What is a Mega Backdoor Roth IRA?

This post was last updated on February 17, 2026, to reflect all updated information and best serve your needs.

In addition to sounding cool, mega backdoor Roth conversions can be super helpful for long-term tax savings. For high-income earners, contributing more to a Roth account now will make retirement income planning much easier.

In addition to sounding cool, mega backdoor Roth conversions can be super helpful for long-term tax savings. For high-income earners, contributing more to a Roth account now will make retirement income planning much easier.

Unfortunately, not everyone can take advantage of a mega backdoor Roth conversion. If you can, it could be highly beneficial for helping you reach your retirement goals.

Table of Contents

A Primer on Qualified Accounts, IRAs, and Retirement Planning

Before we get into the nitty-gritty of making a mega backdoor Roth IRA conversion work for you, let’s take a closer look at IRAs and retirement planning in general. This way, you can ensure you know what to expect and determine whether this is an option for you.

Qualified Retirement Accounts: 401(k), Traditional IRA, SEP, etc.

A good way to save money for retirement is with a “qualified account” such as a 401(k) or traditional IRA. There are some essential elements that you need to understand about these accounts. All these accounts allow you to deduct the contributions you make in the account from your adjusted gross income (AGI), invest the money for growth, and withdraw in retirement.

This allows you to defer paying taxes until you withdraw the funds for retirement income. You’ll get a deduction now in your working years, and then you’ll pay the taxes later in retirement.

No Income Limit

Whether you’re a struggling artist, a middle manager, or a doctor, everyone can contribute to a traditional IRA or another qualified plan. However, the contribution may not be tax-deductible depending on your income level.

Required Minimum Distributions (RMDs)

Once you reach 73 years old (changes to 75 in 2033), you must start taking money out of your IRA or other qualified accounts. These are called required minimum distributions or RMDs. The exact amount varies based on the account balance, life expectancy tables, and other factors.

Even if you have plenty of cash on hand during your golden years, you’ll be required to pull funds from your traditional IRAs and 401(k)s whether you want to or not. Technically, you can reinvest this money rather than spend it. However, you’ll have to withdraw the RMD and pay taxes regardless.

This can create some major issues. First, RMDs will raise your AGI, which could push you into a higher tax bracket, raise your Medicare premiums, or cause more of your Social Security benefits to be taxed. Those are all less than fun; this is where the Roth IRA comes in handy.

Roth IRA

Since 1997, individuals have been able to add money to a Roth IRA. Roth IRAs work a little differently from a traditional, qualified account in some important ways. First, they change the order in which you pay taxes. With a Roth account, you pay taxes now as ordinary income and then pull the money out tax-free in retirement.

Goodbye RMDs!

Roth IRAs are not subject to RMDs. The distributions are not included in your AGI either. Therefore, you don’t pay taxes on qualified distributions from Roth IRAs in retirement (after age 59-1/2).

It's important to note that you may have a Roth account, also called a “designated Roth” account, as part of your retirement plan. With the changes in SECURE 2.0, those Roth accounts are no longer subject to RMDs and still offer tax-free withdrawals in retirement.

The lack of RMDs allows the balance grow, and you can pass it on to your heirs tax-free. Otherwise, you’d have to withdraw the funds, gift them, spend them, or reinvest them elsewhere. It also significantly simplifies tax treatment for inherited IRAs.

Income Restrictions

Unfortunately, if you make too much money in a given year, you can’t contribute directly to a Roth IRA. For individuals making more than $153,000 (Single/Head of Household) or $242,000 (Married Filing Jointly) in 2026, you are subject to phaseouts and can’t max out your Roth IRA.

Once you reach an income of $168,000 (Single/HoH) or $252,000 (MFJ), you can't contribute to a Roth IRA directly.

Roth Conversions

Thankfully, you can complete a Roth conversion to get around these income restrictions. This strategy is the backbone of a mega backdoor Roth IRA conversion. In short, a Roth IRA conversion allows you to take a traditional account, transfer it to a Roth IRA (directly or indirectly), pay the taxes now, and then withdraw money tax-free in retirement.

In other words, you're able to modify when you pay taxes. This can also help you reduce your taxes later by avoiding tax on the growth from conversion to withdrawal.

Backdoor Roth Conversions

A "backdoor" Roth conversion is when you contribute to a traditional retirement account, and then transfer (convert) your contributions into a Roth IRA. Your retirement plan will need to allow in-service withdrawals, but this is fairly common today.

