What is the Best Social Security Withdrawal Strategy for Me?

This post was last updated on November 30, 2025, to reflect all updated information and best serve your needs.

Deciding when to draw Social Security benefits is one of the most important decisions you’ll ever make as a retiree. You must carefully consider your specific situation and goals. Don’t wait until you’re eligible to make these important decisions.

At NextGen Wealth, we take a comprehensive look at the big picture and then “zoom in” on how to fit Social Security benefits into your overall financial plan. There’s a lot of guesswork in knowing your life expectancy and level of health in retirement. However, we can still get a clear picture of when it may be best to start receiving Social Security benefits.

Table of Contents

A Brief History of Social Security

The Social Security program you know today began with the Social Security Act of 1935 as part of the New Deal. This act established Title II, which laid out the basic framework for the Old-Age Reserve Account that was funded throughout a person’s working life. This account was used to pay a benefit to retired workers starting at age 65.

Sound familiar? The details of the Social Security program have expanded over time, but the old-age benefit is fundamentally the same today as it was then. One key difference is how Social Security is calculated based on each person’s working life.

Today, the Social Security Administration (SSA) administers the Social Security program. There are nearly 50,000 employees at the SSA. That’s roughly 2% of the federal employee workforce in case you’re wondering.

The SSA administers a wide variety of social insurance programs offered today. These programs provide survivors of deceased workers, medical insurance through Medicare, old-age, blind, and disabled worker benefits, and other social insurance-related benefits.

