How The One Big Beautiful Bill Affects Medicare

The One Big Beautiful Bill affects retirees in many ways. But how will it change Medicare? Although it’s too early to tell, there will be some immediate changes and several potential long-term impacts you need to be aware of.

We provided a broader overview in our article, "How the One Big Beautiful Bill Affects Retirees." Now we’re going to discuss how this new law impacts Medicare and what you can do to prepare.

Table of Contents

- Medicare Changes at a Glance

- Short-Term Impacts (1–5 Years)

- Long-Term Impacts (5+ Years) of the One Big Beautiful Bill

- What This Means for Pre-Retirees

- What This Means for Current Retirees

- What Can You Do to Prepare?

Medicare Changes at a Glance

The most challenging aspect of the One Big Beautiful Bill Act is its complex and indirect nature. There are some immediate effects, such as changes to eligibility and the blocking of the implementation of previous laws. However, many changes are spread over the next decade, making it difficult to understand their direct impacts.

The most significant cuts in the law are to Medicaid, not to be confused with Medicare. Medicare is a mandatory healthcare program for Americans aged 65 and older.

Short-Term Impacts (1–5 Years)

The most significant immediate changes will be to rural healthcare initiatives as well as changes to eligibility requirements. We’ll cover more of the long-term effects later in the article.

Positive Changes from the One Big Beautiful Bill

Among the most notable changes are expansions in rural funding, as well as temporary increases in Medicare payments to physicians.

