The Best Time of Year for a Roth IRA Conversion

Roth IRA conversions are a valuable tool in long-term tax planning. This method might save you tens of thousands of dollars or more on your taxes. But is there a best time of year to complete Roth conversions?

You must consider many variables to determine what’s best for you. Life happens, and your tax-saving strategies must be adjusted accordingly. This is why we typically evaluate and complete Roth conversions annually.

Table of Contents

- Understanding Roth IRA Conversions

- Factors Influencing the Timing of a Conversion

- Tax Implications of Roth Conversions

- Seasonal Financial Planning Considerations

- Taking Advantage of Market Conditions

- Real-World Applications

- Early vs. Late-Year Conversions

- How NextGen Wealth Can Help with Your Roth IRA Conversion Strategy

Understanding Roth IRA Conversions

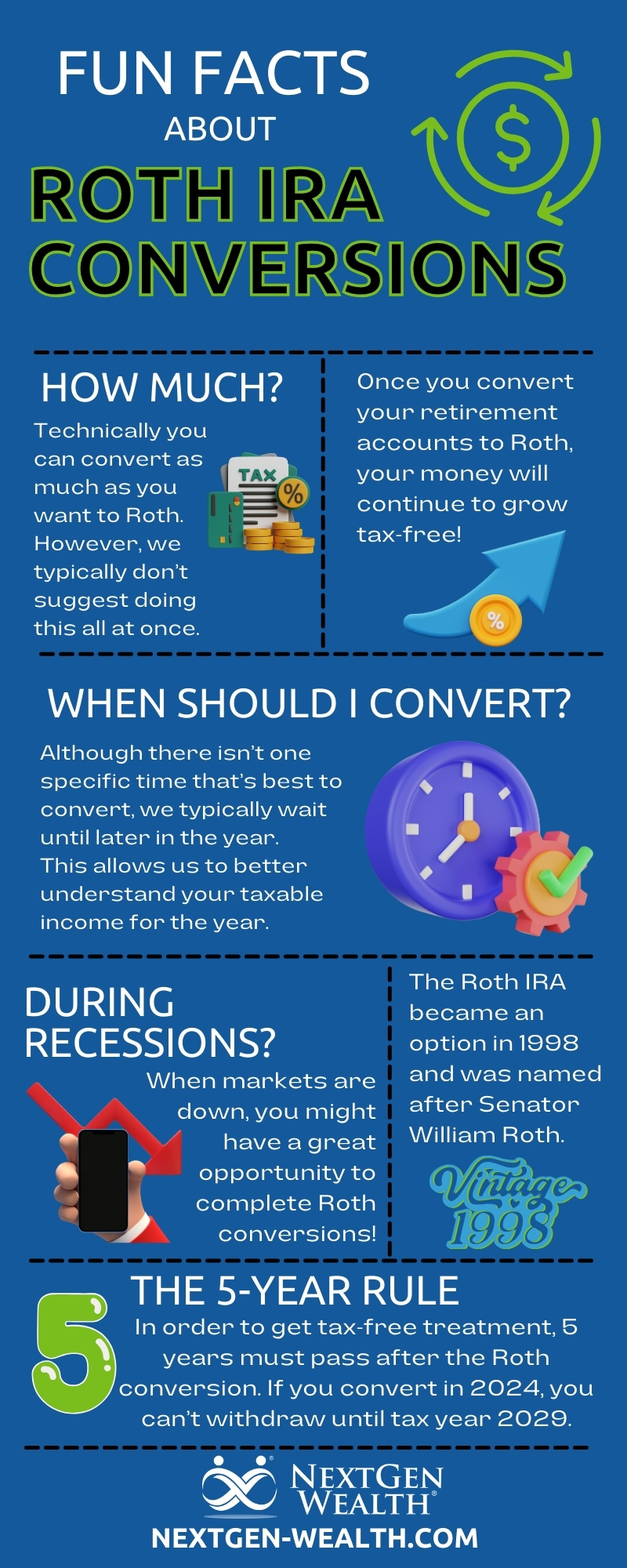

Let’s start by touching on the basics of a Roth IRA conversion. A Roth IRA conversion is when you transfer or convert traditional, tax-deferred retirement savings into a Roth IRA. You must pay the taxes on the amount transferred when completing the Roth IRA conversion.

The benefits of converting a traditional IRA or 401k to a Roth IRA include saving money on taxes, avoiding required minimum distributions, and decreasing your taxable income in retirement. But when should you complete a Roth conversion?

Factors Influencing the Timing of a Conversion

Tax considerations are one of the main factors in determining whether a Roth IRA conversion is right for you. Many variables affect your Roth conversion strategy, including other taxable income, such as whether you’re married, single, divorced, or widowed, and when you’ll start drawing Social Security.

Current and Future Income Streams

Current and future income levels are key to determining how much and when to complete Roth conversions. If you’re in a higher income category now, waiting for a dip in income would make more sense. There are other factors to consider as well, like your health and the total amount of traditional, tax-deferred assets you own.

