What is a Diversified Portfolio Anyway?

You hear the words “diversified portfolio” all the time, but what does diversified even mean? At first, we’re not even comfortable asking because it feels like something we should know, but don’t. Let’s explore what being diversified really means and why you need a diversified portfolio.

You might be surprised at how little it really takes to be “diversified.” There are a lot of technical terms surrounding portfolio construction, but you don’t need to get too wrapped up about those. We’ll talk a lot more about your overall risk in your portfolio.

Diversification Definition

Diversification is a method used to reduce investment risk. According to the Merriam-Webster Dictionary, diversification is “the act or practice of spreading investments among a variety of securities or classes of securities”. This is a very simple definition though.

When it comes to investing, there are a multitude of combinations out there. How should we define “variety”? There is a method to diversify your portfolio to meet your needs.

Signs of Proper Diversification

If you have a properly diversified portfolio, you should see investment returns like “the market.” However, we’re always hoping we can get higher returns. The key thing about being diversified is to help limit the downward swings while also getting good returns.

Healthy Returns, Less Losses

In a perfect world, we’d want to capture all the gains and none of the losses. It’s just not possible to reduce all risk and get sky high market returns. We’d recommend running away from anyone claiming to eliminate all your downside potential.

Overall, the ride will be smoother with a properly diversified portfolio. Your investments may give up a little bit of the more sensational market returns, but you’ll also limit the really bad falls too. Think about Goldilocks, not too hot, not too cold, just right for your needs.

More Does Not Always Mean Better

There’s a common misconception that buying a whole bunch of stocks will make your portfolio diversified. This can be really misleading. You could have a portfolio of thousands of different holdings and still not be properly diversified.

On the other hand, you could have a portfolio with 25 to 50 holdings and achieve adequate diversification. The biggest difference is what we call correlation.

Correlation and Covariance

Correlation is just a fancy term to describe how similar or dissimilar the returns of two or more holdings are. If they have a high correlation, they move almost perfectly together. If they have low correlation, they might still move in a similar direction, but to a lesser degree.

There are also scenarios where two different investments will be negatively correlated. This means they move in the opposite direction. So, what’s best?

Overall, you want to make sure everything in your portfolio isn’t dropping (or rising) at the same time. It might not be possible to have perfectly offset gains and losses. The name of the game is minimizing risk, not eliminating risk – all investments involve some risk.

Why Diversification is Important

Managing risks is the number one job of diversification. There are some risks you simply can’t control or fully mitigate. However, we can do a lot to lessen the effect of other types of risk.

If you don’t have proper diversification then market downturns, high inflation, and other events can make your portfolio drop and your blood pressure rise – not what we want! We often think about risks in two main categories: systematic and unsystematic.

Systematic Risk

Systematic risks are those you can’t diversify away. These are always present “in the system” regardless of what you do. These include things like inflation risk and reinvestment rate risk (think bonds). These are tied more closely with overall economic conditions and monetary policies.

Unsystematic Risk

Unsystematic risks can be reduced effectively with diversification. These include risks to businesses arising from accounting, default, and tariffs. While we can’t control those forces, we can invest in industries affected by them differently.

For instance, a new tariff on imported microchips and electronic components might hurt technology companies. However, domestic textile manufacturers might not bat an eye at a new tariff on microchips. However, they might have a hard time if the cost of cotton rises.

How Diversification Reduces Risk

Diversification seeks to select assets which won’t be affected by risks the same way. Spreading investment dollars around is good, but there needs to be a method to the madness. Financial analysts and financial planners can use many tools to measure the characteristics of a portfolio to understand the risks and potential rewards.

They say more risk, more reward, but more risk also has the potential for more loss too. We want to tailor the amount of risk necessary to your goals and when you’ll need to spend the money. If you have a long time to weather ups and downs, then a little added risk might not be a bad thing.

However, if you’re nearing retirement, you don’t want to take on a bunch of risks you don’t need to. If you have enough money saved to meet your needs, you’ll want to shift money toward safer investments.

How Do I Get Diversified?

As we mentioned before, simply buying thousands of stocks doesn’t necessarily mean you’re diversified. If you take a look at most “total market” indexes, the top 10 holdings make up 15-20% of the total fund.

Currently, the top 10 companies in the U.S. (and many popular index funds) are very focused in one market segment – technology. A quick look showed 5 of the top 10 holdings are tech companies and three others are heavily reliant on technology companies. This market segment has done extremely well in the last 20-30 years, but when the top 20% of an index is invested in only 10 companies (out of almost 4,000), you’re not as diversified as you might think.

Market Sectors

One factor to consider is the mix of different market sectors in your portfolio. There are many ways to categorize companies. For example, Morningstar sorts the broader stock market into 11 sub categories.

