Qualified Charitable Distribution as a Required Minimum Distribution?

This post was last updated on February 24, 2026, to reflect all updated information and best serve your needs.

If you’re required to take Required Minimum Distributions (RMDs), then knowing your options is important. Qualified Charitable Distributions (QCDs) are a useful tool to keep in mind.

You need to know the benefits and drawbacks of QCDs if you’re already taking RMDs or anticipating doing so. Let’s discuss what QCDs are and whether they should be in your arsenal of tax-fighting weaponry.

Table of Contents

Required Minimum Distributions (RMDs)

First, let’s talk about what RMDs are. Required Minimum Distributions (RMDs) are the minimum amount of money that you must withdraw from your retirement accounts each year. Otherwise, you’ll incur a penalty for not making the RMD.

This distribution is taxed as ordinary income just like any other distribution. This may not be an issue for you. However, the penalty for not withdrawing the proper amount is 25% of the money you failed to take out as a distribution. Yikes!

You want to be sure you’re taking out the proper amount. You can reduce the penalty if you correct the mistake of failing to take your RMD in a "timely manner."

What Accounts Are Subject to RMDs?

In general, all retirement accounts except Roth accounts (thanks to the changes in SECURE 2.0) are subject to RMDs. This includes all “employer-sponsored” plans, such as 401(k), 403(b), 457(b), as well as IRAs (including SEP, SIMPLE, and SARSEPs), and profit-sharing plans.

For the year in which you turn 73, you actually have until April 1st of the following year to take your first RMD. However, if you do choose to delay your first RMD to 4/1 of the next year, you'll have to take your next RMD by 12/31 of that same year. After that, and each subsequent year, 12/31 is the RMD deadline.

Note: In 2033, the beginning age for RMDs will increase to 75, also due to changes under the Secure Act 2.0.

The Issue with RMDs

You might be wondering, “What’s the big deal?” You saved this money to spend in retirement, so why not use it? There are some potential issues.

For starters, you might just not need the money right now. You may be trying to employ tax-saving strategies in retirement. If the markets are down, you might not want to withdraw much money, if any, from your portfolio.

Also, you may have other income, and RMDs would push you into a higher tax bracket. All of these make RMDs a potential headache (and tax burden). So how do you avoid RMDs altogether?

How to Avoid RMDs

There are very few ways to avoid RMDs entirely. The most obvious are not saving any money for retirement (just kidding, NOT recommended!) or getting your retirement savings into a Roth IRA. There's another option we'll get to soon.

The most common way to convert traditional retirement accounts into a Roth IRA is through a Roth Conversion. This involves transferring money from your retirement account (IRA, 401(k), 403(b), 457(b), etc.) into a Roth IRA. You pay taxes in the year of the transfer, the money in the Roth IRA grows tax-free, and you avoid RMDs.

Exception to the Roth IRA Exemption for RMDs

There is one exception to the rule for Roth IRAs to be exempt from RMDs (isn’t there always one?). An inherited Roth IRA is subject to RMDs. The beneficiary does have some additional options for distributions.

Regardless, distributions must begin no later than December 31st of the year after the original account holder passed away or would have reached age 73.

I Can’t Avoid RMDs

Let’s say that you can’t avoid RMDs altogether for one reason or another. Now what?

You'll have to take distributions from the account no matter what. However, there's a way to withdraw money from the account without paying taxes – enter the Qualified Charitable Distribution (QCD).

Qualified Charitable Distributions (QCDs)

The Qualified Charitable Distribution (QCD) is pretty much exactly what it sounds like. It’s a charitable contribution that also qualifies toward your Required Minimum Distributions for the year. QCDs are made directly to your charity of choice.

There are several rules surrounding QCDs, but they can be a helpful tool if:

- You’re already planning on giving to charity (including a church) and would do it anyway

- Your accounts are subject to RMDs

QCD Criteria and Limits

To be considered a QCD, you must make the distribution from your retirement account directly to a qualified charity and be over the age of 70-1/2. The maximum you can contribute as a QCD for 2026 is $111,000 per person ($222,000 for a couple). In general, you must also make your QCD before you take any other distributions for the year.

The key thing is that the money goes directly to the charity. You can’t take the distribution and then donate it to charity.