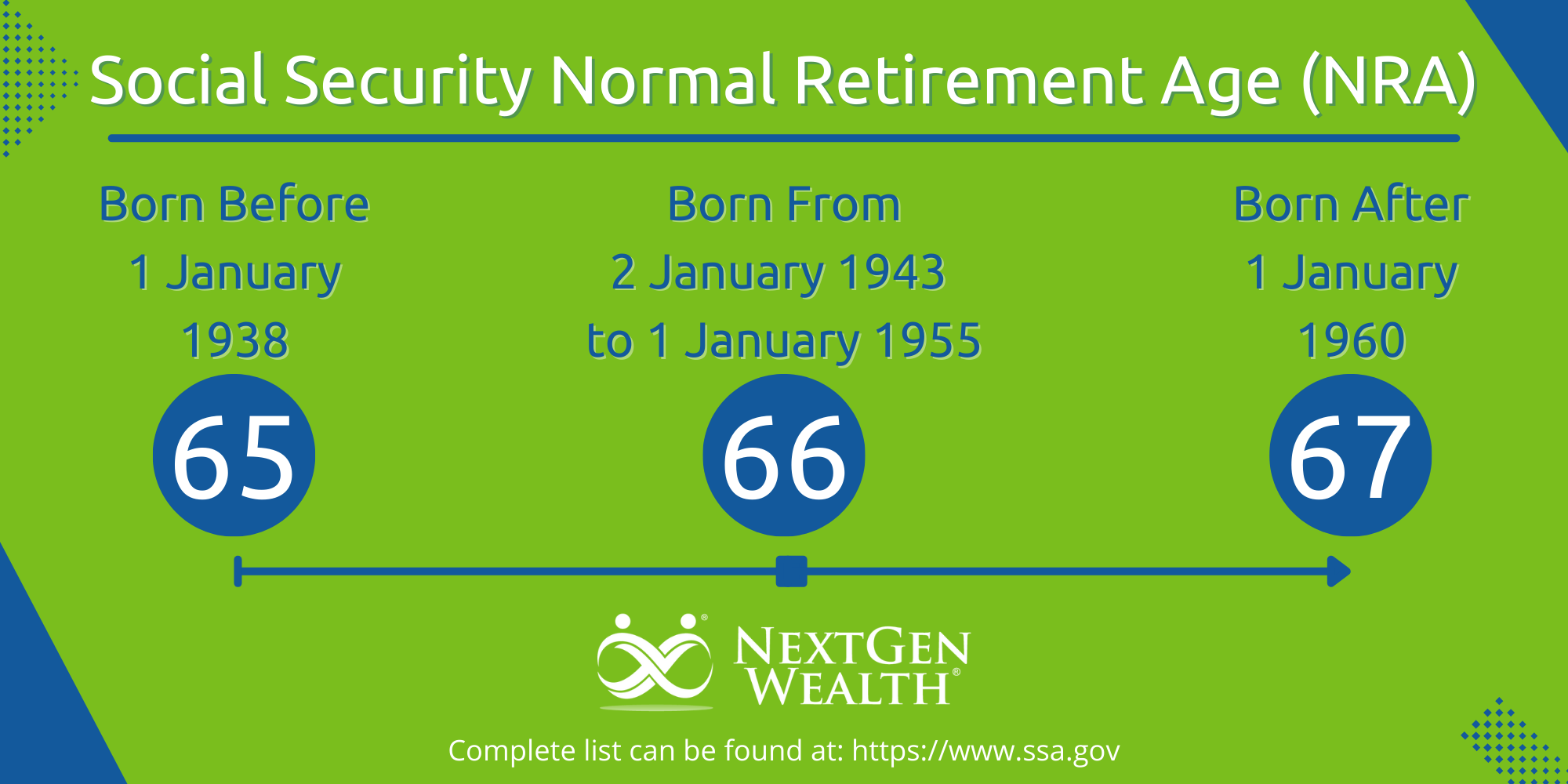

Also, the current normal retirement age has increased from 65 to 67. For perspective, the average life expectancy of Americans was 59.9 years for men and 63.9 years for women in 1935. The overall life expectancy for Americans in 2023 was 78.4 years.

How Social Security is Funded

The main Social Security trust fund is the Old-Age and Survivors Insurance (OASI) Trust Fund. This is a reserve of funds to ensure the government can make required payments to beneficiaries. The last reported balance was about $2.7 trillion.

Most of the funding for the OASI comes from payroll deductions, as it did at the program’s inception. This is deducted along with Disability Insurance (DI) and Medicare Hospital Insurance (HI).

If you are self-employed, you pay the whole tax. If not, you and your employer each pay 7.65%. You will see this deducted as the Federal Insurance Contributions Act (FICA) Tax on your pay stubs. Currently, this is only levied on the first $176,100 of pay.

Calculating How Much Social Security Benefit You Will Get

This can be complicated, but your benefits are based on your highest 35 years of taxable earnings. The SSA has a retirement benefits calculator to help you estimate what you might receive in the future. You’ll need to create a my Social Security account to access your earnings history, or you can estimate your annual salary amounts.

One major factor to consider is whether you’ve worked 35 years total. You don’t have to work 35 years to qualify. However, averaging in many zeroes could reduce your overall benefits. The mechanics of how Social Security is calculated are pretty complicated, but it benefits low-earners more than high-income earners.

When Can I Draw Social Security?

The Social Security Administration tracks three retirement ages as milestones for benefit levels: Full (or Normal) Retirement Age, Early Retirement Age, and Delayed Retirement Age. The monthly benefit amount is lowest if you draw benefits early and increases up to age 70.

Early Retirement and Minimum Social Security Eligibility

To start drawing Social Security benefits, you must be age 62 and have at least 40 Social Security credits. Credits are earned based on your earned income for each year. You can earn up to four credits per year.

In other words, you need to have earned the minimum amount, $7,240 or $1,810/credit for 2025, for at least 10 years in your lifetime. However, these don’t have to be consecutive. You could have earned $1,810 per year for 40 years and met eligibility requirements.

Just remember, your benefits are reduced each year you draw before your full retirement date. Withdrawing at 62 would permanently reduce your benefit by 30%.

Normal or Full Retirement Age

To receive your full Social Security benefit payment, you need to wait until you are at least your full retirement age. This varies based on your date of birth, but the current normal retirement age is 67.

