Why It's Important to Update Estate Planning Documents Regularly

Everyone eventually runs out of “tomorrows." Hopefully, your appointment to update your estate documents is scheduled for today. Passing away without proper estate planning and up-to-date documents can be a nightmare on top of a nightmare for your loved ones.

Don’t let a legal mess be the last thing your family remembers about you. Planning for your eventual demise is about as much fun as a root canal. However, careful planning and current documentation are a great gift when the time comes.

Table of Contents

- Understanding the Basics of Estate Planning

- Benefits of Proper Estate Planning

- Common Misconceptions

- The Importance of Regular Updates

- The Risk of “Stale” Estate Documents

- Updating Medical Power of Attorney and Advanced Directives

- Making Effective Estate Planning Updates

- Consulting with Professionals

- The NextGen Wealth Difference

Understanding the Basics of Estate Planning

When most people think about estate planning, they automatically think about updating their will but stop there. There’s so much more to think about, decide, and implement. Simple actions like updating beneficiaries or transfer on death (TOD) and Pay on Death (POD) designations have significant consequences.

Common Components in an Estate Plan

Wills, trusts, power of attorney, healthcare directives, and legacy contacts for online accounts are all common pieces of a modern estate plan. You’ll likely need professional consultations, legal documentation, and important conversations with loved ones.

Like a financial plan, your estate plan will be unique to your situation and needs. You want to make sure you’re setting things up to go smoothly when the time comes. Nobody wants to be a burden to their loved ones in life or death.

Benefits of Proper Estate Planning

Besides ensuring your wishes are carried out, proper estate planning has several other benefits. One of the most significant benefits is the gift of eliminating guesswork for your heirs. They might know what you want, but communicating this clearly through conversations and solidified with legal documentation eliminates any guesswork.

Nobody wants to leave behind confusion and worry. You want your loved ones to focus on the grieving process, not figuring out who gets what, where the passwords are, or fighting their way through the probate process. A thoughtfully planned estate is truly a gift.

Common Misconceptions

A common misconception is thinking your estate plan is a one-and-done action. Life changes, so your estate plan will need to be adjusted accordingly.

It’s also common for people to create wills or other estate documents, file them away, and forget about them. It could spell trouble if you’re the only one who knows where these are and what they say. Communicating the plan to whoever your executor is, along with your family, is really important.

The Importance of Regular Updates

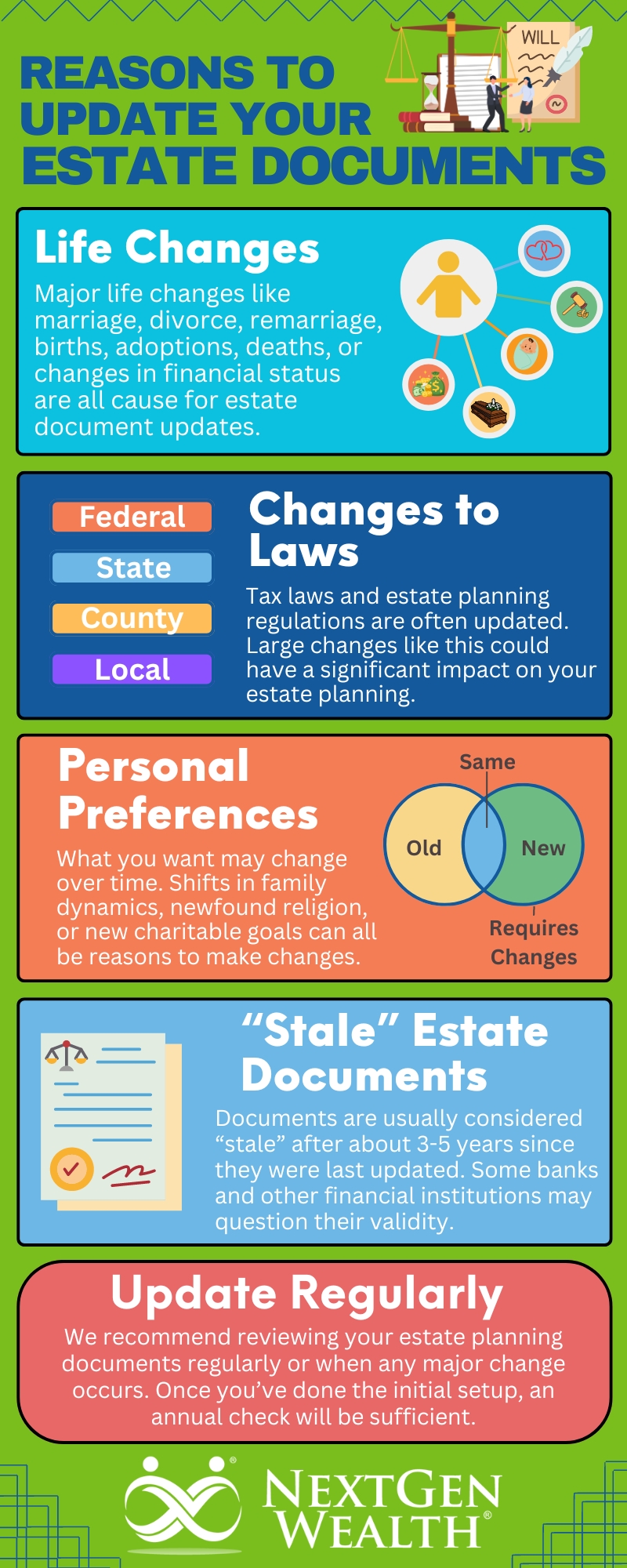

The importance of regular updates can’t be overstated. Life is a mosaic of changes throughout all stages of your retirement. Many of these changes cause your estate planning documents to be outdated or even obsolete.

