Building Your Retirement Team

Retirement isn’t an individual sport. It takes many key players and essential tools to make the most of your golden years. As the saying goes, “If you want to go fast, go alone. If you want to go far, go together.”

As we watch our beloved Kansas City Chiefs continue another great season, it’s important to understand what it really takes to make a great team. The Chiefs took a long-term approach to success when they signed a $503 Million, 10-year contract with Patrick Mahomes. They understood the value of keeping key teammates in place long-term.

So, what does it take to make your winning retirement team?

Table of Contents

Why You Need a Retirement Team

First, let's examine why having a retirement team is important. Modern retirement is full of complexity, including changes to tax laws, constant inflation, confusing investment options, rising healthcare costs, and unique estate planning requirements. All of these require the assistance of specialists in their fields of knowledge.

With so many critical decisions, worrying about making the wrong choice is easy. Consulting with experts and sometimes delegating tasks to them allows you to focus on enjoying retirement. This can go a long way to reducing stress and uncertainty.

It's important to seek wise counsel to get a clear retirement picture. Like a head coach and staff carefully selecting the right players for their team, a coordinated team approach ensures all aspects of retirement are addressed.

Key Members of Your Retirement Team

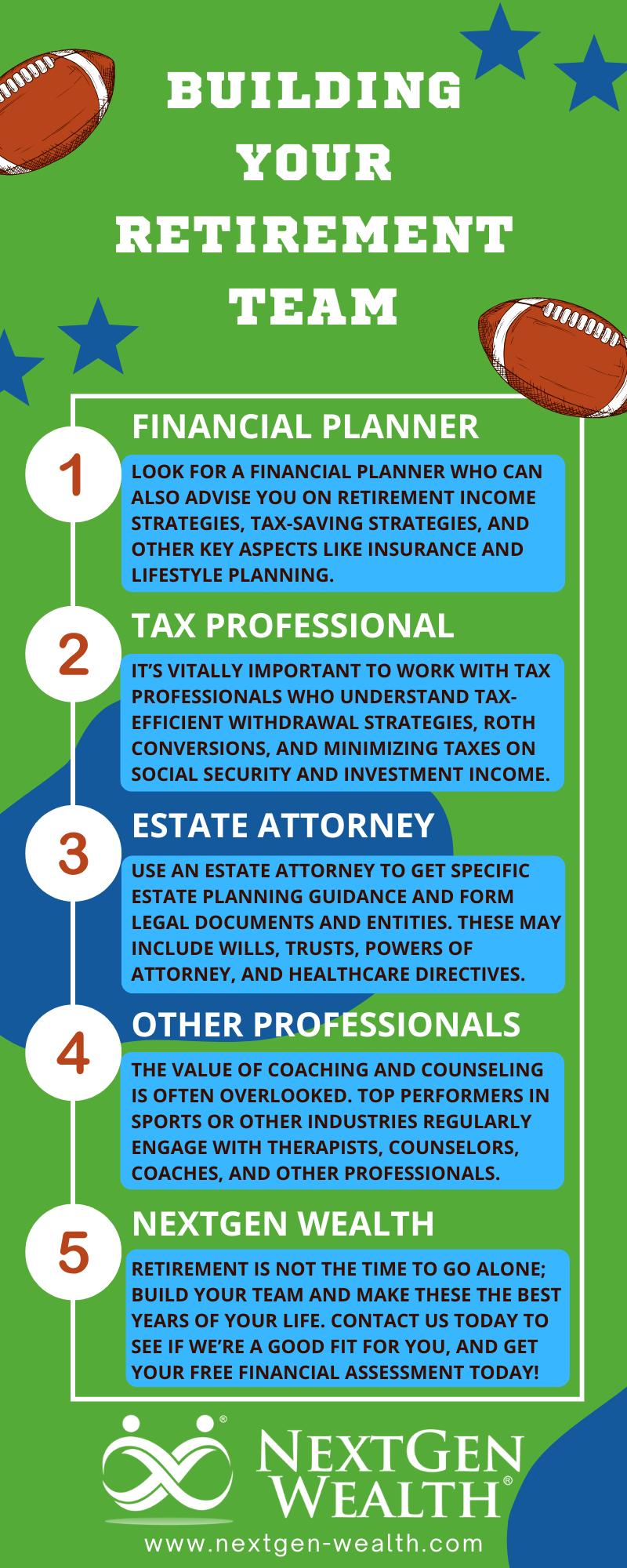

Your retirement team roster needs to include several key members. These include a financial advisor or financial planner, tax professionals like a CPA, an estate attorney, and other professionals as needed.