Delayed Retirement Age

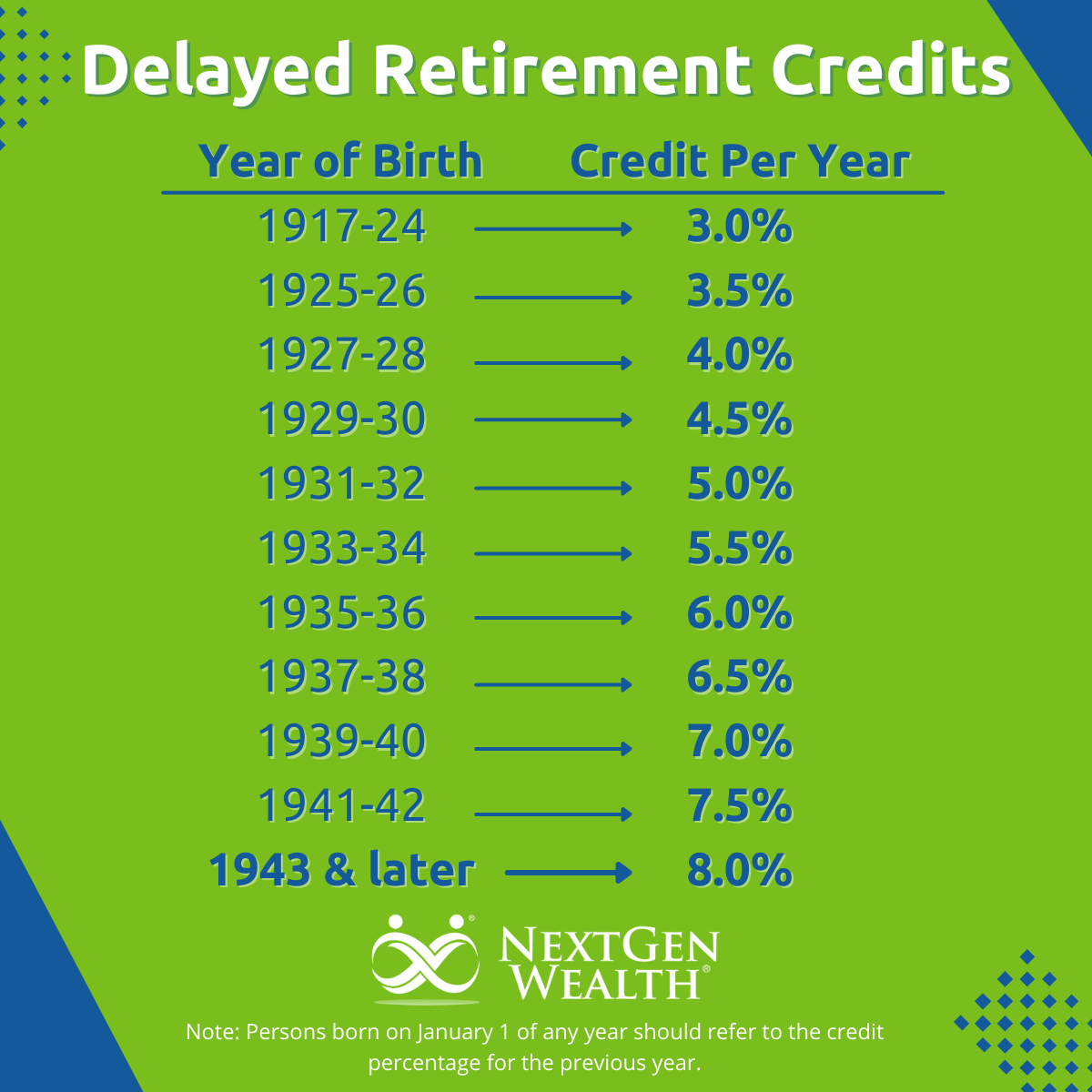

Another option is to wait longer, up to the age of 70, to get the maximum monthly benefit amount. This gives you delayed retirement credits, which increase your benefit amount for waiting past your normal retirement age.

You can receive an increase in benefits of ~8% each year after full retirement age. However, there is no increase in benefits after age 70.

Spousal Benefits

One other consideration is that if you don’t qualify for Social Security, you may be able to receive benefits if your spouse qualifies for Social Security. Also, if your spouse passed away, you can claim benefits based on your spouse’s earnings. If you are divorced or remarried, there are additional considerations.

Maximizing Your Benefits

Once you know how retirement age can affect your benefit amount, you can start to strategize on when to draw benefits. It’s impossible to know with absolute precision what is best (if only we knew exactly how long you would live), but we can optimize your choice based on your goals and what we know about your life.

In other words, what are you solving for? Do you want to get the most money over your entire lifetime? Would you like the highest monthly cash flow later in life? Or do you just want to retire early and move on?

