Will My Pension Reduce My Social Security Benefits?

Your Social Security benefits could be reduced if you also have a pension. Don’t be caught off guard by all the unique rules surrounding pensions and Social Security. Knowing the facts about Social Security taxation, the Windfall Elimination Provision, and the Government Pension Offset is essential.

Armed with the correct information and guidance, you can avoid surprises and cover your bases. A common concern for retirees with a pension is how this will affect their Social Security benefits. Let’s take some time to understand which rules apply to your situation so you can plan accordingly.

Understanding Pensions and Social Security

While a defined benefit pension plan, or simply a pension, is a great benefit, it's important to be aware of the potential downsides and risks. Understanding how your pension income can affect other benefits like Social Security and Medicare is crucial for effective retirement planning.

If you do have a pension, then you’ll have taxable income coming to you regularly. Depending on the pension and whether or not you chose a survivorship option, your surviving spouse may continue receiving a portion of your pension. This can create some additional issues for widows and widowers.

Calculation of Social Security Benefits

Social Security benefits are calculated using a formula based on your average earnings during the highest 35 “covered” years of work. However, this is only up to a certain limit. There are also certain “bend points” where your credited earnings count as less and less income for your benefit amount.

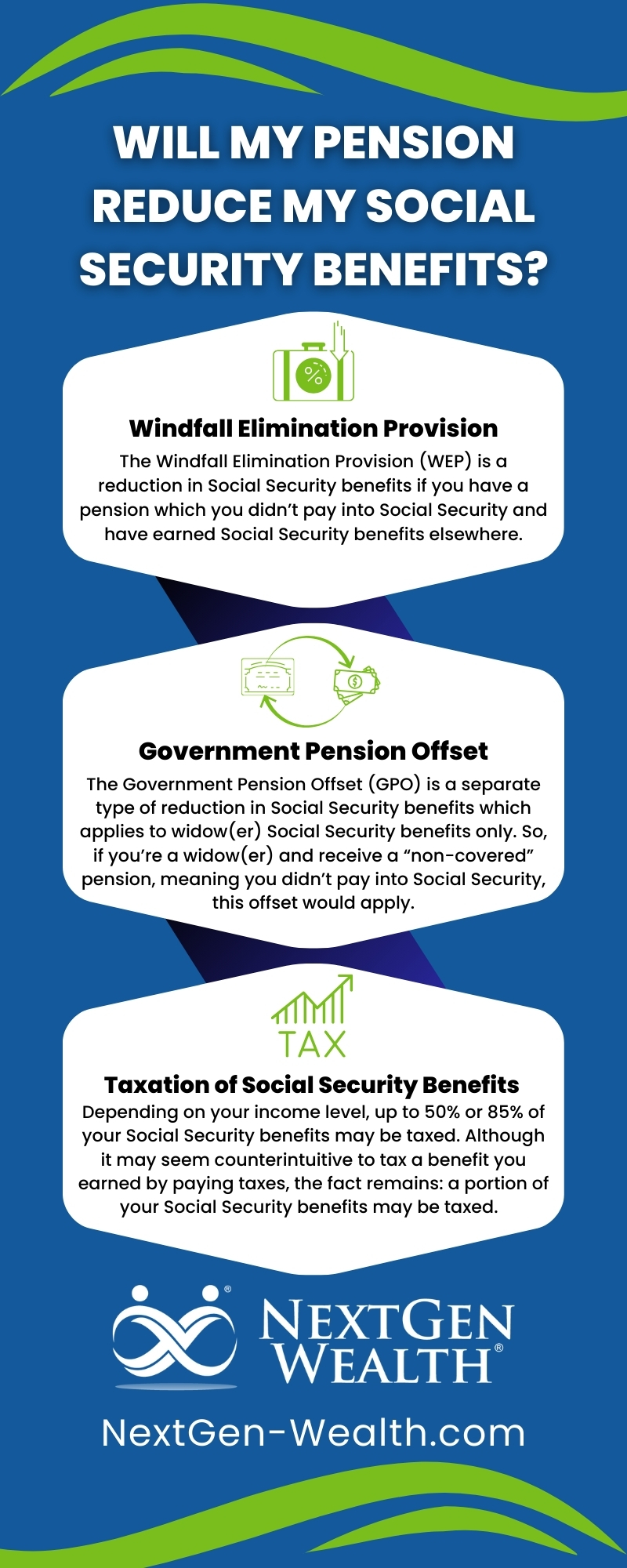

To further complicate things, your pension income may cause certain offsets and adjustments to your Social Security benefits. Depending on the type of pension and whether or not you paid into Social Security, your Social Security benefits may be subject to the Windfall Elimination Provision (WEP) or the Government Pension Offset (GPO).

Taxation of Social Security Benefits

Another issue is that your pension income may cause your Social Security benefits to be taxed. We’ll touch on this later, but this can significantly impact your usable Social Security benefits. It’s crucial to understand the relationship between these income sources for financial planning in retirement.

