Safeguard Your Retirement: Tackling Longevity Risk

Running out of money is a real worry for retirees. However, you can reduce or eliminate worries around longevity risk in retirement. With careful planning, it might be easier than you think.

Running out of money is a real worry for retirees. However, you can reduce or eliminate worries around longevity risk in retirement. With careful planning, it might be easier than you think.

Regardless, we recommend planning for your retirement early and often. The longer you wait, the less options you have. So, what can you do to protect yourself from longevity risk?

Table of Contents

Understanding Longevity Risk

First, let’s talk about what the term longevity risk even means. In simple terms, longevity risk is the risk of outliving your retirement assets. In other words, longevity risk is the fancy term for running out of money in retirement – kind of a big deal.

Many retirees might not realize their actual life expectancy at retirement. Living longer is a good thing, but it can create new problems if you don’t have enough money saved for retirement. You might live longer than you think and need more money for a successful retirement.

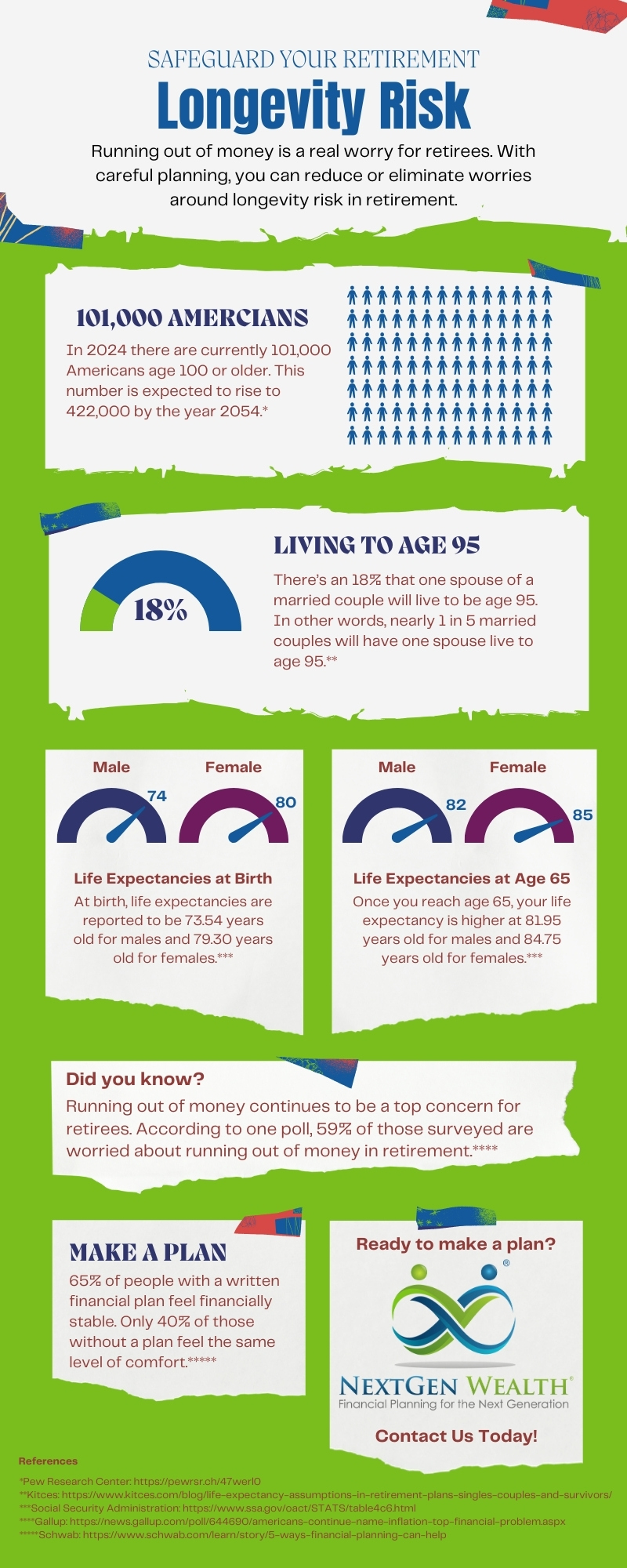

If we look at the life expectancy tables used by the Social Security Administration, we can see how this works. At birth, life expectancies are reported to be 73.54 years old for males and 79.30 years old for females. However, once you reach age 65, your life expectancy is higher at 81.95 years old for males and 84.75 years for females.

Couples Have Higher Longevity Risk

When we look at life expectancies for couples, your combined life expectancy could be even higher. At a minimum, data shows higher life expectancies for married men and women. In other words, it’s reasonable to assume one or both spouses have another 20 years to live after retiring.

