Kansas City, Missouri Property Tax Freeze for Seniors

Rising costs and running out of money are a huge worry for many retirees. However, moving forward, you may be eligible for a new “tax freeze” on your Missouri personal property bill. Every little bit helps!

You need to be aware of many different rules and procedures. It’s also important to note that not all counties in Missouri are implementing this new benefit. You’ll need to check your specific county to see what applies to you.

Table of Contents

Overview of the Missouri Property Tax Freeze

The property tax freeze for seniors is a nice perk for Missouri senior citizens. It could save you a good chunk of change moving forward. However, some major changes have already been made to the program's initial rollout.

In essence, the program gives you a tax credit for the balance between your bill and last year's bills. In other words, whatever the increase in your Missouri primary residence property taxes is for this year (or your initial year of eligibility), you’ll get a tax credit. This acts to “freeze” your property tax liability at your current amount.

A Quick Note on Credits vs Deductions

It’s important to remember the differences between a tax credit and a tax deduction. A deduction reduces the amount subject to tax (like the standard deduction for income taxes), while a credit reduces your tax bill dollar for dollar. A tax credit is typically much more beneficial.

Eligibility Requirements for Seniors

Initially, there were stricter rules for qualifying. However, the newest bill for Missouri allows a little looser eligibility requirements. The basic criteria to qualify are:

- You must be eligible for Social Security retirement benefits (Note: Not required to be drawing Social Security).

- Must be the owner of record of or have a legal or equitable interest in a homestead [primary residence]

-and-

- You must be liable for paying real property taxes on such homestead [primary residence].

The original bill limited the total value of the home. In the latest version, the home value limit was removed. However, you must remember this credit is only for your primary residence, not a rental property. You can only claim one primary residence in one county.

Luckily, the Missouri Department of Revenue has a flowchart to help determine whether you’re eligible for the credit. However, just because you meet the state eligibility rules doesn’t mean your county has implemented this new credit program.

Missouri Counties Near Kansas City Participating in the Program

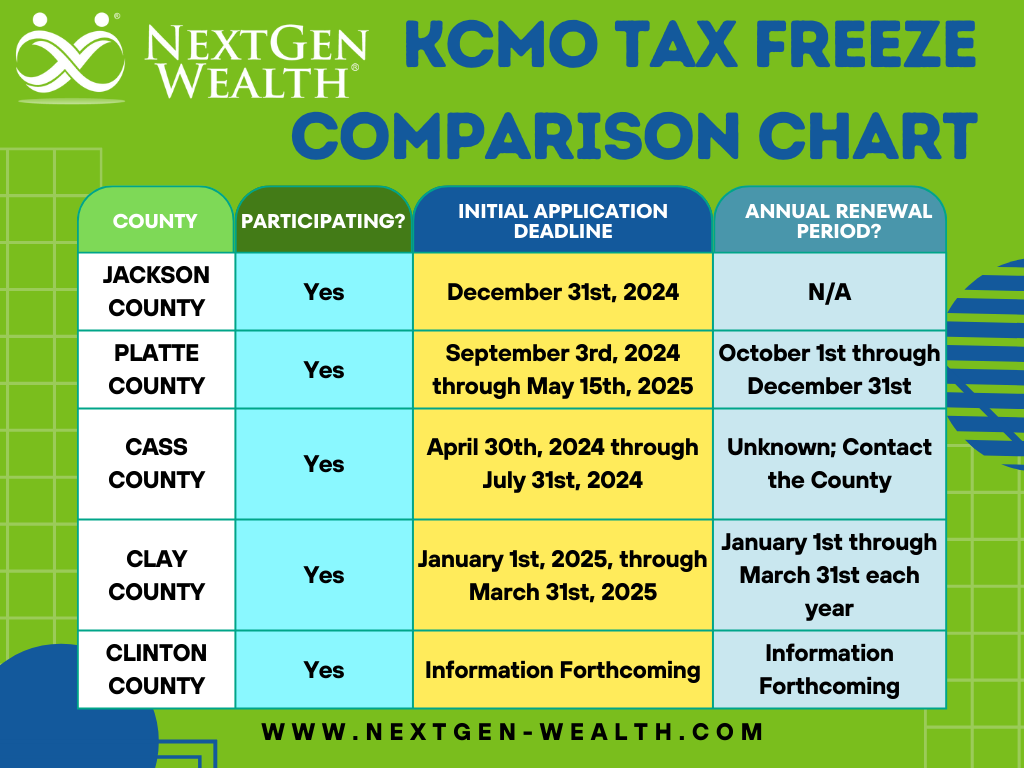

Let’s look into the specific Missouri counties near Kansas City and how they are, or aren’t, implementing the tax freeze.

