What’s a Health Reimbursement Arrangement (HRA)?

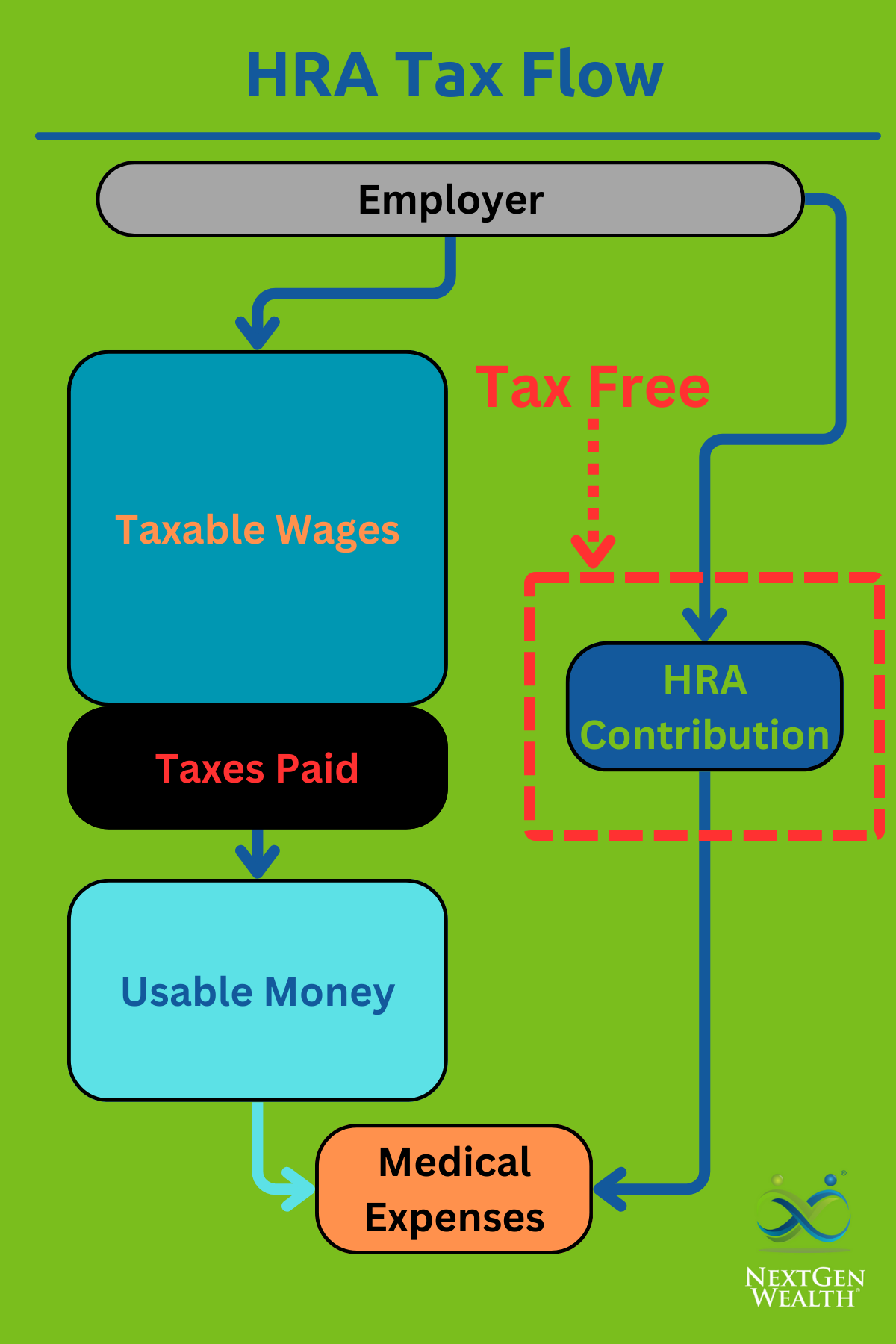

Health Reimbursement Arrangements (HRAs) are employer-funded plans that allow employees to pay for qualified medical expenses with tax-free money. HRAs can be used to reimburse employees for a wide range of expenses, including individual health insurance premiums, deductibles, copayments, and coinsurance.