Mega Backdoor Roth IRA Conversions

If you’ve analyzed your situation and found that a Roth conversion is right for you, then you might also benefit from a mega backdoor Roth conversion. A mega backdoor Roth may allow you to squeeze up to $72,000 into a Roth IRA. Considering the annual cap for Roth IRAs is currently $7,500 ($8,600 if you’re over 50) in 2026, this is a big deal.

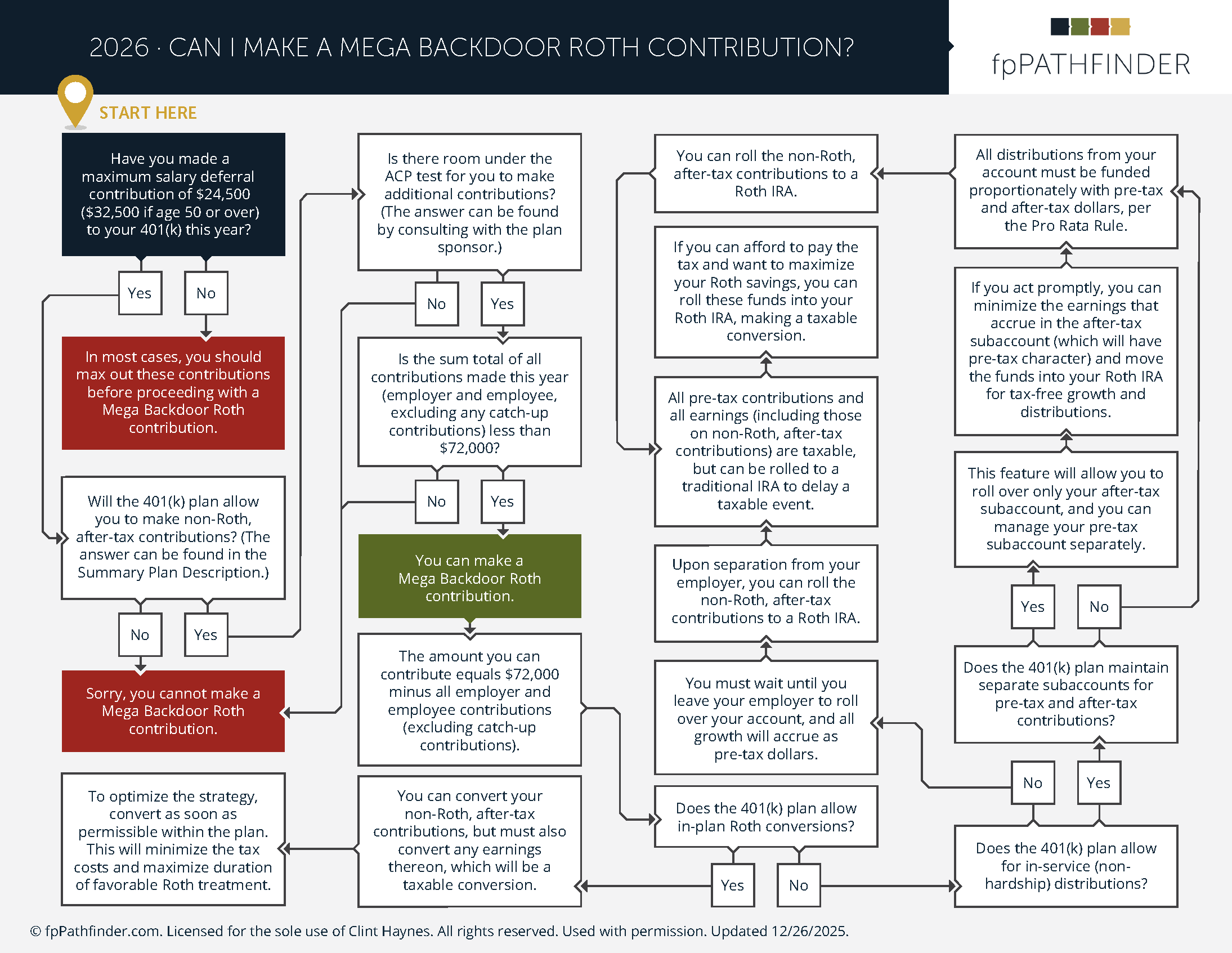

However, not everyone can do this. There are strict guidelines and several steps needed to make a “mega” Roth conversion. The flowchart below (not as complex as it looks) outlines the questions you need to answer to determine whether you can complete a mega backdoor Roth conversion.

