Planning for Retirement in a Down Market

Can you still retire in a recession or “down” market? Many have done it, but there’s so much to think about when things don’t feel very optimistic. Don’t worry.

There are lots of things you can’t control like the markets and when recessions will occur. Many other things you can. Let’s look at what needs to happen to successfully retire in a down market.

Down Markets Are Normal

First, you are not alone, and many others have retired in less than certain financial times. Down markets and recessions are a normal part of economic cycles. As the saying goes, what goes up, must come down. However, they never specified how far up or down or when.

During your working years, it might not have felt like a big deal when markets were down because you were still working and not ready to retire. As you near retirement, the prospect of retiring when your overall portfolio is down 10% or more might feel like stepping into the abyss.

If you’re feeling some stress, you’re perfectly normal. The transition into retirement is stressful even if the markets are doing great. Let’s go ahead and tackle the market worries so you can move onto the more important aspects of your life like what fulfillment looks like to you.

Worried if you're going to have enough income to retire? Learn more here.

Recessions of the Past

It might be helpful to talk about what recent recessions looked like and potential impacts those retirees faced. We’ll look at the first two recessions of the 21st century to get an idea of what things might look like.

Dot-Com Recession of 2001-2002

The “Dot-Com Bubble” burst right after the turn of the century. This was the first official recession of the 21st century. You’ll probably remember things were quite strange leading up to the turn of the century and haven’t gotten any more “normal” since.

With valuations of early tech companies trading well above their actual value, things couldn’t continue. This recession was relatively short lasting “only” 8 months until things started to turn around.

The Great Recession

The Great Recession hit many people hard. The nature of how the mortgage crisis spiraled down was uncharacteristically cruel. Many families lost their homes due to foreclosure or short sales.

The markets continued downward for a total of 18 months before the recovery started. What made this even more devastating is the markets hadn’t fully recovered to previous peak levels from the Dotcom recession. This made this second, sustained downturn even more brutal.

Recessions and Retirements will Happen

Even through all these crises in the 21st century, many Americans have still been able to retire in a recession or market downturn. Once you understand the risks and make a plan, these things become less scary.

The thing to remember is to plan for some sustained drops in the market. This is going to happen, so you should definitely prepare.

Sequence of Return Risk

What if you are ready to retire and now your retirement accounts are decimated due to a recent recession? This is what we financial planners refer to as “sequence of return risk” which is planner speak for not having healthy investment returns when it’s needed. This can have a significant impact on your overall retirement plan.

In other words, this could be called your “retirement date risk” which jeopardizes your ability to reach your retirement savings goals. The biggest thing to consider is what makes the biggest impact on your 401k account balance.

You might be surprised to know your money may be working harder than you are. If your balance has grown large enough, you may have crossed the point where your accumulated savings are rising more from growth than you can contribute each year. This means the market has a little more control over your account balance than it used to.

Don’t worry, just because you drew the short straw on timing your retirement doesn’t mean you can’t retire now. However, you may need to make some adjustments.

Importance of Planning For, Not Around, Market Conditions

Although things may feel out of control, there is still a lot you can do. You control a lot of your spending decisions and how much to withdraw from your retirement accounts. Maybe this means we’re not buying the condo on the beach just yet.

We want to get to a point where we are planning for market downturns and corrections – not around them. We know the economic business cycle continues regardless of what you do or when you retire. There will be a recovery, but we don’t know what it looks like or when it will come.

Regardless, if you’ve saved enough in retirement accounts, you can probably adjust your withdrawal rate to match market conditions. For example, if you’re using the “4-percent rule” for withdrawals, then you might just need to withdraw at a 3.75% rate instead. On the other hand, there may be other opportunities and strategies you haven’t thought of yet.

