Surprising Social Security Calculation Facts

Most retirees don’t really understand how their Social Security benefits are calculated. The more we learn, the more surprised we are. Social Security has evolved over the years to become a major piece of the retirement puzzle for most Americans.

In short, those who understand Social Security can get the most out of the benefits they earned. On the other hand, if you start drawing Social Security without fully understanding the impact on your situation, it could cost you big time.

Table of Contents

- Social Security is Based on Your Top 35 Earning Years

- Age Matters More Than You Think

- Indexing Past Earnings to Inflation

- Example: Max and Minny Benny

- Working Extra Years to Avoid “Rolling a Zero”

- Surprising Impact of Continued Work After Claiming Benefits

- Little-Known Family and Spousal Benefits Calculations

- Special Calculation Rule Changes for Government Workers

- The Bottom Line on Social Security Calculations

Social Security is Based on Your Top 35 Earning Years

The basic premise behind your Social Security benefit calculations is to average your highest 35 years of earnings. However, it’s a little more complicated than just averaging your top-earning years.

Impact of Fewer Than 35 Years of Earnings

You may have heard “rolling a zero” for a year or two will have a significant impact on your Social Security Benefits. Although averaging a true $0 for earnings lowers your average, it may not be as significant as you might think. Because of the way wages are indexed and credited (more on this later), a low-income year won’t have as large of an impact as you might think.

However, if you have large gaps in your income, it could impact you. It could hurt you if you only have 25 years of earnings to add to the primary insurance amount (PIA) calculation. If you have 35 years of covered earnings (known as “computation years”), it might not be as big of a deal.

Age Matters More Than You Think

Retiring early might be on your list of goals but be careful about drawing Social Security early. In many cases, delaying the start of Social Security can be very beneficial. Your Social Security withdrawal strategy needs to be created by carefully considering all your retirement income sources.

Explanation of Full Retirement Age (FRA)

For retirees born in 1960 or later, your full retirement age (FRA) is age 67. If you were born in 1959 or earlier, your FRA will be different. In short, the FRA is when you’re considered to be fully eligible for Social Security retirement benefits.

The Surprising Impact of Claiming Benefits Early

It’s common for folks to think about drawing Social Security when they sign up for Medicare at age 65. However, there is no requirement to do so. Drawing before age 67 (or later) can have a significant impact on your benefit amount.

Drawing early decreases your Social Security significantly. If you draw at age 62, your benefits could be permanently reduced by up to 30%.

Keep in mind, it’s adjusted by each month you draw early. If your personal situation changes and you need to draw early by a few months or a year, the reduction would be much less than 30%.

The Advantage of Delaying Benefits Up to Age 70

On the other hand, delaying benefits until age 70 could increase your benefit amount by as much as 24%. To see the impact of delaying Social Security, check out this calculator on the SSA website.

Besides the higher payout, delaying Social Security could allow you to complete Roth Conversions or other tax-saving strategies more efficiently. Even drawing down your traditional 401(k) or IRA balance could save you from higher required minimum distributions (RMDs). Once again, this adjustment is done by the month, so even delaying a month or two could be helpful.

Indexing Past Earnings to Inflation

Each year of earnings is indexed based on the national average wage for each individual year. The average wage index (AWI) helps the Social Security Administration adjust your earnings for wage growth over time. There’s a pretty good example of how this is calculated on the SSA website.

In effect, this increases your annual earnings for the calculation and, therefore, your benefit amounts. In theory, even if you didn’t earn much in your early working years, those annual amounts could have an outsized impact compared to later years. It’s important to understand this calculation isn’t tied to inflation (consumer price index (CPI)) directly, but has the effect of adjusting for inflation.

One interesting thing to note is the Social Security Administration doesn’t index amounts past the second year before earning eligibility. We know, this sounds confusing (because it is). In other words, anything you earn when you're 62 or older will not be adjusted using the AWI.

Average Indexed Monthly Earnings (AIME)

Once all your covered years are indexed for wage growth, the Average Indexed Monthly Earnings (AIME) is the next calculation completed. The highest 35 years of index-adjusted earnings are added together, and then divided by the total number of months in those years (35x12=420). This figure is rounded down to the nearest dollar, giving your AIME (sometimes referred to as AME).

Once your AIME is calculated, your Primary Insurance Amount (PIA) can be determined.

Primary Insurance Amount (PIA) and the Bend Points

Your PIA is the final piece of what determines your monthly retirement benefit amount. What happens next seems to really “bend” and shape the final outcome.