Note: You may need to click on the image to expand it.

Key Ingredients to a Mega Backdoor Roth IRA Conversion

The main components of this strategy are depositing enough money into your account to max out your qualified contributions for the year, maintaining cash on hand to pay taxes, making additional after-tax contributions, and taking in-service withdrawals.

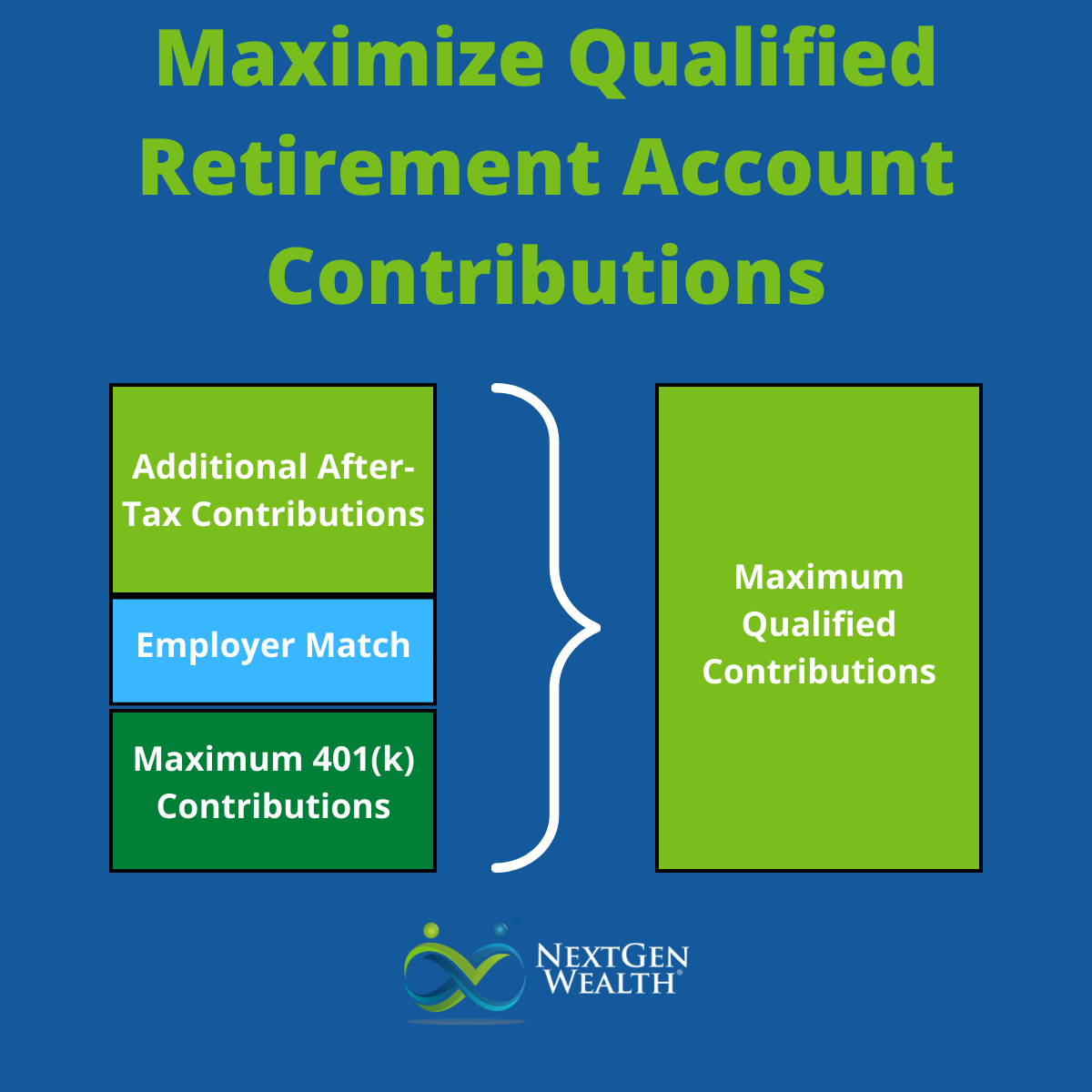

Maximizing Total Contributions

The first step is to contribute the maximum amount to your qualified retirement account. We’ll use a 401(k) as an example. You would need to contribute the maximum amount, add employer match (if applicable), and then make additional after-tax contributions.