These categories include stocks which are “Cyclical” and move with normal business cycles, “Sensitive” which are a little less correlated with business cycles, and “Defensive” which includes more stable industries like healthcare and utilities. Overall, you’ll want to have a mix of all the different market sectors to reduce the risks associated with any particular type of business.

Stocks Versus Bonds

You may have heard the words stocks and bonds thrown around a lot, but not much talk about the fundamental differences of each. At the end of the day, both function similarly – you invest in a company and get rewarded for your investment. However, those investments follow different paths to return money to you.

Stocks

Stocks are representative of partial ownership of a company. You pay the market price (going rate) for a small piece of ownership in a company. As the company grows profits, your stock becomes more valuable.

Profits can also be returned to you in the form of dividends. Companies aren’t obligated to pay a dividend, but stock prices do increase with a larger dividend. Dividends are often seen as a sign of healthy and stable profits.

However, just because a company doesn’t pay a dividend, doesn’t mean it isn’t good. Many growing companies won’t issue dividends. Instead, they’ll reinvest profits to grow the company (and revenue).

Later on, when you need to convert your investments into an income stream, you sell your stocks for cash. The pattern goes: purchase, receive dividends and growth, then sell for cash.

Stocks are more sensitive to business cycles – bull (growing) or bear (shrinking) markets. As profits go up or down, the value of your stock does too. In the worst-case scenario, your investment goes to zero. The best-case scenario, the stock grows well into your retirement when you need the cash.

Bonds

Bonds are issued by companies as well as the federal government, cities, and other state and local governments. Bonds function a little bit differently. When you purchase a bond, you are loaning money to the issuer of the bond. In return, you will be paid interest (coupon payments) at a set rate until the maturity of the bond when you’ll be repaid in full.

There are different types of bonds as well. Zero-coupon bonds are purchased at a discount and then later redeemed for face value. For example, you might purchase a zero-coupon bond for $800 which will be redeemable for $1,000 upon maturity.

You might have also heard of “tax free municipal bonds” advertised as well. Depending on the issuer of the bond and where you live, bonds issued by state and local governments are not subject to tax on the returns. Tax free sounds good, but this advantage is priced into the cost of the bond.

Corporate bonds are issued by companies to fund operations. These may even be the same companies you own stock in. With the bonds, companies have a contractual obligation to pay you back. If you own stock, there isn’t the same obligation.

There is still a risk in buying bonds from a company which might go bankrupt. However, if you own a bond, you may be able to recoup some of what’s left. Also, you’ll be collecting coupon (interest) payments along the way.

Bond prices fluctuate more with changes to interest rates than what the stock market is doing. This isn’t always the case, but oftentimes bonds won’t bat an eye while stocks are dropping by double digits.

The basic pattern for investing in bonds goes: purchase the bond, receive coupon (interest) payments, then receive face value at maturity. Bonds have different maturity rates, so you need to time their maturity with when you need the money.

Other Asset Classes

When we’re looking at your total investment portfolio, we’ll also be considering other investments you may have as well. For instance, if you have rental property, then we can factor in those assets as well. You might have other streams of income like a pension, royalties, or a share in a closely held business to consider.

Real Estate

Real estate can be a great investment to include in your overall portfolio. However, real estate investing and rental properties aren’t for everyone. There is often a large up-front cost to purchase, maintenance, property taxes, and other issues you may have to deal with.

The benefits of real estate come from having a tangible asset you can see. You also get appreciation from holding the property on top of rent payments. Eventually, you can pass these assets down to your heirs and continue the stream of income for them as well.

There are also real estate investment trusts (REITs) you can invest in. These are special trusts set up to purchase real estate investments through pooled funds of investors. You would purchase a share in the trust and then receive growth and dividends similar to the purchase of stocks.

DIY or Managed Portfolio

You can choose to manage your portfolio yourself and use some of these principles as a guide. However, we’ve only begun to scratch the surface of evaluating your portfolio. We haven’t even broken out all the fancy technical terms (alpha, beta, Sharpe ratio, standard deviation, bond duration, etc.).

You may also want to consider having a professionally managed portfolio. Investment management companies spend all their efforts designing what we call “model portfolios” to achieve specific investment objectives. For example, if you’re entering retirement, you might want to invest in a fixed income portfolio with less risk.