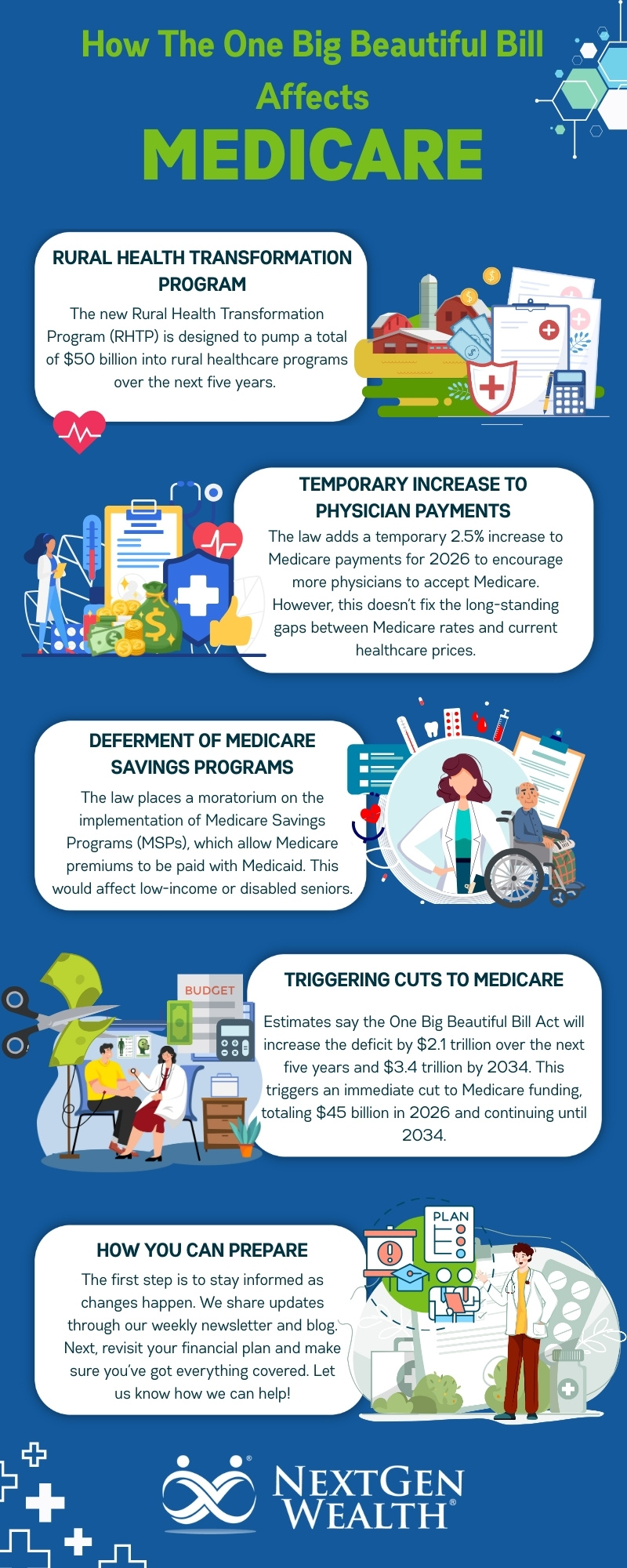

The Rural Health Transformation Program

The only increase in funding for Medicare is for the new Rural Health Transformation Program (RHTP). This program is designed to pump a total of $50 billion into rural healthcare programs over the next five years. However, this is divided into two separate funds and distributed annually.

States must complete a request form (not yet available) by December 31st to qualify. This request is for a piece of $5 billion annually, divided among 50 states. The other half is to be distributed based on metrics partially tied to the percentage of the population located in rural areas.

Missouri and Kansas fall somewhere in the middle of the most rural states. Retirees living in the area surrounding Kansas City might see some additional funding, but it’s unclear exactly how the CMS will distribute funds. For context, Medicare spending in 2024 was roughly $1.12 trillion, so $10 billion per year is about 0.9% of total expenditures.

Temporary Increase to Physician Payments

There is a temporary 2.5% increase to Medicare payments for 2026. This is designed to encourage more physicians to accept Medicare. However, this doesn’t fix the long-standing gaps between Medicare rates and current healthcare prices.

This is another complex, uncertain, and long-term issue we’ll have to monitor. The OBBBA doesn’t fix the problem; it’s only a temporary fix. Unless additional action is taken, rates will revert to the regular fee schedule and calculations in 2027.

Potential Drawbacks of the One Big Beautiful Bill

There are several drawbacks to consider for Medicare. Some provisions will target specific eligibility groups and programs, while others will be a bit broader.

Triggering Cuts to Medicare

The biggest impact is the projected triggering of the Statutory Pay‑As‑You‑Go Act of 2010 (S-PAYGO). In short, this act requires the government to reduce spending if a law would increase the national deficit over a five or ten-year period (or both).

The Congressional Budget Office and the Joint Committee on Taxation estimate that the One Big Beautiful Bill Act will increase the deficit by $2.1 trillion over the next five years and by $3.4 trillion by 2034. This means an immediate cut to Medicare funding, reaching the federal limit of 4%, totaling $45 billion in 2026. More on this later, but it means other programs will need to cut an additional $370 billion to make up the total shortfall of $415 billion.

Potentially Higher Prescription Drug Costs

Although it’s not cut and dry, the new law expands the definition of certain “orphan” drugs designed to treat rare diseases. These drugs would be exempt from Medicare price negotiations, which were set to take effect in 2026 under the Inflation Reduction Act of 2022. In the short term, this means Medicare cannot negotiate prices on a larger number of prescription medications.

The idea behind this exemption was to incentivize pharmaceutical companies to invest more research into treatments for less “popular” diseases. This would make them more expensive – at least until 2028 or later. It’s challenging to predict exactly what will happen because the government can’t fully control the actions of pharmaceutical companies.

Simply put, things are uncertain, and the effects are not yet known.

Decreased Eligibility for Legal Residents

Undocumented immigrants have never been eligible for Medicare. However, many legal residents are now ineligible for benefits despite having paid Social Security and Medicare taxes. People affected by this change will have some time to figure out additional options.

Deferment of Medicare Savings Programs

The law also places a moratorium on the implementation and enforcement of Medicare Savings Programs (MSPs). These programs allow for Medicare premiums to be paid with Medicaid. This would affect low-income or disabled seniors.

Long-Term Impacts (5+ Years) of the One Big Beautiful Bill

Most impacts from the One Big Beautiful Bill on Medicare will be delayed, yet substantial. There are no direct cuts to benefits, but the law creates a cascade of budgetary problems, triggering mandatory cuts that, if no action is taken, will slowly erode funding and the quality of care. There are few, if any, long-term benefits to Medicare.

Positive Changes

Most of the positive changes in the bill are related to expanded tax deductions for seniors. Unfortunately, the lower tax bills are a double-edged sword. Lower tax revenue means increased deficit projections, which leads to reductions across the government.