For 2026, the maximum amount that you can directly contribute to a 401 (k) is $24,500, $32,500 if you’re over 50 (Catch-up Contributions of $8,000), or $35,750 if you're age 60 to 63 (higher $11,250 catch-up). Individual contributions are limited to $72,000 for all qualified retirement accounts combined. The extra comes from employer matching and other contributions.

After-Tax Contributions

To maximize a mega backdoor Roth IRA to work, you'll have to make after-tax contributions to your 401(k) plan. Since you can’t go over the maximum threshold, you will need to do some math to find out how much you can add.

For example, if you contribute the maximum amount to your 401(k) in 2026 ($24,500), and your employer matched 10% ($2,450), then you would add $45,050 as an after-tax contribution to max out your annual contributions ($24,500 + $2,450 + $45,050 = $72,000). If you don’t get an employer match, then that will change things a bit.

401(k) After-Tax Contributions

As mentioned, your 401(k) plan must allow for after-tax contributions. Not all employers offer this feature, so you'll need to check.

New Roth Catch-Up Rules

Also, you may need to navigate the new Roth catch-up rules from SECURE Act 2.0. In short, if you earn over $145,000 per year, any catch-up contributions must be made to a designated Roth account. The final IRS rules on catch-up contributions upheld and clarified much of what was proposed in SUCURE 2.0.

This means you'll contribute those funds directly to a Roth account, and no conversion would be necessary.

In-Service Withdrawals and Rollovers

You’ll need to be able to complete an in-service withdrawal or partial rollover. Many retirement plans allow for in-service withdrawals. If your employer plan doesn’t allow for that, you will need to wait until you leave your job to implement a Roth conversion strategy.

Check with your 401(k) provider to determine if your employer allows for after-tax 401(k) contributions and in-service distributions. All this information should also be found in your retirement plan summary plan description.