How "Bend Points" Affect Your Social Security Benefits

The final step to determining your PIA (amount you’ll receive) is applying the “bend points” to your AIME. We apologize for all the acronyms; we promise it’s easier than reading the whole name each time. The bend points are a sort of “weighting” system to give more credit for lower income levels versus higher amounts.

The first bend point segment credits your PIA with 90% of indexed earnings (AIME), the second bend point segment gives you 32%, and the third bend point segment credits at 15% up to the maximum covered amount. In theory, the maximum Social Security retirement benefits you could receive for 2025 (if you had maximum earnings for 35 years) would be $4,020.90. This figure is rounded down to the nearest 10 cents ($0.10).

Here's how bend point crediting breaks down:

- AIME = $13,689*

- First Bend Point Segment = $1,103.40*

- Second Bend Point Segment = $1,972.80*

- Third Bend Point Segment = $944.70*

- Total PIA Amount (Your Monthly Benefit) = $4,020.90*

*Numbers are not exact; there is more nuance to these calculations, for demonstration only.

What does this really mean for us? The bend points create a situation where lower-income earners receive proportionally higher benefits. We won’t get into why this is, but we will illustrate the effects of bend points.

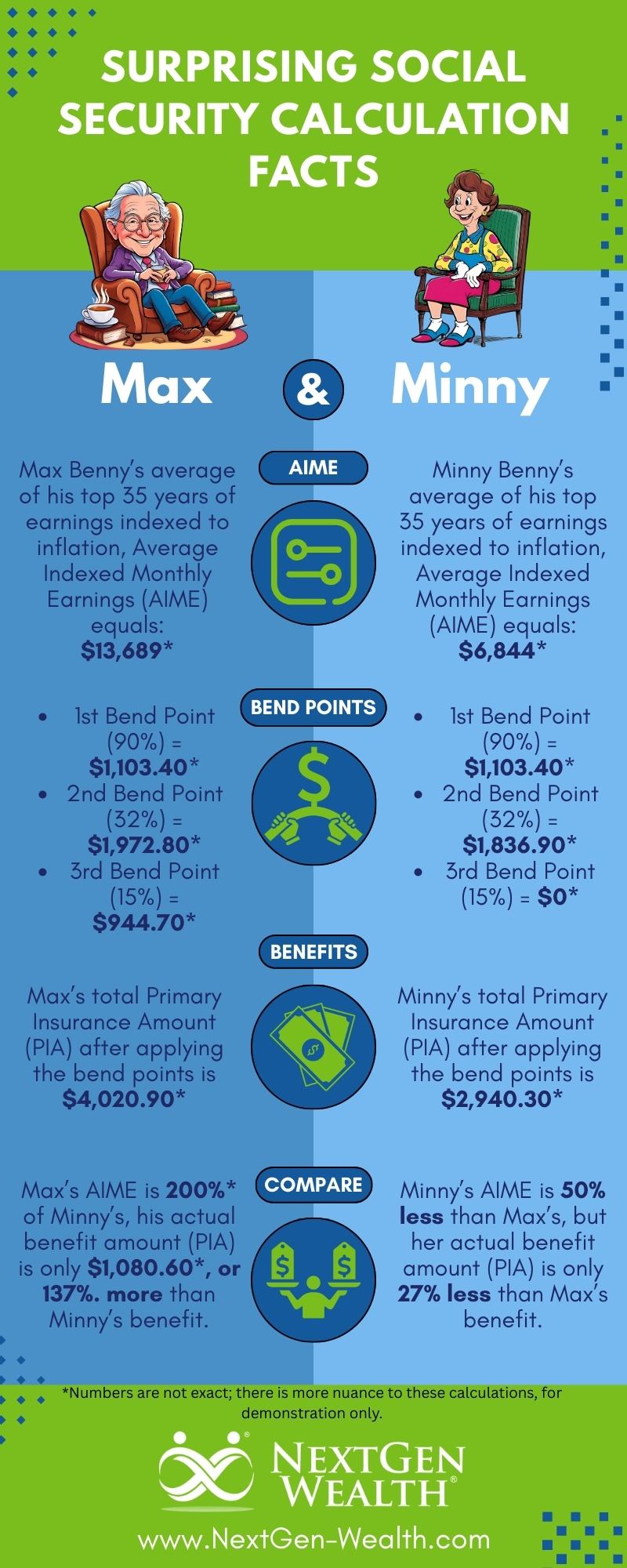

Example: Max and Minny Benny

Let’s assume our pal, Max Benny, and his wife, Minny, are looking at their potential Social Security payouts. Max has worked full-time and earned the maximum covered amount or more every year since he was 21. Minny worked part-time when their kids were young, then full-time later.

