Does Taking a Lump Sum From My Pension Make Sense?

This post was last updated on July 30, 2022, to reflect all updated information and best serve your needs.

If you’re trying to save for retirement, it helps to have an employer-sponsored plan so that you’ll have access to funds once you stop working. Although 401(k) plans are the most common option today, some companies still offer pensions. Now you're probably wondering what the outcome of a pension vs. 401(k) is, don't worry; we cover this a bit later on.

A pension plan is ideal for retirees because it guarantees payments for the individual for life. Some plans will also continue to pay out to spouses, which means that these plans can offer financial stability for years.

While a pension can be highly beneficial, many companies that offer them are starting to entice retirees with a lump-sum payment instead of taking monthly (annuity) payments. If you’re being offered this kind of deal, it’s crucial to understand the various risks and benefits.

In this article, we’re going to discuss the basics of a lump-sum pension payment and whether it makes sense for your situation.

Pension vs. 401(K)

These days, most employers that offer a retirement package will utilize either a 401(k), 403(b), 457, or an IRA (i.e., SIMPLE or SEP). These accounts are considered “defined contribution” because there are specific rules regarding how much money can be put into them. There are limits for both employer and employee, and the employee manages the funds.

However, a pension is a “defined benefit” plan because it outlines the specific benefits that a retiree will receive. Rather than stipulating how much can be contributed, a pension defines how much a worker will be paid.

Another critical distinction between these plans is that the employer assumes the risk with a pension. Since the business and not the employee manage the money, the company has to ensure that it can cover pension payments. Over time, as more and more workers retire, these payments can become a costly line item.

Since the employer covers pensions, fewer companies are offering them as a way to limit their financial liabilities However, those who do have pension plans are starting to provide retirees with a choice: to take ongoing payments or to take a lump sum. Depending on one’s circumstances and financial health, one option might be better than another.

What To Consider When Confronted With A Lump-Sum Payment Offer

At first, seeing the amount of your pension check might seem exciting. For most retirees, the lump sum could be the most substantial windfall they’ve received in their lives.

However, once you realize that companies do this to save money in the long term, you must consider whether it’s the right move for you. Here are some critical factors to think about before making a final decision.

Spousal Support

Most pension plans will only cover the employee. However, some programs may continue monthly payments to spouses as well.

If your pension does offer spousal payments, it could be better not to take a lump-sum payment. This is because the benefits are guaranteed for life, so there will always be money as long as you or your spouse are alive.

Even if your spouse is older than you or more likely to die first, the fact that they are covered may be cause to hold off on a lump-sum payment. What you really have to consider is what will happen if you die before your spouse.

Do you have life insurance that will provide a substantial death benefit? If so, a pension lump-sum might not be necessary.

However, if a guaranteed monthly payment can make a massive difference for your spouse after you’re gone, it’s probably better to take the monthly payout instead.

Age And Health

For the rest of these factors, we’re going to consider pension plans that don’t cover spouses. One of the primary benefits of a pension is that the payments are guaranteed for life.

Since you don’t know how long you’ll live through retirement, this guarantee can be a financial safety net. No matter what else happens or what other investment accounts you have, the pension checks will keep coming.

While a pension can be highly beneficial, you do want to consider your age and health. If your life expectancy is relatively limited, a lump sum may offer more financial freedom to live your retirement on your terms. If you believe that you’ll be retired for several decades, pension annuities might be the better choice.

Other Retirement Accounts

A pension plan can be an excellent source of continuous income during retirement, but it shouldn’t be the only one. Ideally, you’ll be contributing to other accounts like IRAs to maintain multiple revenue streams.

If you have alternative resources that will pay out during retirement, consider how much your pension will affect your earnings. If these monthly payments will be the majority of your income, it doesn’t make much sense to stop them. However, if you can easily make up the money with other accounts, a lump sum might be more appealing.

Taxes

Pension payments are taxable income, so you’ll have to pay taxes on each check forever. However, when taking a lump sum, you can roll it into an IRA, which gives you more flexibility tax-wise. There are two types of IRAs, and each one offers different benefits.

Traditional IRAs allow you to claim contributions as tax deductions the year you make them. So, by taking a massive lump-sum payment and rolling it into your IRA, you won’t have to pay taxes.

IRA’s are also tax-deferred, so you don’t have to pay anything until you take the money out. The 2017 Tax Cuts and Jobs Act raised the age for required minimum distributions (RMDs) to age 72, so you can let the funds grow tax-deferred for much longer than you would with a pension plan. Since your income will likely be less during retirement, you’ll most likely still save money in the long run.

By comparison, Roth IRAs offer tax-free growth and tax-free distributions once you reach age 59 1/2. The trade-off is that you can’t claim contributions as a deduction, so you’ll have to pay income taxes upfront. If you take a lump-sum payment and move it into a Roth IRA, it could cause a significant tax issue, so you’ll want to consider that before attempting to roll your lump-sum into a Roth IRA.

One potential strategy can be to roll the funds into a Traditional IRA and then transfer money into a Roth over time. This way, you can avoid a massive tax bill up-front while getting tax-free growth. Then, once you retire, you can withdraw money from your Roth IRA without paying any taxes.

Cost Of Living Adjustments (COLA)

Some pension plans account for the rise of inflation and the cost of living. These adjustments ensure that your monthly check can still provide financial stability throughout your retirement.

If your plan does include a COLA, it might not make sense to take a lump-sum payment because this can really add up over the years. Overall, you could receive much more money from the monthly pension payout, and it will provide more peace of mind as you get older.

