What Smart Evergy Employees Know About Retirement

Supplying the greater Kansas City area with the city’s energy needs is no easy feat. However, Evergy employees must take time off their demanding jobs and invest in their retirement planning.

Smart Evergy employees know how to maximize their benefits to make the most of their working years while building the retirement lifestyle of their dreams. Let's see how to make your retirement dreams a reality.

Table of Contents

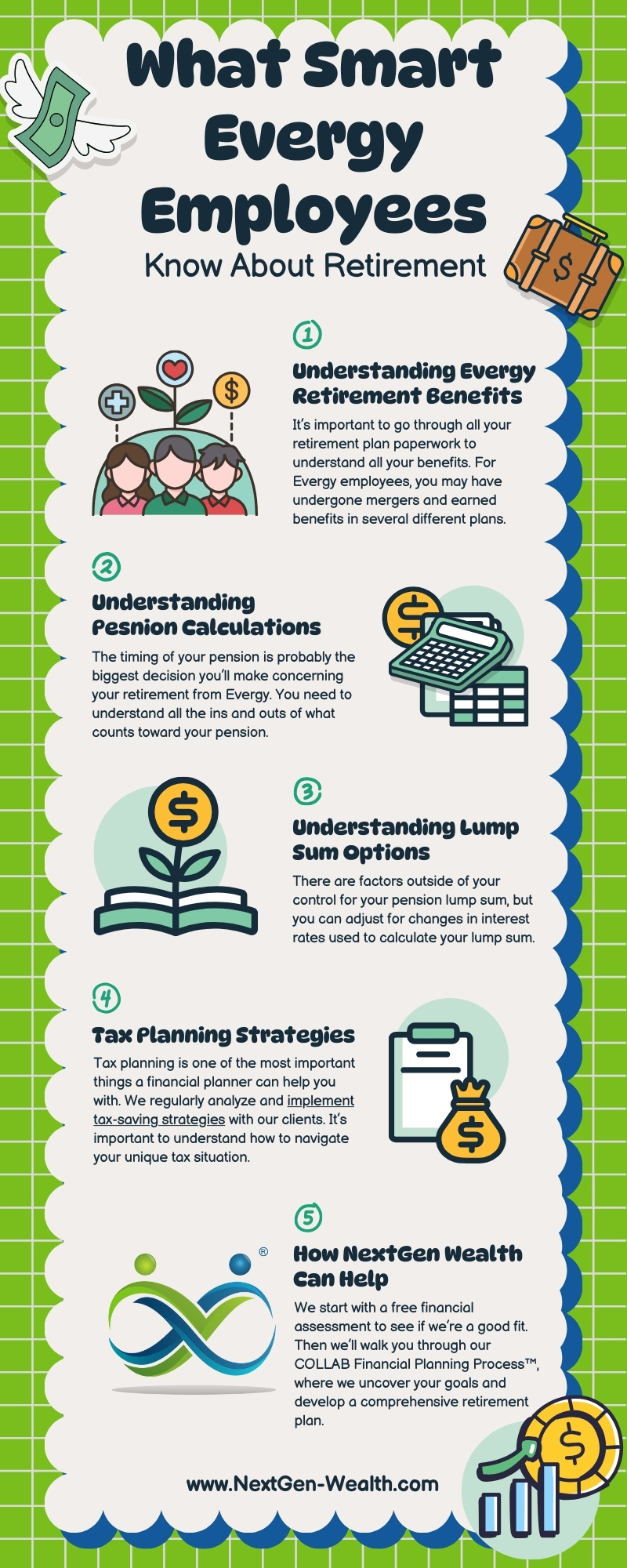

Understanding Evergy Retirement Benefits

Evergy has a very robust benefits package. It’s essential to go through all your retirement plan paperwork to understand all your benefits. For Evergy employees, this is even more complicated because you may have undergone one or many mergers and earned benefits in several different plans (KC P&L, Westar, Aprila, Wolf Creek, Metro, etc.).

Make sure to keep any documentation you have and ensure your dates of employment are correct, too.

Overview of the Retirement Plan Options

With Evergy offering a pension plan (defined benefits package), it’s one of only about 15% of employers in the U.S. offering a pension plan. Unfortunately, long-term employees may have difficulty understanding their benefits due to several mergers and acquisitions.

For most newer employees, the only pension plan offered is a cash balance pension plan. Fortunately, cash balance plans are some of the most straightforward pension plans to understand.

For more tenured employees, you may accrue benefits in several different former pension plans. We discuss this more in our Evergy Retirement Guide, available here.

Health and Insurance Benefits for Retirees

Evergy offers some health care benefits to retirees, which is fairly rare in the private sector. They provide a retiree-only health reimbursement arrangement (HRA), not to be confused with a Health Savings Account (HSA) or flexible savings account (FSA). An HRA is money from the employer, Evergy, which the retiree can use to pay for health care premiums and other medical coverage.