Maximizing Monthly Social Security Benefits for Monthly Cashflow

Maximizing total monthly Social Security benefits is relatively easy. There’s a calculator on the SSA website to help with this. However, the maximum monthly benefit will always come from waiting to draw until age 70.

If you were born after 1943, each additional year you wait to draw benefits adds ~8%. This is called a delayed retirement credit. The maximum benefit if you were born after 1960, drawing at age 70, is 124% of your primary insurance (benefit) amount.

Depending on your year of birth and how long you delay drawing Social Security, you could receive as much as 130% or more of your full benefit amount. Keep in mind, you technically could wait to draw until after age 70, but you will not receive any additional delayed retirement credits, so it doesn’t make sense to wait any longer than age 70.

Maximizing for Enjoyment Now

You might want to retire as soon as possible. In this case, drawing Social Security sooner rather than later might seem like a good option. However, your monthly benefit amount is reduced…forever!

For each year you draw Social Security benefits before your full retirement age, your benefit amount will be reduced by 5/9 of 1% for the first 36 months and 5/12 of 1% for each additional month you draw early. If you draw at age 62, you could be reducing your monthly benefit by up to 30 percent for the rest of your life!

You might look at the amount you’ll get at age 62 and decide that’s enough for you. Also, if you have a health concern or a shorter anticipated lifespan, you may want to draw benefits earlier to help you enjoy the time you perceive you have left. To be clear, this is different than if you know you are terminally ill. There are other considerations if that’s the case.