Planning for Down Markets with Portfolio Adjustments

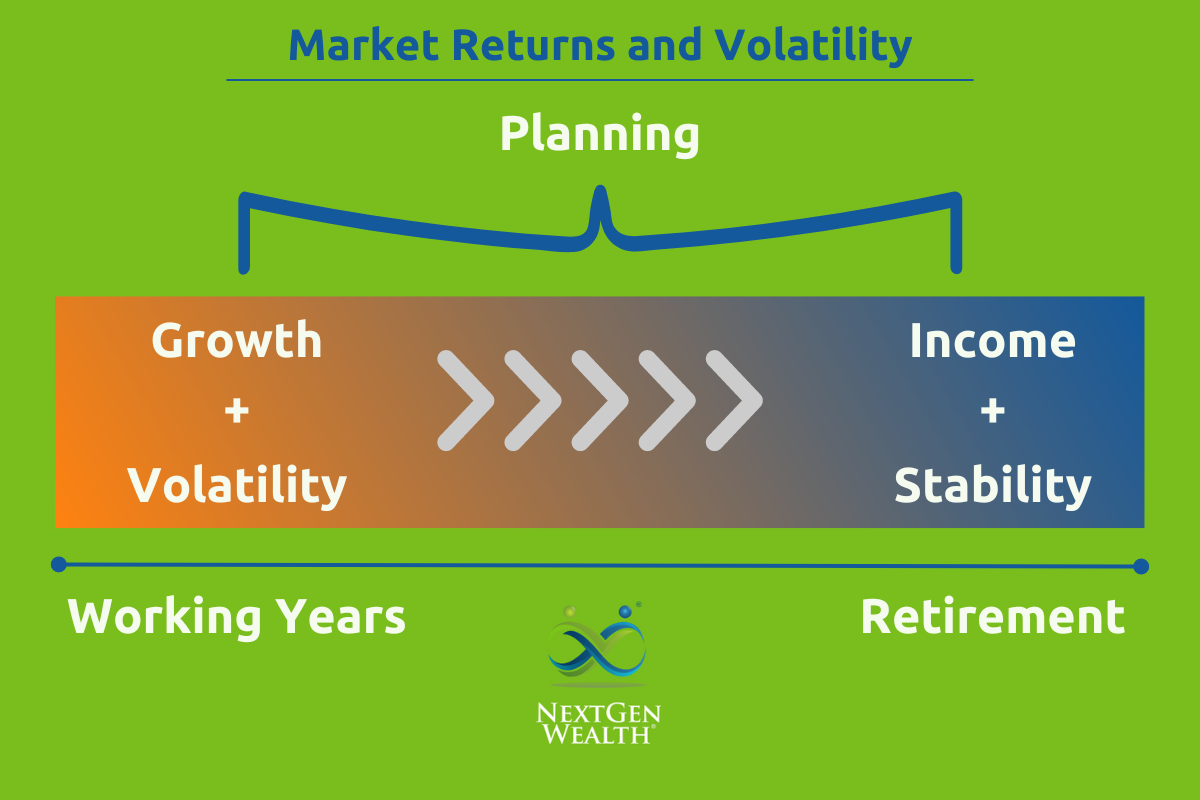

If you are still in the accumulation phase (still working and saving), then you can start to shift your asset allocations to be more resistant to big market swings. We would normally do this throughout your working years and in the 5-10 years preceding retirement. The idea is to gradually decrease your equity exposure (a little more bonds and less stocks) to decrease the portfolio volatility (how much it moves with market swings).

Essentially, we’re looking to “smooth out the ride” a little. Think about it like the tires on a truck or SUV. When you were younger, you might have preferred to buy big mud tires and seek out bumps and jumps for fun. In your later years, you might prioritize tires for a smoother ride, snow traction, and fuel economy.

In other words, we might enjoy a rougher ride at the beginning of our investment journey. After all, the stories (and gains) from those rougher times keep us going in retirement. However, we probably want to transition to a smoother, softer experience as we approach retirement.

Focus on What You Can Control

If you’re getting ready to retire in a down market you need to look at all your resources (retirement accounts, pension, etc.) and assess where you’re at. Given the current market conditions, will you need to make any adjustments? It’s entirely possible you won’t need to make any changes at all.

This is something a financial planner can help you crunch the numbers on and visualize for your situation. There’s a lot of best-guessing involved here too. We have no idea how bad the down market or recession will be or how long it will last.

Actions You Can Take

There is nothing you can do to change the market. The best thing to do is focus on things you can control. Your savings rate and household spending are the two areas you have the most control over.

Spending

Don’t worry, we’re not going to tell you to cut all spending and stop living life as you know it. However, there is likely to be some discretionary spending you can delay for a little while. For instance, this might not be the year you replace your car or purchase a vacation home.

Smaller cuts over a longer period can have a much bigger impact. If you can find a way to shave $1,000 a year over the next 25 years, it’s much more effective than cutting $10,000 right now. We’re thinking about this like turning a large ship in deep waves, not whipping a kayak around a rushing river.

Saving

Saving is the other side of cutting spending. If you’re able to trim expenses, putting extra money into your retirement savings can go a long way to overcoming sequence of return risk. You can still make a significant impact through extra savings regardless of market conditions.

Maybe you already live a frugal life, and you can’t really cut spending or increase savings. If so, then you may need to think about other options.

Continue to Work

Although delaying retirement may make a difference, you might be surprised at the true mathematical impact. In our article on planning for retirement and inflation, we saw our pal Max can make a difference by working longer, but it’s not the only (or even preferred) option. In fact, Max and Minny would have needed to work an additional 4 years to “fix” their shortfalls.

The decision to work longer should be looked at through the lens of personal fulfillment instead of purely financial. As you get closer to the end of your career, the effects of working longer diminish as well.

Adjust Portfolio Strategy

The other things to consider are your overall investment and withdrawal strategies. As mentioned before, you could adjust the amount you’re pulling from retirement accounts. However, this could cause more issues down the road when Required Minimum Distributions (RMDs) kick in.

You can also adjust your expected risk/return in your portfolio. This can be tricky because nobody can guarantee what market returns will be.

Worried that you might run of money in retirement? Learn more here.

Down Market Mistakes to Avoid

The biggest thing to avoid is panicking and completely pulling your money out of the markets. This can be a natural reaction to watching your 401k balance drop. You might think you can pull everything out and just “wait until things get better.”

If you pull all your money out, you could be missing the best days to be in the market. The road to recovery is often choppy and unpredictable. Nobody gets nervous when the plane ride is smooth, but the take-off, turbulence, and landing make a lot of people say a prayer or two.

This is no different. Trust the markets to do the same things they’ve always done and recover.

When you’re “in it” is not the time to make drastic changes. If you have a properly diversified portfolio, suited to your investment needs, you have nothing to worry about. Stick to the plan and things should eventually smooth out.

Should I Worry if the Markets are Down?

In a word, no – if you have a solid plan (I know, easier said than done). No matter if you’re a do-it-yourself investor or employ a financial advisor, you need clear rules for what you will and won’t do in a down market. Emotions are hard to avoid when you check your retirement accounts and see you’ve “lost” a big chunk of your nest egg.

Create a plan and stick to it. Once you have your playbook all mapped out, just keep executing. Stay calm, remember what’s important to you, and press forward.