know what’s covered by insurance, estimated out-of-pocket expenses, and more. It’s also important to consider the impact of your care on loved ones. Long-term care planning can help you secure access to the care you want and avoid burdening your children.

Table of Contents

Introduction to Long-Term Care

In short, long-term care refers to care needed as someone's ability to care for themselves diminishes. Unfortunately, accomplishing simple tasks like bathing and dressing becomes harder as we age. Eventually, this requires help in some form.

Once upon a time, extended family might have been an option, but an increasing number of seniors will need outside assistance. This can come in the form of in-home care, assisted living facilities, or nursing homes.

In-Home Care

Access to in-home care can be a real blessing. It may be as simple as a visit to your home to help administer medications or assist with recovery after surgery. There are often a variety of options and services available.

Depending on your needs, Medicare does cover some in-home care services. It won’t help with covering meal delivery or upkeep of your home. There is also a limit to how many hours of care you can receive daily and per week.

An In-Law Suite or Retirement Communities

Sometimes, you may not need care regularly, but having someone nearby is helpful. If you live close to relatives or other retirees, you may be able to help each other out. Some families have a basement or spare room for aging relatives to move into.

Assisted Living Facilities

Another option may be to move to an assisted living facility or other group living arrangement. These are also quite varied in layout, service offerings, and price. There are over 400 assisted living facilities in Missouri.

Many facilities also offer a variety of entertainment options. These might include pools, movie theaters, and outdoor activities like walking paths. Assisted living facilities also offer niche offerings like memory care or specific religious services.

Medicare will not pay for assisted living. Some services, such as skilled nursing care, may be covered, but the normal fees are not.

Nursing Homes

At some point, 24-hour care may become necessary. In fact, roughly 35% of adults turning 65 (based on 2005 data) will enter a nursing home. Most older adults need two years or less of such care, but 9% of adults with severe needs will need care for ten years or more.

Nursing homes can also vary widely in terms of the type of care offered, cleanliness, and staff skills. Also, Medicare does not pay for nursing home costs.

Skilled Nursing Facilities

Skilled nursing facilities are often attached to another facility but may be standalone. Many nursing homes have an in-house skilled nursing facility. This is important because Medicare does cover skilled nursing facilities for up to 100 days per benefit period.

However, specific criteria must be met. Depending on the length of care needed, you may also need to pay a portion of the costs and, eventually, all the costs.

The Importance of Planning Ahead

One of the biggest things you can do now is plan ahead. You don’t want to start thinking about long-term care when the need arises. You want to think through the type of care you want, which facilities are reputable and affordable, and how to pay for any care you might need.

In fact, you may not be able to voice your opinion and wishes directly when the need for long-term care arises. A sudden event, like an accident or stroke, may leave you unable to articulate exactly what you want. Don’t leave your care to chance – make a plan.

Assessing Your Long-Term Care Needs

How can you plan for something you don’t even know will happen? We understand how difficult it may be to prepare for the unknown. However, you might be able to make educated guesses based on family history and your own health.

Evaluating Personal and Family Health History

Looking at family history can provide many clues. If Alzheimer's runs in your family, it may be a good idea to consider longer stays in facilities with highly-rated memory care. Personal risk factors like obesity or respiratory disease might also indicate a higher risk for long-term care needs.

You might live an active lifestyle and be in good health. This could mean you’ll never need long-term care. Your current health might also have nothing to do with what eventually causes a need for long-term care.

It’s hard to know exactly what kind of care you’ll need, if any. This makes things complicated and leaves us with only our best guesses.

Understanding the Costs of Long-Term Care

Long-term care is not cheap. Care costs can vary widely depending on the type of facility, where you live, and the care needed. Luckily, Missouri is rated as one of the more affordable states for long-term care.

However, we wouldn’t call roughly $3,000 or more per month cheap by any means. If you need full-time or memory care, your monthly costs could be over $6,000. It’s also common for couples to want to stay together, so you might need to double your estimates.