Maximize for Total Benefits Paid to You

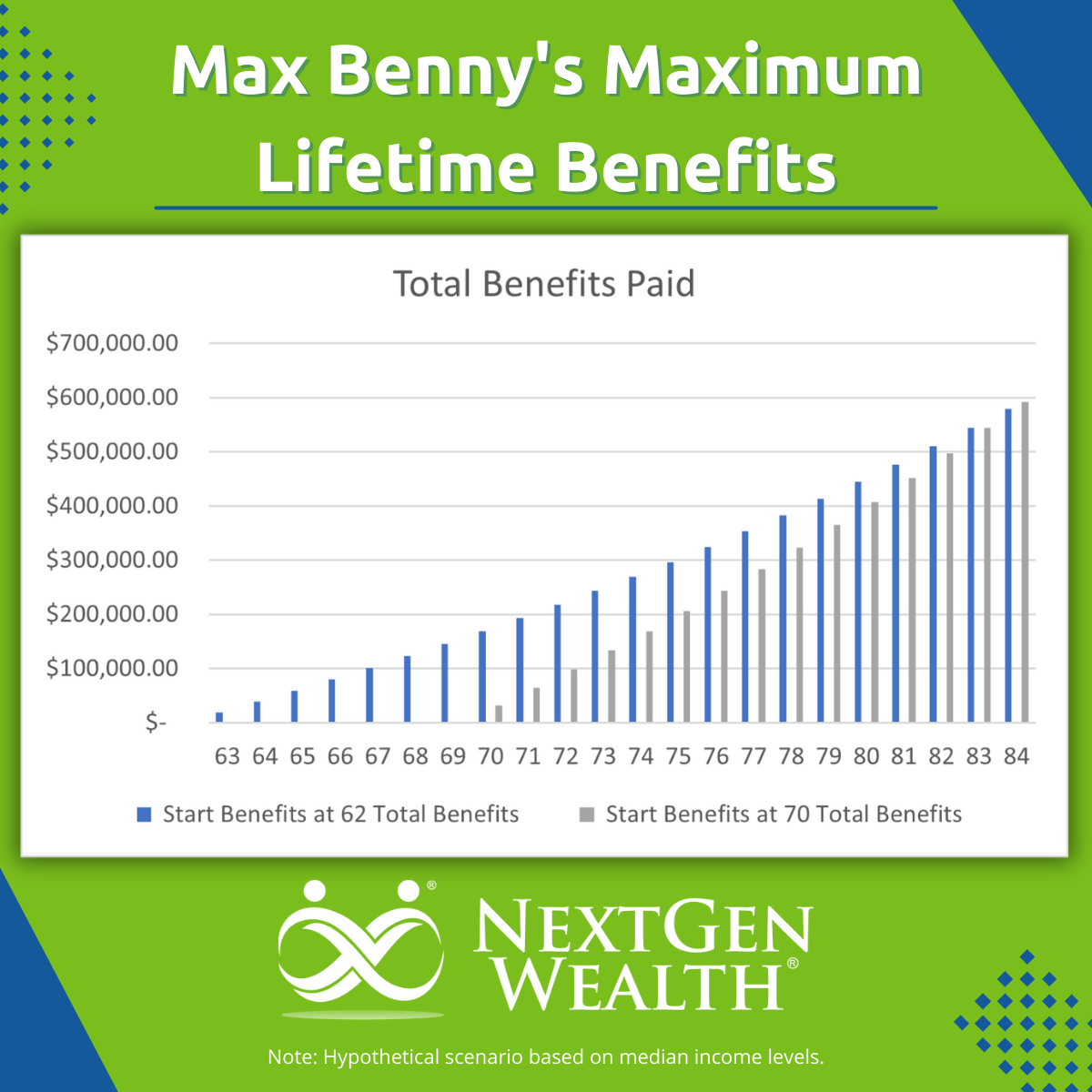

You might be wondering how to get the most money back over the rest of your lifetime. You might be surprised at what we found in our example using median income levels.

Our imaginary friend, Max Benny, is a 62-year-old who started working at 18 and earned the median income. He also finished his working career earning the median income. He really is an average Joe at heart.

Max calculated his estimated monthly benefit at age 62 to be $1,507. At age 70, his maximum monthly benefit would be an estimated $2,654. That’s a significant difference. However, Max is wondering whether it’s better to start drawing earlier at age 62, when he becomes eligible, or at his full retirement age.

If Max starts drawing at 62, he’ll get a higher total lifetime dollar amount until age 83. In other words, he’d have to live until age 84 for it to be worth waiting until age 70 to draw Social Security.

Longer Life Span

If Max lives longer, waiting to draw would be mathematically optimal. If Max lives to be 100 years old, he’ll receive a total of $1.25 million if he starts drawing at age 62, and $1.52 million if he waits until age 70.

Although living to age 100 is fairly rare in America, some families tend to live particularly long. If longevity is a family trait, take this into consideration.

When You Live Longer, You’re Expected to Live Longer

It’s also important to understand the life expectancy for a 65-year-old is different than at birth.

For men who reach age 65, their life expectancy is an additional 17.48 years, for a total of 82.48 years, versus the median at birth of 74.74. For women, this is slightly higher, with a remaining life expectancy of 20.12 years (age 85.12), versus 80.18 at birth. In other words, if you make it to the age of 65, there’s a good chance you’ll live into your eighties.

Additional Considerations for Drawing Social Security Benefits

It’s straightforward to get a basic understanding of when to start drawing Social Security benefits. However, there are always some other variables at play. We need to zoom out and look at the big picture to ensure we’re not affecting other optimization strategies.

Continuing to Work Part-time or Full-time

Even though you’re drawing Social Security benefits, you could still want to work. Many retirees work until the age of 65, when they become eligible for Medicare. If you’re not careful, your Social Security could be reduced for the additional income you make.

However, once you reach full retirement age, your Social Security benefits are no longer reduced. For income above the threshold, you’ll have to pay taxes on your earnings, as well as a portion of your Social Security benefits.

Roth Conversions

If a Roth conversion strategy makes sense in your situation for tax savings, you’ll want to align this with your decision to draw benefits. The additional income from Social Security could complicate the taxation of your Roth conversions. This can be an important consideration if you anticipate having required minimum distributions (RMDs) from your other retirement savings.

Spousal Benefits

If you’re a widow or widower, it may be more advantageous to draw based on your deceased spouse’s benefits, and then switch to your benefit amount later. This is worth looking into at a minimum.

What Are You Really Solving For?

If your head is spinning thinking about all the different nuances to the Social Security system, don’t worry, you’re not alone. Making decisions based on guesses about your own mortality isn’t a fun exercise. However, these are important decisions to make.

Overall, you want to maximize your quality of life and enjoyment. Getting the most out of the benefits you earned is essential as well. Consulting a financial planner to help make sense of your specific situation can give you peace of mind, regardless of what you decide.