On the other hand, if there is no COLA, a lump sum might be a viable option. This way, you can roll the funds into an IRA that will grow over the same period, potentially netting you more over the long term.

Breaking It Down: When A Pension Lump-Sum Payment Makes Sense

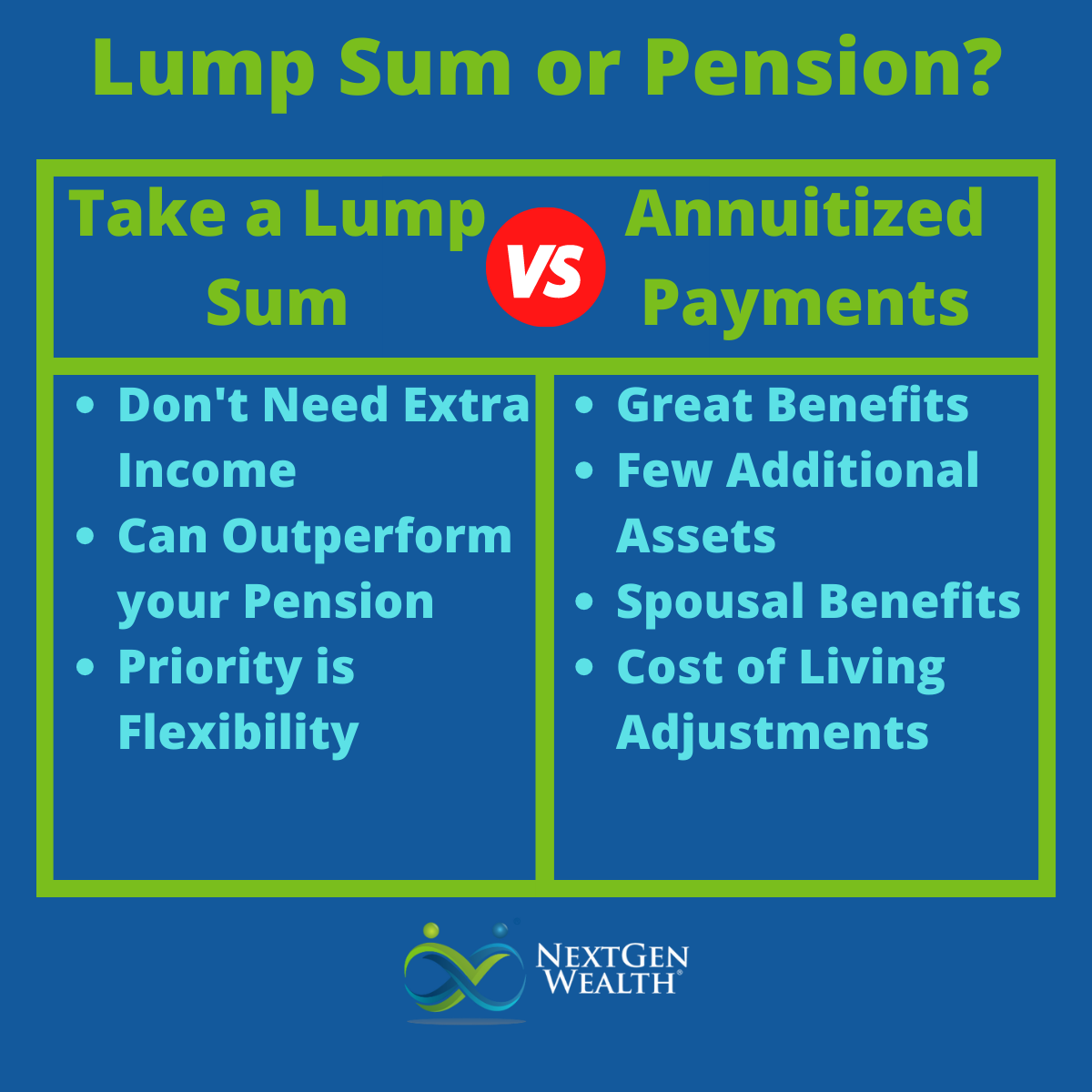

Because there are so many variables to consider, the decision can seem overwhelming. While everyone’s situation will be unique, here is a quick overview of when a lump sum might make sense and when it won’t.

When To Take A Lump-Sum Payment

If you’re not worried about making money during retirement, a monthly pension payout might not offer the best peace of mind. While you might be able to earn more overall, taking a payment upfront gives you more flexibility regarding how to invest those funds. For example, if you want to earn passive income with long-term investments (i.e., rental properties), a lump sum may allow you to do that.

Overall, if you can make the money work for you more than it would in a pension plan, a lump-sum payment will make sense for your needs. Be sure to talk to a financial planner before deciding so that you can be sure that you’ll make the right decision.

When Not To Take A Lump-Sum Payment

If you don’t have much money in other retirement accounts, a pension will likely be your primary income source. Even if you take the lump sum and invest it, the dividends and interest payments probably won’t compare.

Another reason to avoid a lump-sum payment is if your pension benefits are too good to pass up. For example, if your spouse will be covered, and there is a cost of living adjustment, you probably won’t do better if you try investing the lump-sum. Instead, it’s probably better to take the guaranteed monthly payments.

Contact NextGen Wealth Today

Weighing the pros and cons of a lump-sum payment requires planning and foresight. At NextGen Wealth, we can help you make the right decision for your needs. We can also assist with other retirement planning, such as IRAs and 401(k)s. Don’t let retirement take you by surprise; call us to get prepared today.