Financial Advisor or Financial Planner

A typical financial advisor is expected to perform tasks such as portfolio management and provide guidance during market changes. However, many financial planners offer much more than just investment management. At NextGen Wealth, we like to work with clients in a more holistic manner.

We feel you should look for a financial planner who can advise you on retirement income, tax-saving strategies, and other key aspects like insurance and lifestyle planning. We help you gain a holistic view of your financial life. A good financial planner also helps coordinate efforts and “move the ball down the field” for you.

We highly recommend you find a financial planner who takes their fiduciary duty seriously and puts your needs first. Find someone who can provide retirement planning expertise and personalized attention. A good financial planner can also help give recommendations to other professionals for your retirement team.

Tax Professional or CPA

We all know taxes are a constant part of life before, during, and after your retirement. Working with tax professionals who understand tax-efficient withdrawal strategies and Roth conversions and minimizing taxes on Social Security and investment income is vitally important. We believe communicating with your CPA or other tax professionals is vitally important.

Look for someone who has experience with retirees and knowledge of current tax laws. If your situation is unique, you might consider consulting with specialists.

Estate Planning Attorney

You can get a lot of information about estate planning options from your financial planner. However, you’ll need to engage an estate attorney to get specific estate planning guidance and form legal documents and entities. These may include wills, trusts, powers of attorney, and healthcare directives.

Working with an estate attorney has several key benefits. These include avoiding probate, reducing estate taxes, and ensuring your legacy aligns with your wishes.

Your “Special Teams” Unit: Other Professionals to Consider

As mentioned, your retirement team may have other specific needs. Like any football game, you will run into special situations and need specific help. You may need to employ a number of different professionals to give you the edge on winning in retirement.

Insurance Specialists

Insurance is a key aspect of our financial lives. You’ll need to consider long-term care insurance, Medicare planning, and life insurance. You may also need to engage with professionals who are well-versed in annuities.

The main objective of insurance is to protect assets and manage unexpected healthcare expenses. You might be able to “self-insure” for many risks, but probably not everything.

Mental Health Professionals, Lifestyle Coaches, and Specialists

The value of coaching and counseling is often overlooked. Top performers in sports or other industries regularly engage with therapists, counselors, coaches, and other professionals. Consider the same if you want a top-notch retirement.

As a matter of fact, the Kansas City Chiefs employ 30 people on their coaching staff alone!

Ultimately, the financial aspects of your life don’t matter if they’re not aligned with your deeper goals and purpose. This is why we take so much time to work through your goals in our COLLAB Financial Planning Process™. You must also ensure the team you work with understands these goals.

How to Choose the Right Professionals

Make sure you clearly define your needs. Not everyone has a super complex financial situation. However, some nuances, such as employer stock options, pensions, veterans’ benefits, real estate holdings, small business ownership, and more, can create unique financial planning needs and opportunities.

You’ll want to vet candidates carefully for your team. We keep a list of questions to ask advisors on our website. You’ll also want to consider looking for professionals with relevant credentials. We recommend looking for designations like CFP® professional, CPA, EA, JD, or similar credentials.

Most importantly, you need to find professionals compatible with your values and priorities. You need to ensure you’ll be happy to hear from the people on your team.

The Importance of Collaboration Among Team Members

Just like a well-coordinated offensive and defensive line, you need to make sure your retirement team works well together. For instance, we work closely with CPAs and attorneys to ensure everyone is on the same page. We believe communicating with your tax professionals is a great idea.

In some cases, your trusted professionals can coordinate directly with each other to create more thorough recommendations for you. A financial planner can keep things all meshed together and working smoothly.

The Cost of Building a Team (and Why It’s Worth It)

It’s important to understand fee structures when engaging with professionals. You could pay them by the hour, with fixed fees, project-based, through percentage-based compensation, or a combination of these. We keep our pricing clearly posted on our website.

However you pay for professional guidance, you’ll want to make sure you’re comfortable with the value you receive in return. Many studies have shown better outcomes for individuals who work with a financial planner. But more importantly, working with professionals provides peace of mind.

Take Action Today to Secure Your Retirement Success

Having your retirement team in place to provide expertise, reduce stress, and optimize your retirement is critical as you shift into the next phase of retirement. Don’t let retirement just happen to you. Be proactive and take the first step by finding the right financial planner for you.

Just like a good quarterback helps bring the team together for success on the football field, a quality financial advisor helps you build a cohesive strategy to meet your most important goals in retirement. Retirement is not the time to go alone; build your team and make these the best years of your life. Contact us today to see if we’re a good fit for you, and get your free financial assessment today!