Tax Implications of Roth Conversions

Roth conversions impact your taxable income in the year you make the conversion. Technically, you’re increasing your taxable income for the year. You’ll often want to avoid or potentially limit Roth conversions if your income is higher.

Strategies to Minimize Tax Liabilities

We have many different ways to save money on taxes. Roth conversions can be powerful, but they’re not always the best way to go. Technically, you’re just shifting when you pay taxes.

We can often time Roth conversions after you’ve stopped working but before you start drawing Social Security. This allows you to take full advantage of a lower effective tax rate. However, you’ll want to be careful once you turn age 63 because you could cause issues with raising your Medicare premiums.

Seasonal Financial Planning Considerations

End-of-year tax planning is typically when we’re calculating Roth conversions for the year. You might not know exactly what your income will be until the end of the year. This may be especially true if you run your own business, rely on income from bonuses and commissions, or plan to switch jobs.

These kinds of financial events can significantly impact how much you should convert to Roth. In some cases, completing a Roth conversion at all might not make sense. We want to avoid doing a big Roth conversion early in the year if there’s a potential for your income to be much higher than you anticipated.

Taking Advantage of Market Conditions

Market conditions and investment performance can create some opportunities for Roth conversions. When the market is down, you can get more “bang for your buck” on Roth conversions since you can convert more shares.

In other words, if there’s a temporary dip in the market, you can convert more shares into a Roth IRA and pay less taxes on the conversion. Plus, as long as the market rebounds, all of that appreciation will be tax-free in your Roth IRA.

How a Down-Market Roth Conversion Works

Let’s say you wanted to convert some of your traditional IRA to Roth this year. You’ll pay taxes on the transferred money now. Once the market recovers, you’ll have more tax-free money than if you waited. You only paid the taxes on the amount you converted.

The larger the dip, the greater the tax advantage. However, we never try to time the market specifically for this. We can take advantage of Roth conversions in a down market if it happens, but only if we’ve already done a comprehensive analysis and determined Roth conversions are right for you.

Other Market and Timing Variables

Many different studies have tried to figure out how to time the market. People have also made up all sorts of theories and “rules.” One study even discusses which day of the week has more market volatility.

Your Roth conversion shouldn’t be affected. You’re taking one investment, moving it from one account, and transferring it into another. Technically, each part of the operation takes some time.

With modern technology, minimal market changes will occur during a conversion. We also have no control over any anomalies which may occur. Once again, we’ll gladly take advantage of market conditions if they occur, but we’re not letting current conditions drive the process.

Real-World Applications

We regularly analyze your situation to determine if Roth conversions are beneficial. We carefully analyze various scenarios utilizing advanced software to help visualize the total tax savings.

In many cases, there’s a balance between adding to your tax bill now versus later. We also calculate when your efforts will pay off and break even with the upfront tax costs. The right amount of Roth conversions will be different for everyone.

Early vs. Late-Year Conversions

Normally, we wouldn’t wait to complete an action. However, converting in January versus December isn’t typically a major difference. However, as we mentioned, market fluctuations can create some nice opportunities to convert money to Roth more tax-efficiently.

It’s impossible to predict exactly what will happen in a year, so we usually wait until the end of the year to assess accurately how much we can convert without going over certain thresholds. For instance, we may want to stay under the Income Related Monthly Adjustment Amounts (IRMAA) threshold so your Medicare premiums don’t increase (although this isn’t always true).

If we get excited and convert too much, we could undo the tax savings we created. We want to keep more money in your pocket – not save one place to pay elsewhere.

Converting Over Time

One other thing to remember is you’ll probably complete a Roth conversion strategy over several years. This creates an effect similar to dollar-cost averaging. So even if the market is up this year, it may be down next year and back up the following year.

The primary goal of spreading Roth conversions out is to maximize tax benefits. Regardless, your particular needs and strategy will be unique. This is why having a financial plan is so important.

Is There Really a “Best” Time?

You might have already figured this out, but there isn’t one universal best time to complete a Roth conversion. Ultimately, the variables related to your situation are much more important than anything else. Your life remains the most important variable in the equation.

Professional Guidance

At a minimum, you must coordinate Roth conversions with your financial planner and accountant. These conversions need to be properly tracked and recorded. You’ll also need to track when you make conversions to know when the money is available.

When you complete a Roth conversion, your money has to stay invested in the account for at least five years before it can be withdrawn. In most cases, this isn’t a major deal, but you must be aware of the rules.

How NextGen Wealth Can Help with Your Roth IRA Conversion Strategy

At NextGen Wealth, we have been looking at Roth conversions since our relationship with you began. We’ll do a broad overview and analysis during your initial financial assessment. When you complete the COLLAB Financial Planning Process™ with us, we’ll give you personalized Roth conversion strategy recommendations.

If all this seems complicated, don’t worry. We regularly complete Roth IRA conversions for our clients, and we’re happy to discuss your options. Contact us today to see if we’re a good fit and schedule your free financial assessment.