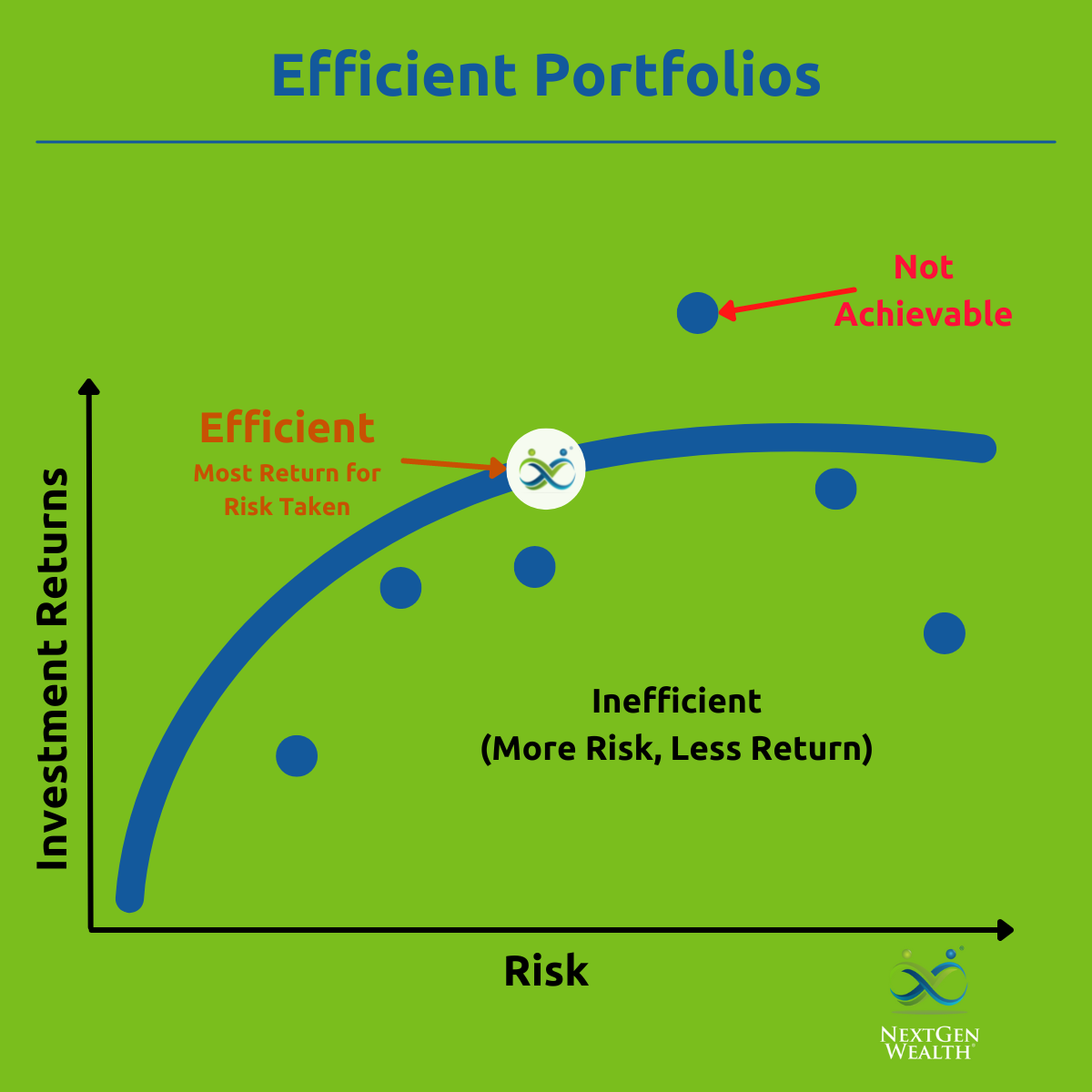

Model portfolios are designed to achieve the highest return for a set amount of risk. Financial analysts and financial planners look to create a portfolio using the “efficient frontier” which is just the fancy way to say best bang for your buck (risk tolerance/capacity). If you plot portfolios on a graph with the expected return on the left and volatility or risk on the bottom, you can see their risk/return profiles (see below).

Ideally, you want to be right on the efficient frontier (remember, not too much, not too little, just right). Keep in mind, as you get to your retirement goals, you’ll want to dial back the risk. This also means you’ll give up a little bit of performance, but it’s okay as long as you’re still able to meet your goals.

Using available research and tools out there, you can create your own portfolio. However, you really need to understand everything going into the mechanics of how your money leaves your wallet and returns to you.

Final Thoughts

Overall, you don’t have to own every stock or bond on earth to be diversified. However, you do need to be intentional and have a solid plan. Having a thoughtfully constructed portfolio will help you achieve your goals and sleep better moving forward.

If all this seems too much to deal with when you’re trying to enjoy retirement, we get it. You can hire a professional to manage all these nitty gritty details for you. At the end of the day, don’t just assume you’re diversified – you need to know for sure.