Avoid Costly Tax Mistakes by Collaborating with Your Accountant

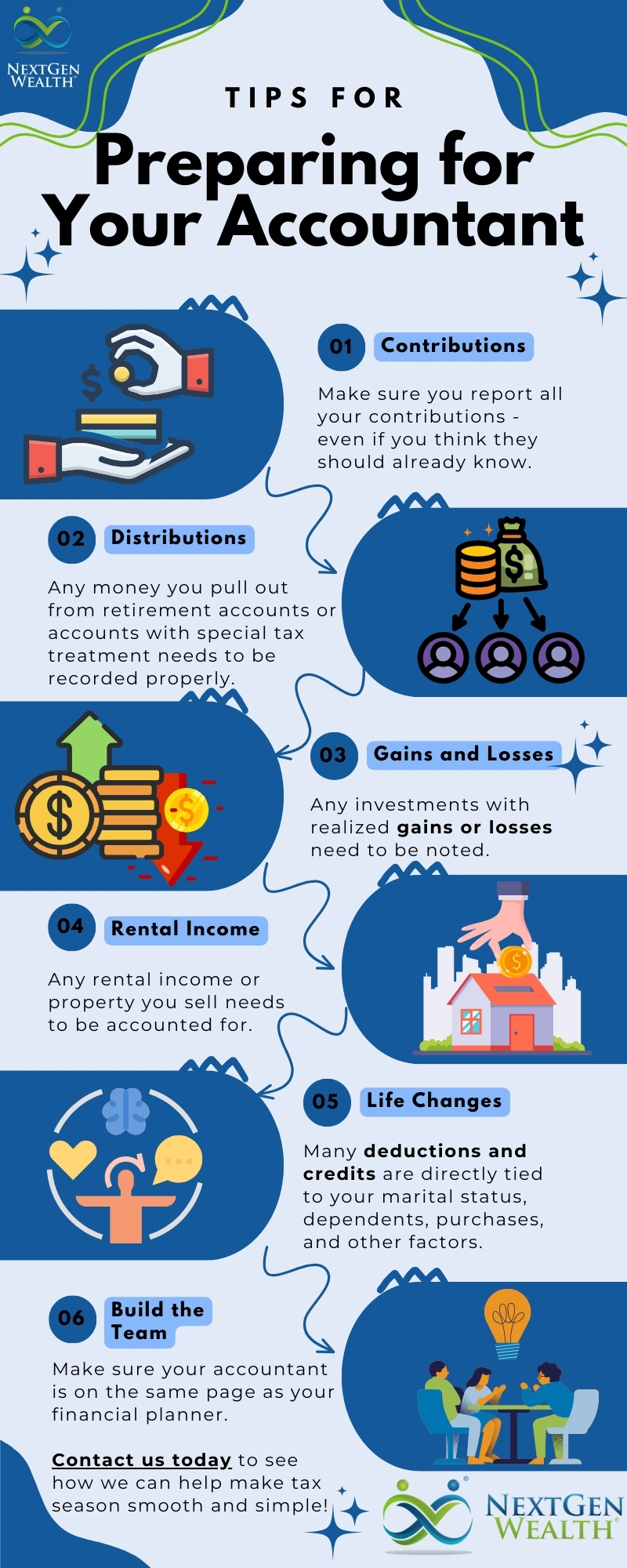

Getting accurate and timely information is critical to your success every tax season. Unfortunately, not all of the details about your financial life show up in your tax documents. Your accountant will need your input to understand the context of your tax documents.

You don't want to miss out on any potential tax savings or make a mistake on your taxes. This is why communicating and collaborating with your financial planner and accountant is so important. Timely and accurate information can prevent problems and possibly keep more money in your pocket.

Table of Contents

Properly Accounting for Contributions

In many cases, only you will know you made certain contributions. Your accountant needs to know about all these. They’ll have a questionnaire for you to fill out, but it may not always capture the specifics of your situation, or you might forget about something.

Bottom line, don’t forget to tell your accountant about contributions made to retirement accounts, such as IRAs or 401(k) plans, HSAs, 529s, or other tax-advantaged accounts. These could impact your taxable income and tax savings.