If your employer offers an HRA, you should certainly check it out. It’s a great benefit to help reduce your overall healthcare costs! There are several types of HRAs, so be sure to check your plan documents carefully.

Purpose and Objectives of HRAs

HRAs are designed to help employers provide their employees with affordable health insurance and to help employees save money on their medical expenses. HRAs can also be used to attract and retain employees. In a nutshell, an HRA is an account your employer funds for you to use for healthcare costs.

This can be particularly useful if you’re in a high-deductible health plan. Instead of paying the higher deductible out of pocket, you can use the funds in your HRA. This can be a helpful benefit if you have other out-of-pocket medical expenses, such as copays for prescription medications.

HRAs can also be used to offer additional flexibility for employees. Instead of trying to manage a one-size-fits-all group healthcare plan, an employer might use an HRA instead.

Evolution and Regulatory Landscape of HRAs

While the history of HRAs isn’t particularly important, it’s good to know they’re not a new thing. HRAs were first introduced in the 1980s. Since then, the rules governing HRAs have changed several times.

The most recent changes were made in 2019. In 2019, new types of HRAs were added and there were several clarifications to the rules. This significantly increased the flexibility and potential benefits of employers offering an HRA.

Types of Health Reimbursement Arrangement (HRAs)

There are generally four different types of HRAs you may hear about. These are the regular HRA (sometimes called the “standard” HRA), Individual Coverage HRA (ICHRA), Excepted Benefits HRA (EBHRA), and the Qualified Small Employer HRA (QSEHRA). Not exactly the easiest acronyms to remember or pronounce.

Regardless, if you’re not self-employed, the main three you’ll encounter would be the “standard” HRA, Individual Coverage HRA, and Excepted Benefits HRA. You’ll need to check with your employer to see what type(s) of HRA(s) they offer.

Standard Health Reimbursement Arrangement (HRA)

A standard HRA can reimburse you for any number of out-of-pocket healthcare expenses but not health insurance premiums (see ICHRAs below). However, you are limited to qualifying medical expenses as defined by the IRS, which your employer allows. The employer owns the account, so they can make rules on what expenses they will cover.

There’s no limit to how much your employer can contribute. Your employer may also allow you to roll these funds over year to year. Remember, your employer gets to decide what healthcare expenses they are willing to cover, as well as the rollover rules.

HRAs are not portable. Once you leave your employer, that’s the end of the road for your HRA. However, some employers allow you to keep your HRA if you retire.

Individual Coverage HRA (ICHRA)

This type of HRA can be offered instead of individual health insurance coverage. ICHRAs are designed to help employees afford individual health insurance premiums. The employer funds these and can be used for paying your regular health insurance premiums which you purchase on your own.

Employers decide whether they pay for group insurance for you or provide you with an ICHRA instead. They’re not allowed to give you a choice between group coverage or the HRA. However, they may allow different benefits to separate “classes” of employees.

These HRAs are allowed to roll any unused balances over to the next year. One limitation is you can’t use an individual coverage HRA for vision, dental, or other “excepted” benefits. However, you might be able to use an Excepted Benefits HRA for those.

Excepted Benefits HRA (EBHRA)

An excepted benefits HRA can be used for healthcare costs outside your normal health insurance coverage. You cannot use this type of HRA to pay for insurance premiums. You can use this to pay for copays, vision, and dental coverage.

There is an annual limit to how much an employer can contribute ($2,100 for 2024). The annual limit is adjusted every year for inflation and rounded down to the nearest $50.

Qualified Small Employer HRA (QSEHRA)

A Qualified Small Employer Health Reimbursement Arrangement (QSEHRA) is designed for small businesses with fewer than 50 full-time employees. QSEHRAs are subject to annual contribution limits. The limit for 2024 is $6,150 for an individual or $12,450 for family coverage.