Benefits of the QCD

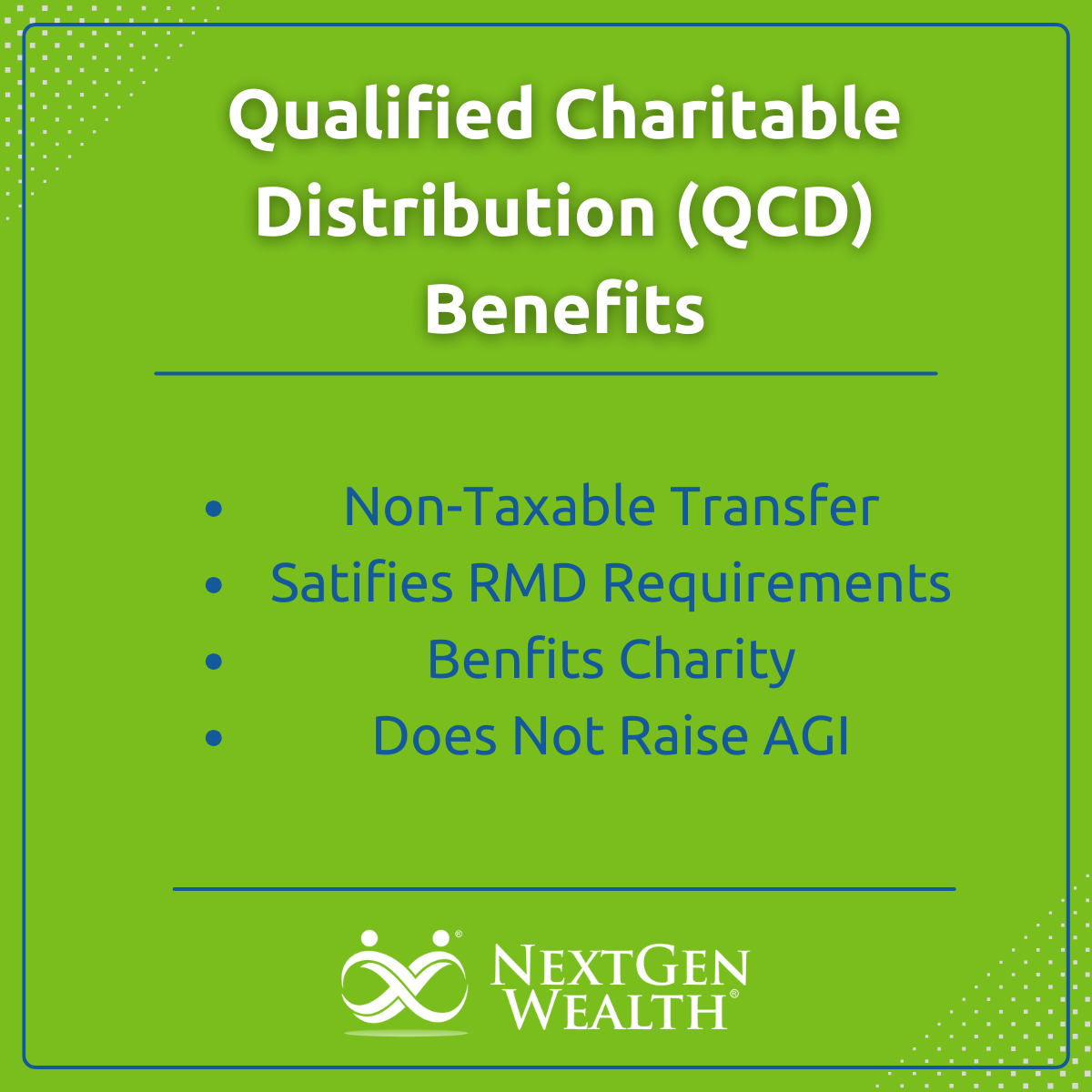

The main benefits of the QCD are:

- Non-taxable transfer

- Satisfies the RMD requirement

- Benefits your charity of choice

Non-taxable Transfer

Since the money is sent directly to the charity, it's not taxed. Normally, if you take a distribution and donate it to the charity, then your original distribution is subject to your normal income tax rate. If a qualified charity receives the money via QCD, you are not taxed, and it doesn’t raise your Adjusted Gross Income (AGI) either.

The fact that a QCD doesn’t raise your AGI is an important distinction. Your AGI is used to determine many different tax rates as well as your Medicare Part B premiums. If you’re already at the limits for these, then a QCD may be beneficial.

Make sure you coordinate with your accountant to ensure the QCD is annotated on your taxes. Otherwise, it might get missed, and you'll lose the tax benefits.

Satisfies the RMD Requirement

Even though you didn’t receive the money directly, the distribution still counts toward your required distribution amount. This meets the IRS requirements in part or in full. You don’t have to use the QCD to satisfy the RMD requirement in full.

Example: If your RMD was calculated at $20,000 for the year and you made a QCD of $10,000, you can make a normal distribution for the remaining RMD of $10,000.

Benefits Charity

Besides tax savings, donating to a cause you care about is the biggest benefit of the QCD. If you can help one of your favorite charities and avoid paying taxes, it really is a win-win!

Limitations of QCDs

There are some notable limitations for QCDs. These are:

- Limited to $111,000

- Limited to qualified charities only (no Donor Advised Funds (DAFs))

- Can only be distributed directly to a qualified charity

- Might not always be the best strategy for minimizing RMD impact

Limited to $111,000

Although this doesn’t seem like a huge problem, it can be limiting in some instances. Keep in mind that spouses can combine their QCD limit.

Qualified Charities Only

The requirement that the QCD must go directly to a qualified charity can be restrictive. You can't contribute to a donor-advised fund (DAF) to qualify as a QCD.

Not Always the Best Strategy

Overall, there may be more tax-efficient strategies for your charitable giving, such as donating appreciated securities from a taxable account. This will depend on your situation. If you don’t have appreciated securities to donate, this is a moot point.

Should I Make a QCD?

Without knowing your situation, it’s hard to tell whether a QCD is right for you. There are many ways to give to charity. The QCD is more helpful in situations where you don’t want to incur RMDs and don’t want to raise your taxable income.

You should pay particular attention to QCDs if you are close to the income limits for capital gains tax, income tax, or Medicare Part B premium rates. Your AGI is also important if you're subject to the Net Investment Income Tax (NIIT) of 3.8%.

A QCD is useful if your RMDs will raise your Adjusted Gross Income (AGI) above these thresholds, you don’t need the money, and you don’t have other preferred options available. If giving to charity is a goal, you should be aware of how each giving method affects your overall financial picture.

Good Tool When Needed

You may never want or need to use this strategy, but you never know. The primary line of defense against RMDs is usually to dial in your income and use Roth conversions.

However, everyone’s situation is different. If you’re up against a 25% penalty, having additional options like the QCD is super helpful! If you'd like help with your own personal situation, contact NextGen Wealth today to get your no-obligation financial assessment and see if we're a good fit to work together.