Inflation of Long-term Care Costs

Once you understand roughly how much it will cost today, you still need to anticipate how much it might cost when you need care. Inflation affects everything – including long-term care costs. One article reports cost increases of 1.4% to 10% depending on the type of care required.

For example, $5,000 per month would become roughly $6,600 per month in 20 years, with 1.4% inflation. At 10% inflation, your monthly costs could be an astronomical $33,600! We’re hoping real inflation numbers are much closer to 1.4%.

Remember, these are just guesses, and actual care costs may differ depending on the time you need care. Regardless, you may be faced with a large bill you’ll have to pay.

Options to Pay for Long-Term Care

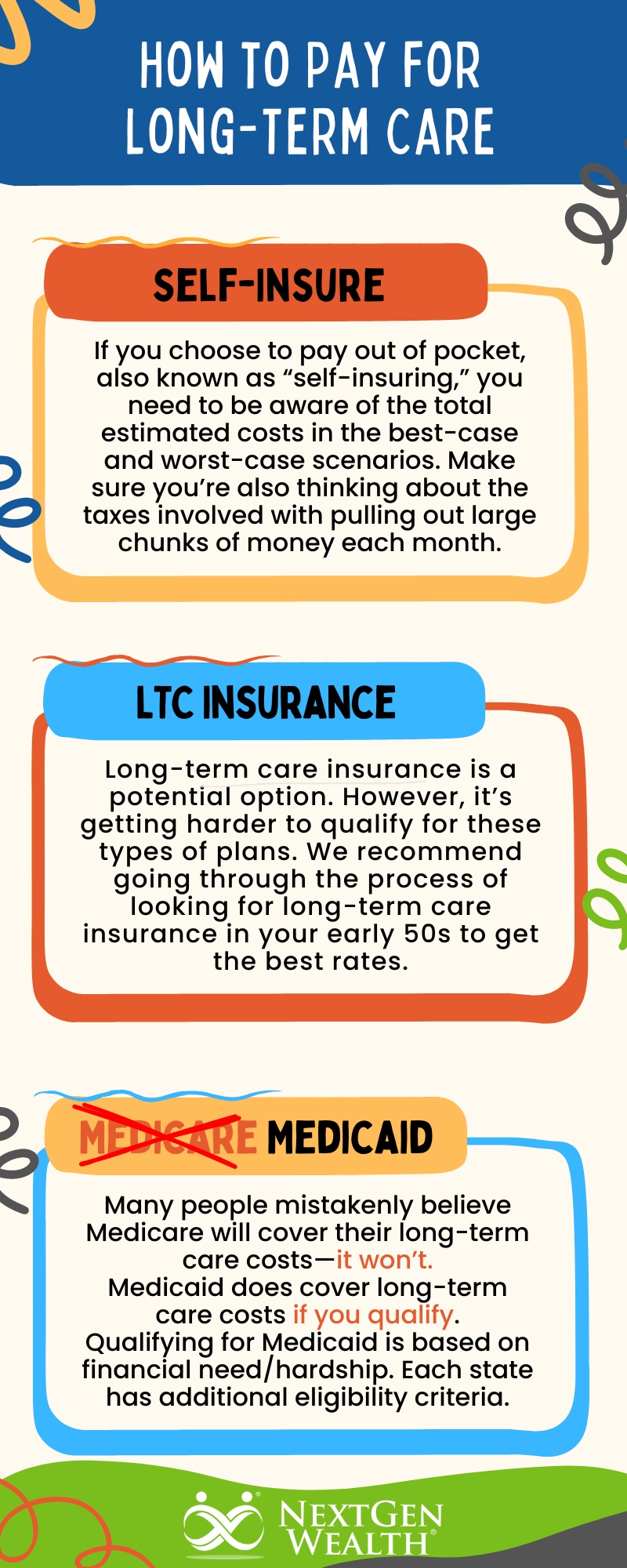

You have a few basic options for paying for long-term care costs: out-of-pocket, long-term care insurance, and Medicaid (not Medicare). Each has its own pros and cons.