The Windfall Elimination Provision

The Windfall Elimination Provision (WEP) is a reduction in Social Security benefits if you have a pension for which you didn’t pay into Social Security and have earned Social Security benefits elsewhere. In other words, if you earned a pension from a job that didn’t withhold for Social Security and worked another job where you did pay into Social Security, you may be eligible for both a pension and Social Security.

However, suppose your pension income comes from a job where you didn’t pay into Social Security (some state and local government jobs, for instance). In that case, your Social Security benefits will be reduced. This may not affect you very much, or it could make a significant difference. It may even be a factor to consider when applying for Social Security benefits.

There are some exceptions to the WEP, such as for certain federal employees, if your only pension is from the railroad or if you have at least 30 years of work (substantial earnings) at a job where you paid into Social Security. The WEP doesn’t apply to surviving spouses, but their surviving pension benefits may affect Social Security payments through a different law – the Government Pension Offset.

The Government Pension Offset

The Government Pension Offset (GPO) is a separate reduction in Social Security benefits, which only applies to widow(er) Social Security benefits. So, this offset would apply if you’re a widow(er) and receive a “non-covered” pension, meaning you didn’t pay into Social Security. The GPO only applies to any Social Security benefits you receive based on your deceased spouse, not your earned Social Security benefits.

For example, if you were a federal, state, or local government employee and didn’t pay into Social Security, your widow(er)’s Social Security benefits would be reduced. However, this is calculated differently than the WEP.

How the GPO is Calculated

The GPO is calculated by reducing your Social Security benefits by two-thirds (2/3) of your pension amount. So, if you get $3,600 from your pension each month, your widow(er) Social Security benefit would be reduced by $2,400.

Exceptions to the GPO

There are some exceptions for the Government Pension Offset. Most notably, there are several exceptions for federal employees. These exceptions vary based on whether you were in the Civil Service Retirement System (CSRS) and switched to the Federal Employees Retirement System (FERS), if you paid into Social Security for specific time periods, and when you were entitled to widow(er) benefits.

This offset does not apply to any Social Security benefits you earned from your own “covered” work. The Windfall Elimination Provision applies to your earned benefits, and the Government Pension Offset applies to your surviving spouse's benefits.

Military Pensions

In general, neither the WEP nor the GPO applies to military pensions today. Military members pay Social Security taxes (at least since 1957), so their wages are considered covered employment. However, there are many other nuances with military retired pay, which may also vary depending on the state.

Taxation of Social Security Benefits

Depending on your income level, up to 50% or 85% of your Social Security benefits may also be taxed. Although it may seem counterintuitive to tax a benefit you earned by paying taxes, here is a history covering the taxation of Social Security benefits if you’re interested. However, the fact remains: a portion of your Social Security benefits may be taxed.

Most defined benefit pensions are included in taxable income, so your pension will likely increase your taxable income. This is important to know heading into retirement. Your decisions on when to draw Social Security and employ other tax-saving strategies may change depending on your pension payout.

Social Security Income Limits and Thresholds

You need to be aware of two basic thresholds: the 50% threshold and the 85% threshold. When your income exceeds $25,000 (single) or $32,000 (filing jointly), up to 50% of your Social Security benefits would be taxed. Once your income rises above $34,000 (single) or $44,000 (filing jointly), up to 85% of your Social Security would be taxed as income.

These have not been adjusted for inflation, so the thresholds are comparatively low. For many retirees with a pension, your pension check will be enough to push you over these thresholds. This isn’t a direct reduction in benefits; it just makes your benefits taxable.

Lowering Your Taxes

There may be several strategies you can employ early in retirement, like Roth conversions, which could help reduce some of your taxes. It just really depends on your personal situation. It’s a “good problem to have,” as they say, but getting hit with more taxes never feels good.

You’ll need to look at all income sources in aggregate to help devise a plan to lower your tax burden. This could make a significant difference in the timing of benefits, whether or not to take a pension lump sum, or other significant decisions you need to make.

Potential Changes in the Future

Your amount of taxable Social Security income may change. There are several proposals to modify the taxation of Social Security. These are just proposals, but many of them could be helpful to retirees.

This also highlights the need to plan early and revisit the plan often. As tax laws and your personal situation change over time, you'll have to make changes. Regardless, having a solid financial plan is a necessity.

How NextGen Wealth Helps

At NextGen Wealth, we comprehensively examine all your income sources. We pride ourselves on our COLLAB Financial Planning Process™, which goes way beyond investment management. Through careful consideration of your goals, years of experience, and advanced software, we uncover the best strategies for your retirement journey.

No matter what phase of retirement you’re in, we can help. However, we specialize in helping you transition into retirement so you’re starting off on the right foot. Contact us today to see if we’re a good fit and schedule your financial assessment.