These plans cannot be offered in addition to group health insurance. This is a replacement for group coverage.

Significance in Retirement Planning

Not all employers allow you to keep your HRA after you stop working there. However, some employers continue to fund an HRA as part of your pension benefits or have a retiree-only HRA as an option. This is a really sweet deal for you.

Not only does an HRA reduce your health care costs, but it won’t raise your income level. This means you can maintain a higher standard of living without needing to pull extra funds from your retirement account. This might also allow you to take advantage of tax-saving strategies such as Roth conversions.

Linking HRAs to Retirement Health Expenses

HRAs can be used to help pay for retirement health expenses, such as Medicare premiums, deductibles, and copays. As we age, our healthcare costs will continue to rise over time. As a matter of fact, healthcare costs are possibly the largest expense you'll have in retirement.

Role in Comprehensive Retirement Financial Planning

You need to look at your HRA as a part of your comprehensive financial plan in retirement. HRAs can be used to coordinate with other retirement accounts, such as 401(k)s and IRAs. The biggest advantage of an HRA is its exclusion from your taxable income.

The tax-free HRA funds can help keep your overall adjusted gross income (AGI) lower – a major benefit. A lower AGI can keep you in lower tax brackets for regular income, capital gains, and Medicare premiums. The biggest tax advantage of HRAs is your tax-free withdrawals for qualified medical expenses.

Navigating Health Reimbursement Arrangements (HRAs) for Retirement

Let’s assume your employer has extended coverage to employees as part of your pension package. If so, this is a major benefit. Now how do you integrate this into your overall financial plan?

Retirement HRA Funding and Contributions

Just like when you were working, employers can contribute to HRAs on a retiree's behalf. Employer contributions are tax-deductible and tax-free to retirees.

Retirees cannot make contributions to HRAs. This is different from a Health Savings Account (HSA). Health reimbursement arrangement (HRA) contributions come from the employer only.

Utilizing HRAs for Retirement Health Expenses

The biggest question might be how you’ll actually use the HRA. In many cases, you’ll be given a debit card linked to your HRA to pay for expenses. The expenses you can use the HRA for will vary.

Approved Expenses Covered by HRAs

HRAs can be used to reimburse employees for a wide range of qualified medical expenses. The expense must be an approved medical expense as defined by the IRS and be an approved expense by your employer or plan sponsor.

Once again, check with your plan documents to be sure.

Strategic Planning for Long-Term Health Needs

You should plan strategically for your long-term health needs when using HRAs. Since the HRA may have the ability to roll over from year to year, this could be a great way to save tax-free funds for higher healthcare costs as you age.

Another thing to consider is reducing your taxable income when you have to start taking required minimum distributions (RMDs). If you pay for medical expenses out of pocket in the beginning years of retirement, you can use the tax-free HRA benefits later on.

There’s a risk involved in waiting to use your HRA money. If you pass away suddenly, you may not see the benefits of the HRA. However, if you’re married, your spouse or qualified dependents may be able to “spend down” your HRA.

Can you ace this basic tax literacy quiz? See what you know & don't know (& why it matters).

Maximizing the Benefits of Health Reimbursement Arrangements (HRAs) in Retirement

You’ll have to consider your HRA benefits very carefully. Just because laws and the IRS allow features and deductions in your HRA, doesn’t mean your plan offers them. Ultimately, the employer funds and owns the HRA.

It’s a great idea to get all the plan documentation early and have a financial planner and/or tax professional take a look at it for you. You’ll need to put together a spending plan and tax strategy to maximize all your benefits – including your HRA.

Getting Expert Advice

You’ll need to get as much information from your human resources (HR) department or the plan administrator. They should also be able to answer any plan-specific questions. However, they won’t know all the details of your financial life and future goals.

At NextGen Wealth, we walk clients through our COLLAB Financial Planning Process™ to go over all your financial needs. Your HRA is one tool among many. How it fits within your broader financial picture takes additional consideration and planning.