Paying Out of Pocket

If you choose to pay out of pocket, also known as “self-insuring,” you need to be aware of the total estimated costs in the best-case and worst-case scenarios. You’ll also want to make sure you’re thinking about the taxes involved with pulling out large chunks of money each month. The goal would be to have easy access to the money needed without creating a large tax burden or cash flow problem.

Long-term Care Insurance

Long-term care insurance is a potential option. However, it’s getting harder to qualify for these types of plans. We recommend going through the process of looking for long-term care insurance in your early 50s to get the best rates. Depending on the premium amount and benefits covered, this may or may not make sense in your situation.

Life Insurance Products

There are some types of life insurance with long-term care benefits. These are often an additional option (rider) added to another policy. Once again, you’ll need to weigh options carefully.

We highly recommend getting an outside opinion to help evaluate these options before buying. Many insurance contracts are overly complex and have specific conditions you must meet before covering expenses.

Medicaid

Many people mistakenly believe Medicare will cover their long-term care costs—it won’t. In some cases, Medicare does cover some medical care, but only for a limited number of days if all other conditions are met. However, Medicaid does cover long-term care costs if you qualify.

Qualifying for Medicaid is based on financial need/hardship. Each state has additional eligibility criteria. Medicaid is how many Americans (44.3%) pay for long-term care.

Qualifying for Medicaid

You must meet specific income and “resource” limits, which can vary widely by state. We’ll briefly discuss eligibility requirements in Missouri and Kansas.

Missouri Medicaid: MO HealthNet Coverage

Missouri’s version of Medicaid is called MO HealthNet. There are a variety of individuals who qualify, but for those requiring long-term care over age 65, the basic criteria are:

- Live in Missouri and be a U.S. citizen (or “qualified” non-citizen)

- Have a Social Security number

- Make less than $12,801 (single) or $17,374 (couple) per year (2024 numbers)

- Own fewer assets than the thresholds, which vary based on the care needed (including the equity in your home)

- Not reside in a “public, private, or endowed institution (unless it’s a public medical institution).”

In other words, you can’t have much income (85% of the poverty level) and can have very little in terms of assets. More or less, you have to prove you’re destitute aside from your personal residence – not most peoples’ goal.

Kansas Medicaid: KanCare

The Kansas Medicaid program is called KanCare and has specific eligibility criteria. There are also specific rules regarding the income you can make and the assets you can own. Kansas also has a spend-down provision and estate recovery program.

Once again, you’ll have many limitations placed on you to qualify for Medicaid. This is why planning for these expenses is important, as well as understanding that Medicare won’t cover long-term care. Qualifying for Medicaid means you have very few resources left.

Financial Planning for Long-Term Care

So, how are you supposed to plan for long-term care? This depends on your situation, but a good start is assessing your current assets, such as personal savings, health savings accounts (HSAs), investment accounts, and long-term care insurance.

You’ll also want to ensure you cover all your legal preparations. As part of your estate planning, you want to ensure documents like a durable power of attorney, healthcare directives, living wills, and other documents are up to date. Don’t leave things for your loved ones to make guesses.

Once you’ve covered the basics of what you have and what you want, we can start running what-if scenarios and testing your plan. It’s impossible to plan for everything, but it’s better than making assumptions or waiting to “figure it out” when the need for long-term care comes.

NextGen Wealth’s Role in Long-Term Care Planning

At NextGen Wealth, we’re huge advocates for planning early. We walk our clients through long-term care options during our COLLAB Financial Planning Process™. We help identify resources you already have, any shortfalls in funding, long-term care insurance options, and more. It’s more than just checking a box saying we talked about it.

We’ll regularly review the plan to ensure everything makes sense, check for cost changes, and adjust as needed. Covering your long-term care needs can make a significant difference when you’re older and most vulnerable. Regardless of how you choose to pay for long-term care, you need to have a plan in place.

Contact us today to see if we’re a good fit and get your free financial assessment!