We’ll just assume Max’s AIME as the maximum amount of $13,689* – the same as the example above. We’ll assume Minny’s average indexed monthly earnings were half of Max’s, giving her an AIME of $6,844* (always rounded down to the nearest dollar). Max and Minny are the same age in this case.

Once we apply Minny’s AIME to the bend points, her benefit amount (PIA) breaks down like this:

- AIME = $6,844*

- First Bend Point Segment = $1,103.40*

- Second Bend Point Segment = $1,836.90*

- Third Bend Point Segment = $0*

- Total PIA Amount (Monthly Benefit) = $2,940.30*

*Numbers are not exact; there is more nuance to these calculations, for demonstration only.

As you can see, even though Minny earned 50% less than Max on average, she’ll receive roughly 73% of the benefit Max will receive. This also shows how much goes into leveling things out across different wage earners for Social Security.

Working Extra Years to Avoid “Rolling a Zero”

The other implication of the collective effects of Social Security calculations is the marginal utility of working extra to avoid “rolling a zero” in early retirement. There are two main reasons why having a few non-earning or low-earning years may not affect you as much as you think: covered/base years and bend points.

As we mentioned earlier, if you have 40 or more working years, only the highest 35 will be counted. So, if you didn’t work for five years and had zero income, those years would be excluded from the calculation. In other words, if you have 35 “good” earning years, you can quit working and not worry about it (assuming you have enough money to cover your bills).

The Bend Points Applied

The other interesting factor is the effect of bend points on removing another five years of working. For fun, we removed the top 10 years of earnings in a scenario presented on the Social Security site where the AIME was $11,351. The resulting AIME (simulating quitting working at age 55) was $9,480*.

This gives us a benefit amount of $3,670.20* and $3,400.20* respectively. So, in other words, taking another five whole years off work reduced the monthly Social Security retirement benefits by $270*. This may seem like a lot, but this difference could be made up by delaying claiming benefits by one year after reaching full retirement age ($3,400.20 + 8% = $3,672.22*).

*Numbers are not exact; there is more nuance to these calculations, for demonstration only.

Our point is, don’t let some strange concoction of formulas control your life. This is why we love what we do. When we can put real numbers to real and specific situations, you can have the freedom to build the retirement you want.

Surprising Impact of Continued Work After Claiming Benefits

In general, continuing to work after claiming Social Security has a negative effect. Before full retirement age, you’re limited to how much you can make before receiving a reduction in benefits. There’s a direct reduction of Social Security benefits of either $1 for every $2 you earn or a reduction of $1 for every $3 you earn.

After full retirement age, you can earn as much as you want without a reduction in benefits. The higher your earnings, the more Social Security benefits are taxed. You’ll still have more money in your pocket from earnings, but you need to be aware of the tax implications.

How Continuing to Work Can Increase Your Benefits

The surprising thing about continuing to work is it could increase your Social Security payments at full retirement age. The Social Security Administration reviews your records each year, and if your earnings would increase your PIA, they’ll recalculate your benefit amount.

There may be some unique circumstances where this could be beneficial.

Little-Known Family and Spousal Benefits Calculations

The rules for family benefits are complex. One of the interesting things is families may receive more than what the covered worker would have received in benefits. However, the formulas for this are complex.

The calculated family maximum reduces potential benefits for all beneficiaries. The spouse’s benefits are also adjusted based on their own estimated benefits they earned. Each family’s situation will be unique.

Spousal Benefits

Spouses may also be entitled to up to 50% of an employee’s PIA. There are still reductions for withdrawing early unless the spouse is caring for a qualifying child. For more information, you can calculate estimated benefits for spouses here.

Special Calculation Rule Changes for Government Workers

Until recently, the Windfall Elimination Provision (WEP) and Government Pension Offset (GPO) impacted the benefits of retirees who were entitled to both a pension and Social Security. However, the Social Security Fairness Act was signed into law on January 05, 2025. This eliminated the WEP and GPO.

Affected retirees should receive (or may have already received) a back payment for the reduction in benefits retroactive to January of 2024.

The Bottom Line on Social Security Calculations

As you can see, many surprising facts about Social Security calculations exist. Significant offsets in calculations, such as indexing for inflation, bend points, and adjustments for starting benefits before or after your Full Retirement Age (FRA), can make dramatic differences. Deciding on the right Social Security strategy can get even more complicated when you layer on other income, such as retirement account withdrawals and pension income.

We highly recommend consulting with a financial planner to create a personalized strategy. At NextGen Wealth, we start every client relationship with a financial assessment to ensure we’re a good fit and get you started on your retirement journey. Contact us today to start planning your ideal retirement!

What surprised you the most about Social Security calculations?