Jackson County

Jackson County probably has the easiest and most straightforward application process out of the Missouri counties we researched. The Jackson County Senior Property Tax Credit Program website lists all forms and eligibility requirements. Applications are open for the initial enrollment period through December 31st, 2024.

The nicest part about how Jackson County is administering the credit is there’s no annual renewal requirement. However, the county reserves the right to verify eligibility upon request.

Platte County

Platte County started accepting applications for the tax credit on September 3rd, 2024, and will accept applications through May 15th, 2025. After this initial enrollment period, you can submit applications during their annual application period (October 1st through December 31st of each year).

For more information on Platte County, check out their Senior Citizens' Real Property Tax Freeze Credit page or contact the county clerk’s office.

Can you ace this basic tax literacy quiz? See what you know & don't know (& why it matters).

Cass County

Cass County seniors are also eligible for the property tax freeze credit. However, information wasn’t very easy to find on the county’s website. We found quite a bit by using their website’s search function and typing “Senate Bill 190.” We found much more information, including this committee meeting agenda with discussion notes from the Assessor’s Office and Clerk’s Office stating they’re working on software for implementing Senate Bill 190.

Cass County only had a 93-day enrollment period, which ended on July 31st, 2024. We also found this document with more details regarding the documents needed to apply for the credit. Hopefully, more information will be provided in the future. In the meantime, we recommend calling the County Collector’s Office at 816-380-8377.

Clay County

For Clay County seniors, the application window will be from January 1st, 2025, through March 31st, 2025. Applicants must reapply each year during the same period (first quarter of the calendar year).

Clay County also has a page with information regarding its Senior Real Estate Property Tax Relief program and has posted information regarding several public information updates.

Clinton County

Although a little further North, it seems Clinton County seniors will also be getting the property tax credit. Their website has limited information, but they stated they’ll send information regarding public informational meetings in the spring of 2025. The county also says questions and concerns can be brought to the County Commission during their weekly meetings.

Potential Impact on Your Financial Stability

The Missouri property tax freeze could help you maintain financial stability in retirement. We have all felt the effects of inflation, but this new tax freeze credit helps by reducing the burden of rising property taxes. Home values in Kansas City, Missouri, and surrounding areas have continued to rise, so property tax assessments will also start to rise.

Too Little Too Late?

In many cases, property taxes have already increased significantly. There’s even some discourse between Missouri State officials and Jackson County over how they conducted the latest tax assessment cycle. Even if you freeze your tax bill now, the worst initial damage might already be done.

However, this new tax freeze would protect you from further increases. Saving money on taxes is always a good idea.

Impact of the Tax Freeze on County Revenues

The total impact of the tax freeze on county budgets is still unclear. However, property tax revenues are a major source of income for county budgets. If county tax revenue decreases, they’ll need to make up the difference somewhere else or cut back on programs.

It’s probably still too early to tell the short-term and long-term effects. We recommend monitoring additional tax levies or bond issues in the future.

Challenges or Concerns with the Property Tax Freeze

One of the major issues we’re seeing right now with the Missouri tax freeze is getting up-to-date information. Each county sets its own program rules and application procedures. We hope this article helps create additional understanding and knowledge.

The other potential issue with a program like the tax freeze is it's always subject to change. We’ve already seen one change, and the program hasn’t yet been implemented everywhere. It’s important to stay on top of changes as they happen.

What NextGen Wealth is Doing About the Property Tax Freeze

Earlier this year, we started sending out information in our weekly newsletter (you can subscribe here) and notifying clients. For many of our clients, this tax freeze doesn’t change their lives dramatically but helps control a variable in their financial plans. However, there’s no need to miss out on potentially significant future tax savings.

Whether you’re wondering how to save money on taxes or are looking to build your retirement plan, our financial planners in Kansas City got you covered. Contact us today to see if we’re a good fit for you and get your free financial assessment!