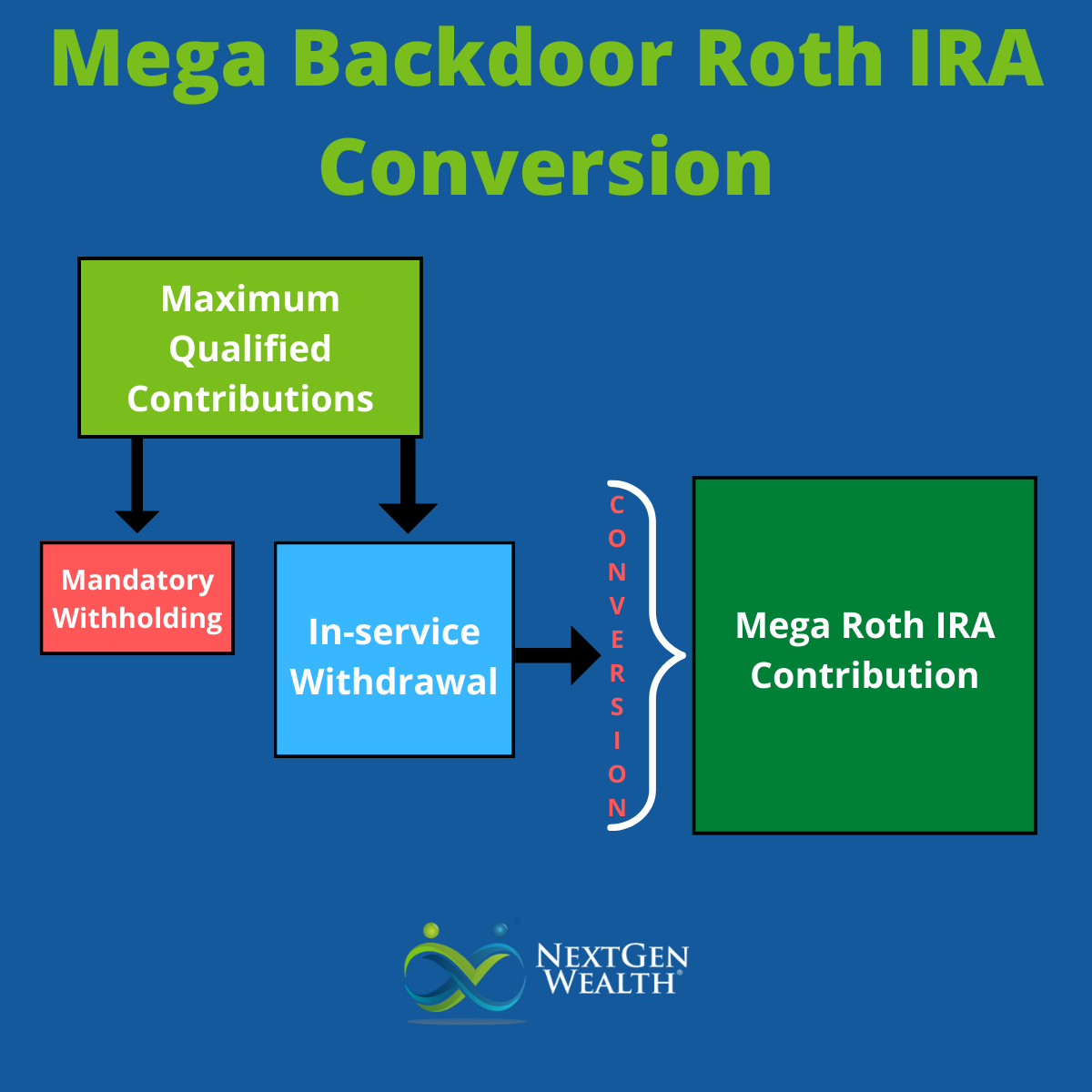

Cash for Mandatory Withholding

Your 401(k) provider is required to withhold 20% for taxes for any distributions made directly to you. To avoid a penalty, you’ll need cash on hand to “replenish” the amount withheld. In other words, the total amount withdrawn from the account must be deposited into the rollover account (Roth IRA in this case), or you'll be hit with a tax penalty.

The Mega Backdoor Roth IRA Conversion Process

Now that we’ve checked and rechecked, we’re ready to rock. Keep in mind that everything needs to be done in order and within specific timeframes. If it gets messed up, then you could get hit with tax penalties, and that’s not good!

Complete the Necessary Contributions

Depending on your income and employer match, this may take most of the year. Often, Roth conversions are completed closer to the end of the year. By that time, we know how much you’ve made for the year (important for AGI thresholds, etc.) and know how much after-tax contributions to make.

Also, if you have a match, you don’t want to totally front-load your 401(k) contributions because you might miss out on the match. That’s like throwing away money!

Once you’ve maximized your individual contributions and employer contributions, then you’ll need to “top off” your contributions for the year. Do the calculations we discussed earlier and adjust your contributions to make your after-tax contributions.

Open a Roth IRA

If you don’t already have a Roth IRA, then you’ll need to open one. This is an easy step, but you want to make sure it’s established and ready to go.

Initiate the In-service Withdrawal or Rollover

Once you’re ready, it's time to take the in-service withdrawal. Keep in mind that your plan administrator or custodian will withhold 20% for taxes. If you’re able to do a direct rollover for the conversion, then there’s no issue with withholding.

If the funds are dispersed directly to you, you have to deposit them into the Roth IRA within 60 days to avoid a penalty. Do this immediately so there are no questions or unforeseen snags.

Pay the Taxes

Upon completing the transfer, you’ll need to pay taxes on the portion of the balance converted from a traditional account to Roth. You won’t have to pay additional taxes on the after-tax contributions you made to “top off” your 401(k) or other qualified account.

Let it Compound Tax Free!

That’s it! Ideally, you’ll be able to maximize your mega backdoor Roth IRA conversion and stuff a whole $72,000 into your Roth accounts for the year! It can now grow tax-free and RMD-free until you use it or pass it on. This strategy is a bit complicated, but it can be well worth it to save you on taxes in the long run.

Getting Help from a Professional

Even if you plan to do this on your own, we strongly recommend seeking advice from a tax professional and a financial planner. You don’t want to accidentally create a tax problem for yourself by trying to save money on taxes. Also, you want to ensure everything was done correctly the first time.

While a mega backdoor Roth IRA conversion may sound appealing, you need to be sure that you have all your bases covered. If you'd like help planning your retirement, contact us to request a no-obligation financial assessment and see whether working with NextGen Wealth is a good fit for you.