Retirement Account Contributions

You’ll need to report retirement account contributions. Luckily, your retirement account provider should issue statements showing your contributions. This makes it pretty easy.

This is important because you might receive deductions and credits for contributions. You also want to include any contributions to other retirement accounts, such as a traditional or Roth IRA. This can also be important if you accidentally overcontributed or contributed to a Roth IRA when you’re no longer eligible.

Health Saving Account Contributions

A Health Savings Account (HSA) is a great benefit if you have a high-deductible health plan. The reporting for these contributions can be confusing sometimes. Your employer should report any employer contributions on your W-2.

However, the reporting of employer-sponsored HSA contributions is an optional reporting requirement. The actual form used to calculate and report deductible HSA contributions is IRS Form 8889. You’ll need to ensure your accountant knows any contributions and distributions from your HSA, particularly if you’re making contributions to an HSA outside your employer.

529 Accounts for College Savings

You’ll also need to inform your accountant about any contributions to 529 college savings accounts. Many states, including Missouri and Kansas offer tax deductions for contributions. There are no tax deductions at the federal level, though. Again, like an HSA, if you don’t let your accountant know about these contributions, they won’t know that you’ve made them.

You can learn more about 529 accounts in our article on expert strategies to pay for your grandchild's college.

Charitable Contributions

Charitable contributions are really easy to overlook. If you’re like us, your concern is the giving, not getting a tax deduction. However, we definitely encourage you to get the proper deductions you’re allowed.

It’s easy to overlook providing documentation or information regarding charitable donations made throughout the year. Remember, donations to organizations like your church could still be deductible. If you’re in the habit of tithing, this can add up over time.

It’s also important to note the limitations on how much you can deduct for tax purposes. Regardless, we don’t want you to miss deductions for charitable contributions. You have to keep track of these and report them to your accountant. Otherwise, they will not know.

Properly Identifying Which Withdrawal is What

On the other side of things, properly identifying and reporting your withdrawals from an IRA is equally important – if not more important. You could be subject to penalties if you get your withdrawals mixed up.

Required Minimum Distributions (RMDs)

Understanding the rules and timing for taking RMDs from your retirement accounts is very important. You need to know the rules so you can avoid penalties and minimize tax implications. You can read more on RMDs in our article on whether RMDs will affect your retirement.

Qualified Charitable Contributions (QCDs)

Qualified charitable contributions (QCDs) allow you to make charitable contributions directly from your retirement accounts. This can be very beneficial at tax time. However, QCDs aren’t specifically noted in the 1099s you’ll get, so you have to tell your accountant which distributions were QCDs.

There are very specific rules to QCDs, so it’s critical you “dot your i’s and cross your t’s.” For instance, QCDs must be completed first before other RMDs. To learn more, you can check out our article about using a QCD as an RMD (sorry for the acronym overload!).

Roth IRA Conversions

We check for opportunities to complete Roth conversions every year for our clients. Roth conversions might not make sense for everyone, but if you have a large traditional 401k or IRA, Roth conversions might be right for you. Regardless, if your financial planner hasn’t looked into this for you, please give us a call.

You should also discuss Roth IRA conversions with your accountant. In a perfect world, your financial planner and accountant will be on the same page about reducing your tax burden over your lifetime. Regardless, they need to know if you completed a Roth conversion to make sure it’s properly documented for tax purposes.

Investment Gains and Losses

It can be really easy to forget about certain gains or losses you have throughout the year. In particular, we tend to forget about capturing our losses. To be fair, most of us don’t want to remember the losses as much as the gains.

However, it’s in your best interest (pun intended) to report all investment transactions, including the sale of stocks, bonds, or other securities like crypto or other investment property. These are usually subject to capital gains taxes and require accurate reporting for tax purposes. You’ll also want to review investment transactions throughout the year to plan around capital gains and losses.

Tax-Loss Harvesting

It’s possible to offset some of your capital gains by selling investments at a loss, potentially reducing your overall tax liability. This is called tax-loss harvesting, which becomes even more important if you have a large taxable brokerage balance.