Life Insurance Coverage

Evergy offers life insurance benefits, but they vary. Life insurance benefits can range from $5,000 to $20,000 of coverage or more. You’ll need to check to see what coverage you have.

This is important because you need to cover any life insurance needs you may have. Depending on your situation, you may need additional coverage.

Key Financial Decisions for Evergy Employees Nearing Retirement

There are many different decisions you’ll need to make for your retirement. Some factors are out of your control, but you have some options to choose from.

When to Take Your Pension

The timing of your pension is probably the most significant decision you’ll make concerning your retirement from Evergy. You need to understand all the ins and outs of what counts toward your pension. Your final average earnings (FAE) calculation has several factors and definitions you need to know.

Your total creditable years matter, but we don’t recommend “grinding it out” just for the extra bump in your pension. Once we run the numbers, you might be surprised at what you can do with a slightly smaller pension. You may be able to retire earlier than you think if you’re deliberate about your 401(k) contributions, Social Security strategy, and other benefit decisions.

Maximizing Your 401(k) Contributions

Although spending more money might be more fun, stressing about running out of money in retirement isn’t. You’ll want to make sure you’re contributing enough to get the full benefit of your 401(k). If you’re over 50, you may be able to use catch-up contributions to do a final “topping off” of your retirement savings.

Social Security Timing

Social Security is one of the most significant decisions retirees in America make. Your Social Security strategy is critical. There’s no going back and changing your mind later.

Lump Sum or Annuity Payout

Receiving your pension all at once is a major decision. More importantly, you need a solid plan for managing your money. You’ll want a diversified portfolio to give you adequate returns to fund your retirement without taking unnecessary risks.

There are factors outside your control for your pension lump sum, but you can adjust to account for changes in interest rates used to calculate your lump sum.

Unique Challenges and Opportunities for Evergy Employees

You’ll face numerous challenges in retirement but don’t have to go alone. As you move into the transition phase of retirement, you’ll have many different opportunities to maximize your future.

Managing Longevity Risk

One thing to consider is managing your risk of running out of money, often called longevity risk. Evergy offers a pension, so there are some unique planning opportunities for you to limit your longevity risk. A pension works similarly to an annuity by protecting you against outliving your money.

You’ll need to make critical decisions like picking a pension payout option or deciding whether you want to take a lump sum. Many Evergy employees are in a cash balance pension plan, which is relatively straightforward to understand. You can check the Mercer benefits portal to see your estimated payout.

Tax Planning Strategies

Tax planning is one of the most important things a financial planner can help you with. We regularly analyze and implement tax-saving strategies with our clients. Once we zoom out and look at your whole retirement, we can pinpoint at least a few areas where you can save on taxes.

There are also different state tax rules depending on which side of the state line you’re on. It’s essential to understand how to navigate your unique tax situation.

Preparing for Healthcare Costs

We usually work with clients to ensure they can afford quality care, walk through options, and strategize on how to keep Medicare costs down. For Evergy employees, you need to understand the relationship between your current healthcare, retiree medical benefit options, and Medicare.

Your health is the most important thing. We want to ensure you have all the tools you need to live as many healthy and happy days as possible.

How a Financial Advisor Can Help

The biggest benefit of working with a financial planner is a better quality of life. People who work with a financial planner report living better lives than those who don’t. Quality advice is a huge help in navigating the complex and uncertain challenges ahead.

Investment Management

Personalized financial planning is more than just investments. We’d argue money is less important than most people think. However, your investment portfolio still matters.

Ensuring your money is invested to get the necessary returns without taking unnecessary risks is still vital. Knowing your money is managed correctly will help you sleep better at night.

Tax and Estate Planning

We already talked about tax planning, but it’s closely tied to estate planning. The efficient transfer of your estate has significant consequences for the loved ones you leave behind. Avoiding the widow’s penalty and probate are major benefits of proper estate planning.

You don’t want to leave a tax problem behind.

Navigating Complex Decisions

Lastly, a financial planner can help you run the numbers on life problems you’re trying to solve. You might even be surprised at what the math reveals. Most problems people face can become minor inconveniences with a bit of planning.

Unfortunately, we don’t know exactly what the future holds. However, making the best decisions requires thoughtful analysis, careful planning, and timely implementation. A good financial planner can help with all those.

How NextGen Wealth Works with Evergy Employees and Retirees

At NextGen Wealth, we start with a financial assessment to see if we’re a good fit. Then we’ll walk you through our COLLAB Financial Planning Process™, where we uncover your goals and develop a comprehensive retirement plan. We’ve even put together a comprehensive Evergy Retirement Guide to help get you started on the right foot – even if we don’t end up working together.

We’re constantly working to optimize our clients’ financial lives for what matters, living a stress-free and fulfilling retirement. Contact us today to see if we’re a good fit and get your financial assessment.