Life Changes for Estate Planning

Any major life changes like marriage, divorce, remarriage, births, adoptions, deaths in the family, or significant changes in financial status are cause for updates. Depending on how large your family is, this could mean annual or semi-annual changes could be occurring. However, updating all your documents every year is probably not practical.

Creating a regular update schedule to review all your documents may be best. You may also consider how much detail you must put into the decisions after passing. For instance, if you concentrate on dividing assets among your direct heirs within one generation, you can make fewer changes as your family tree expands and grows to include 3 or more generations behind you.

Changes to Laws and Requirements

Many retirees consider moving when they transition into retirement. Maybe you’ll age in place, relocate to a different state, or simply downsize based on your needs. It’s important to remember which laws apply in different areas.

The Impact of Changing States on Your Estate Plan

Changing states can significantly impact what legal documents you need (power of attorney, advanced directives, etc.). Unfortunately, many states vary widely regarding property division, what documents they honor, estate (death) taxes, and many other issues.

You should consider these changes before you make the move, so you’re good to go. You shouldn’t make any assumptions about whether your current documentation will work for your new state of residence.

The Risk of “Stale” Estate Documents

States typically don’t stop honoring things like power of attorney or healthcare directives after a certain period of time. However, you may run into resistance from third-party (non-government) institutions. Some banks and other financial institutions may deem old documents “stale” because they haven’t been updated and question their validity.

This won’t usually happen for several years, but it depends. Documents are usually considered “stale” once they’re about 3-5 years old. You should still be able to fight with the institution to get them to honor all the documents, but it’s a much smoother process if everything is current and up to date.

In fairness, these institutions do this to protect against someone abusing a power of attorney. If you had given power of attorney to someone and you had a falling out, they could use the power of attorney to cause you financial harm. It’s also common to place an expiration date on these to eliminate confusion and abuse.

Legal and Financial Changes

Tax laws and estate planning regulations are often updated. For instance, many significant changes may occur when much of the Tax Cuts and Jobs Act expires at the end of 2025. The current estate tax and gift tax exemptions may change dramatically.

Substantial changes like this could have a significant impact on your estate planning. In the past, changes to required minimum distributions (RMDs) from inherited retirement accounts changed how we think about transferring wealth to heirs. The Setting Every Community Up for Retirement Enhancement (SECURE) Act ended the “stretch IRA” and created a 10-year window to draw down an inherited retirement account instead.

Updating Medical Power of Attorney and Advanced Directives

Your choices for medical care as you age are another critical consideration for regular updates. There may be changes in healthcare laws, how you feel about emerging technology, and new conditions you may develop. Your chosen agent or proxy may no longer be able to make decisions on your behalf as they age, too.

Another important consideration is if you spend time in multiple states. Your documents might need to comply with the rules in Missouri and Kansas. Once again, your specific circumstances will dictate this.

Personal Preferences and Circumstances

We’ve touched on this, but what you want may change. Shifts in family dynamics, newfound religious needs, or new charitable goals can all be reasons to make changes.

You always want to revisit who you’ve designated as executors, trustees, and agents on your behalf. It’s important to review all your documents and simply ask, “Is this still what I want?” You might not need any changes, but you’ll be confident in your decisions.

Making Effective Estate Planning Updates

As mentioned, you should review and assess your current plan regularly. At NextGen Wealth, we provide many services to clients at no additional cost, including basic estate planning documents such as revocable living trusts, wills, powers of attorney, and healthcare directives (prepared by an attorney). We’re happy to help manage changes and ensure everything matches your desires.

We help you control the process of creating an estate plan every step of the way. We also help in the actual implementation of an estate plan – including periodic changes.

Regularly Scheduled Reviews

We recommend reviewing your estate planning documents annually or any time there’s a change in your life. For many people, once you’ve done the initial setup, there’s not much you’ll need to change annually.

Consulting with Professionals

Many different professionals may be involved in your estate planning. These include estate planning attorneys, financial advisors, and tax professionals. We keep a list of trusted professionals to whom we can refer our clients.

We’re happy to offer our clients access to some of these services at no additional cost. Better yet, we know it’s done correctly. Being able to provide these services and help control the process every step of the way makes it much smoother than going to an outside attorney.

Implementing Changes

Attorneys don’t help with the hardest part: all the steps required after the documents are created. We help with the tedious actions that are easy to forget but vitally important, such as updating beneficiaries and adding TOD/POD designations to titles and accounts. Also, getting assets moved into the trust can be lengthy if you create a trust.

We track and manage all of these actions to ensure there are no loose ends or surprises later on. Following through and following up, make the plan happen. Communicating changes to everyone involved is also extremely important.

The NextGen Wealth Difference

At NextGen Wealth, we thoroughly examine all your documents during the client onboarding process. We’ll walk you through our COLLAB Financial Planning Process™, where we take special care and consider your hopes, fears, and dreams. We’ll help craft a cohesive plan and make all necessary recommendations and referrals to manage your estate planning needs.

Our goal is for you to live a long and prosperous life without worrying about what will happen when your retirement ends. Don’t let another day go by without checking all your documents and scheduling updates. Contact us today to see if we’re a good fit and schedule your free financial assessment.