This is why planning can be so critical. You must be prepared for problems like required minimum distributions, the risk of the widow’s penalty, or changes to tax laws.

The Importance of Income Planning

There’s a lot of talk about having a diversified portfolio, but having diverse streams of income can be even more important. As the saying goes, you never want to put all your eggs in one basket, and planning your retirement is no different.

You’ll want to have stable streams of income in retirement, such as Social Security, pensions, and annuities, which can all be structured to last a lifetime. It’s also best to think through what happens regardless of which partner is the last to pass away.

Inflation Protection

Inflation is another problem that can affect your retirement. Inflation can erode your purchasing power over time and really stress your income sources. We always plan for this and factor inflation into our calculations. The more protection you have from inflation, the better.

Certain types of income, like Social Security and federal pensions, have built-in inflation protection. Getting annual cost of living (COLA) adjustments can be really helpful. However, you can also curb the effects of inflation by investing in assets to outpace inflation.

Health Care and Long-Term Care Costs

Healthcare costs continue to rise as well. You’ll always need insurance to have access to quality healthcare. Medicare might not be enough to cover all your expenses. Long-term care planning is another important topic to discuss as well – something Medicare doesn’t cover.

Medical care costs are rising each year, which is a real concern for retirees. We want to ensure you can always afford the care you need.

Investment Strategies for Longevity

Structuring investment portfolios with an eye toward longevity looks different than when you first started investing. Your retirement portfolio's job changes as we shift from one retirement phase to another. It’s vitally important to reconsider diversification, risk management, and strategies like the “bucket” approach.

The amount of risk you can endure is lower in retirement. In a perfect world, you’ve already accumulated all the assets you need for retirement, so you’ll want to have a larger focus on preservation. This means you’ll likely shift to more stable assets with less risk and lower overall returns as you start to withdraw retirement income.

Withdrawal Strategies to Minimize Risk

You may be familiar with different withdrawal strategies, like the 4% rule. However, we’re not content with “good enough” rules of thumb. At NextGen Wealth, we prefer to have the flexibility to adjust spending as needed. Actually, we often encourage our clients to spend more than 4% - especially if it’ll bring value to their lives.

We implement a “guardrails” approach to the decumulation phase of retirement. In other words, we can adjust withdrawals from retirement accounts as needed to help manage the risk of depleting retirement savings too soon. We prefer to create a retirement spending plan around living your best retirement lifestyle – not the other way around.

Tax Efficiency in Retirement

Proper tax planning can maximize your income in retirement and minimize your lifetime tax bill. We use tax strategies like Roth conversions to reduce your tax burden. This can be especially helpful in managing required minimum distributions (RMDs).

There’s always a tradeoff, but we can probably all agree that saving money on taxes is always a win. You’ll want to collaborate with your accountant and financial planner to ensure everyone is on the same page. Certain items like qualified charitable distributions (QCDs) need special attention to how they’re reported.

Estate and Legacy Planning

As mentioned earlier, you’ll need to plan for a much longer time period than you think – or at least the data points to the possibility. Creating a solid estate plan to protect assets and ensure they are passed on efficiently to your surviving spouse and heirs is essential. This can be even more critical with special rules for inherited retirement accounts.

In many ways, your retirement plan doesn’t end until all your assets have been successfully transferred. Depending on who gets what, things can get pretty complicated.

Estate Planning Order of Operations

The “order of operations” for who gets what and when is critical, especially with upcoming potential changes to estate tax and gift tax exemptions. It’s best to work with an estate attorney and a financial planner to ensure everything you want to happen actually happens.

Many other factors must be considered depending on which spouse passes first, age gaps, and income tied to each person. If the passing of one spouse creates a “widow’s penalty” for the surviving spouse, you’ll want to take this into consideration. You may consider different tools and strategies for your situation.

Choosing the Right Financial Advisor for Longevity Planning

When it comes to making critical retirement decisions, we’re big fans of getting quality advice. We might be slightly biased, but we’ve seen the positive impact of planning early and keeping a long-term relationship with a financial planner. We highly recommend at least interviewing a financial planner.

Retirees should seek out a financial advisor who understands longevity risk and has experience crafting retirement plans to account for it. It’s also important to find someone with a good personality fit. The bottom line is to find someone with the training and temperament to be your trusted guide throughout retirement.

The NextGen Wealth Difference

At NextGen Wealth, we specialize in the transition into retirement. We believe nailing the transition is critical to preventing problems like longevity risk. We regularly monitor and adjust our clients’ plans to ensure they’re never caught off-guard.

Contact us today to see if we’re a good fit and schedule your free financial assessment. Start planning your retirement and take action to prepare for your retirement today!