Nearly all the benefits of this new law are short-term in nature. It’s a frustrating mix of confusing budgetary acrobatics to make things look good in the short term, but the law will indirectly reduce funding and care over time. Congress may still make adjustments to address some of the issues created by the new law, but only time will tell.

Long-Term Challenges

Unfortunately, many of the negative effects of the One Big Beautiful Bill Act are delayed or spread over the next decade. This makes it significantly more challenging to fully comprehend the impact. However, we already have reports and indicators of long-term funding issues stemming from the act.

Long-term Budget Problems

As we mentioned earlier, the triggering of the S-PAYGO will lead to forced sequestration. The sequestration cuts from the early 2010s had a widespread impact. Cuts will be needed through 2034. It doesn’t take a math whiz to understand the effect of a 4% decrease on the Medicare budget for 10 years straight.

Medicare was Already on a Path to Problems

Healthcare in America is already expensive, and it’s not getting any cheaper. This was already creating problems for funding Medicare. The One Big Beautiful Bill Act accelerates this issue. We’re no longer marching toward Medicare insolvency; we’re running toward massive shortfalls and rising prices.

The Medicare Hospital Insurance (HI) trust fund was projected to be depleted by 2033. The OBBBA is estimated to accelerate depletion by one year.

More concerning is the continued projected growth of Medicare costs. When you couple higher costs with cuts to funding and income (due to reduced tax revenue), something has to give. More than likely, the availability and quality of care will suffer.

Block to Minimum Staffing Standards

Furthermore, the act delays the implementation of minimum nursing standards outlined in the Centers for Medicare & Medicaid Services (CMS) Final Rule 3442-F. This law and its implementation would have required minimum levels of nursing staff. It also required 24/7 Registered Nurse (RN) coverage for skilled nursing facilities.

In short, it was designed to ensure higher standards of care and staffing for long-term care (LTC) facilities such as nursing homes. The new law delays implementation of these higher standards of care until 2034. This has the potential to limit acceptable options for LTC for seniors even more.

Continued Uncertainty

The most significant long-term impact of these changes is the increased complexity and uncertainty surrounding the future of Medicare. When you’re transitioning into retirement, the last thing you want is uncertainty. We have no idea what additional laws or implementation rules will come. Unfortunately, it appears that this type of political tug-of-war will persist for the foreseeable future.

What This Means for Pre-Retirees

If you’re retiring soon, you really need to pay attention to changes. More importantly, if you’re planning to retire early, any changes to the Affordable Care Act may also come into play. You’ll want to carefully plan out your healthcare and Medicare enrollment options and prioritize maintaining your health.

Luckily, you still have time to adjust your financial plan to account for increases in costs and decreases in care. The biggest takeaway is this: establish a plan and reduce your reliance on the federal government for your healthcare needs.

Nobody likes uncertainty, but it’s even more problematic as you prepare for retirement.

What This Means for Current Retirees

If you’re already retired or enrolled in Medicare, you’ll need to keep an eye on services. You may see fluctuations in prescription coverage, prices, and the level of service you receive. It’s a great time to pay attention to both Medicare Advantage plans and Medicare Supplement (Medigap) plans.

Be sure to look over all your options before open enrollment season.

You can also take advantage of other tax-saving strategies using the increased standard deductions included in the new law. This could help you avoid potential Income-Related Monthly Adjustment Amounts (IRMAAs) and reduce the impact of required minimum distributions (RMDs).

What Can You Do to Prepare?

As with any law change, there are new opportunities, potential drawbacks, and added complexity. The first step is to stay informed as changes happen. We’ve found it helpful to share updates through our weekly newsletter and blog.

The next step is to revisit your financial plan and ensure you have everything covered. If you don’t have a written plan or aren’t sure how this impacts you, it’s a good idea to sit down and think through potential impacts. Now is the time to review coverage options, including Medicare Advantage and Medigap options, and seriously consider long-term care.

You can always contact us to receive a no-obligation financial assessment to help ensure you’re on track for a successful retirement. Through our COLLAB™ financial planning process, we ensure that all your bases are covered, regardless of future changes.