Qualified Dividends and Interest Income

Don’t just assume all income from your investments is equal. Your accountant can help you understand the tax treatment of dividends and interest income. From a financial planning perspective, we want to optimize your investment portfolio to include proper asset diversification and asset location.

Rental Income and Other Real Estate Information

Rental income can be tricky. This gets even more confusing with the rise of short-term rentals and the potential for what’s called “mixed-use” property. Expenses and cash flow are important to Properly track if and when you stay at the property (if any).

Tracking Expenses

You want to make sure you’re capturing all of your expenses for rental properties. This can feel tedious, but little things can really add up over time.

Depreciation

Depreciation schedules are very important to track meticulously. Your accountant can help you with the different depreciation schedules and how to track this. Tracking depreciation works hand-in-hand with tracking your expenses and any improvements to the property.

Depreciation becomes even more important when you sell a property. If you’re not careful, you can end up with a bit of a tax headache.

Sale, Purchase, or Change in Status of Real Estate

Any time you’re thinking about buying, selling, or converting property into a way to make money, you need to engage your accountant. There are specific rules about how the income from rent payments or a property sale is handled.

This can be especially important if the sale of the property results in a large gain.

Deductions and Credits

Everything we’ve talked about so far feeds into what deductions and credits you’re eligible for. We don’t want the possibility of a deduction or credit to dictate how we live our lives. However, you want to get credit when you’re eligible.

Depending on your personal circumstances, there are all kinds of credits and deductions you may qualify for. In short, a deduction reduces the amount of your income subject to tax. A credit is a dollar-for-dollar reduction in your final tax bill.

Itemized Deductions vs. Standard Deduction

You’ll need to decide whether to take the standard deduction or claim itemized deductions. This really just depends on which would be more advantageous for your tax situation. There are some deductions you can get even if you don’t itemize.

To maximize your tax savings, you’ll want to discuss potential deductions such as mortgage interest, property taxes, medical expenses, and charitable contributions.

Tax Credits

There are many different tax credits such as the Child Tax Credit, Clean Vehicle Credit, Earned Income Tax Credit, Education Credits, and Home Energy Credits to lower your tax bill. Each one has its own rules. Some of these credits are what we call “refundable” credits, which can get your tax bill to zero.

Additional Income and Life Changes

At the end of the day, your lifestyle and specific financial life drive the tax conversation. We don’t’ want it the other way around. We plan out the life you want to live and then maximize tax savings around your life.

Many of these have significant impacts on your tax situation. Make sure you keep your accountant and financial planner informed of any changes.

Additional Income Sources

Make sure to inform your accountant about any additional sources of income. They need to know if you took on a part-time job, received rental income, completed freelance work, or have investment income. In some cases, even a hobby could have income, which needs to be reported.

Life Changes

It’s important to discuss changes in your life. Significant life changes such as marriage, divorce, birth of a child, or a change in dependents will impact your tax filing status and eligibility for certain tax credits or deductions. In many cases, there are specific deadlines to receive these credits and deductions, so don’t wait until you’re filing your taxes to bring these things up.

Can you ace this basic tax literacy quiz? See what you know & don't know (& why it matters).

Get the Whole Retirement Team Together

Sometimes, it’s difficult to translate your life into “tax speak” or “planner speak” for your accountant or financial planner. It’s possible for your financial professionals to talk directly and consult you to approve the final plan. You can just tell everyone what you want without trying to explain everything your financial planner or CPA is doing for you.

There are documents you’ll need to sign to allow these professionals to collaborate on your behalf, but this can save you a lot of time and frustration. The bottom line is that we want to ensure all the financial planning work gets reported to the IRS properly. The IRS needs accurate data to ensure you get the proper deductions and credits to avoid penalties.

How NextGen Wealth Can Help

At NextGen Wealth, we take tax planning very seriously. We prepare a tax letter each year for our clients to ensure you’ve got all the proper documentation for your accountant. Then, we get tax returns from our clients to make sure nothing was missing and complete an in-depth tax planning analysis.

Your accountant and other professionals can only do great work if they have great data. We do everything we can to ensure things are done right the first time. Contact us today to see how we can help guide you on your own retirement journey.