What is a Solo 401(k)?

This post was last updated on October 25, 2022, to reflect all updated information and best serve your needs.

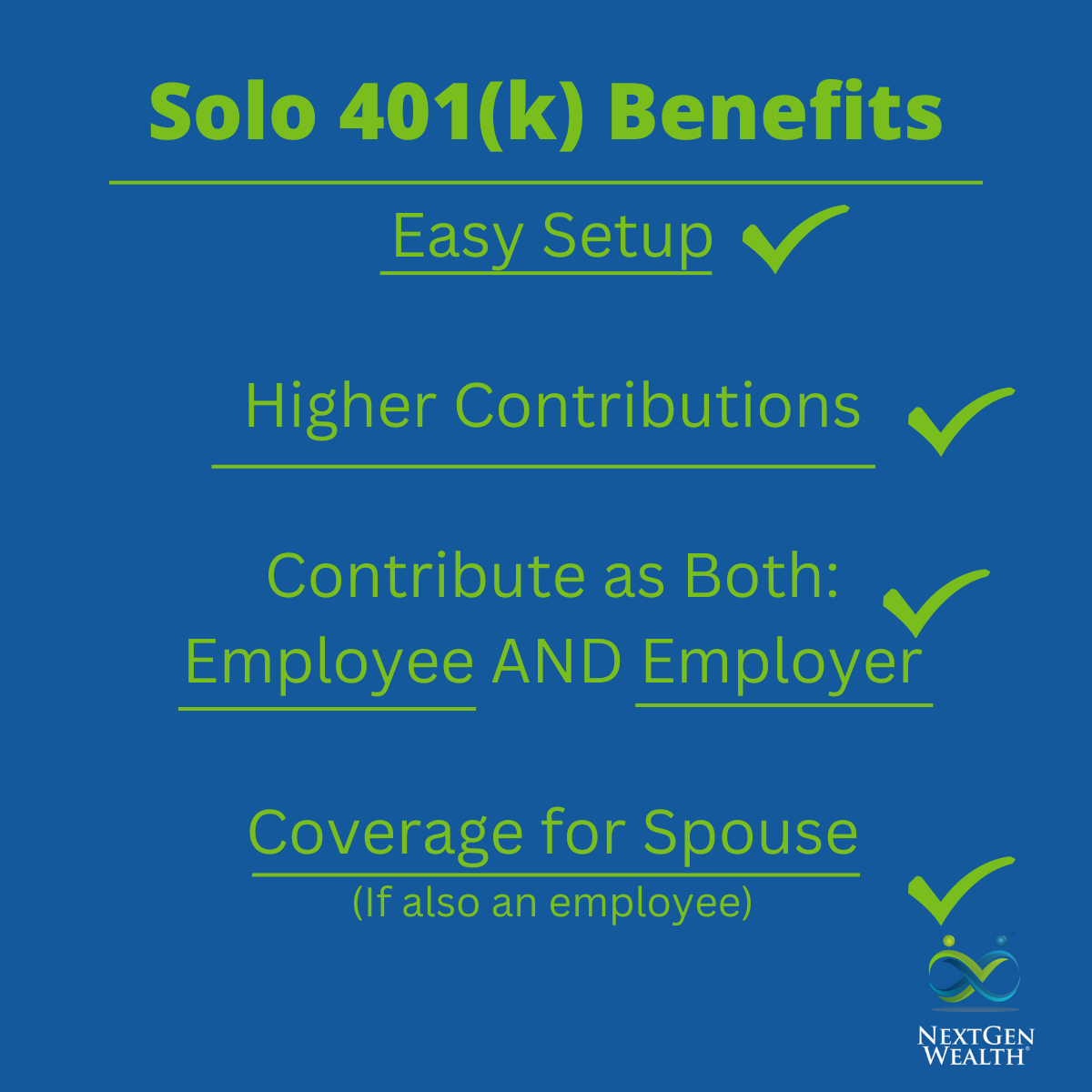

The Solo 401(k) is one of the most powerful retirement savings options for self-employed individuals. If you’re trying to save on taxes, save for your future, and run a business, the Solo 401(k) might be right for you.

The Solo 401(k) is one of the most powerful retirement savings options for self-employed individuals. If you’re trying to save on taxes, save for your future, and run a business, the Solo 401(k) might be right for you.

Many companies set up 401(k) plans for their employees, but if you work for yourself, you might be wondering what options you have. A one-participant 401(k), also known as the solo 401(k), is one of retirement tools available to self-employed individuals. Solo 401(k)s give self-employed individuals and business owners the opportunity to save for retirement just like they would with an employer-sponsored plan.

The History of Solo 401(k)s

401(k)s weren’t the first option available to the self-employed or business owners. For example, Keogh Plans and SEP IRAs were available for self-employed and small businesses already. However, Keogh Plans require a lot of paperwork to set up. SEPs are limited to the smaller of 25% of income or $66,000 (for 2023).

Solo 401(k) had existed in some form since 1981. However, in 2001 Congress passed the Economic Growth and Tax Relief Reconciliation Act (EGTRRA). This made some key reforms to retirement plan contributions, portability, catch-up contributions, and many other things too.

More importantly, 401(k), including Solo 401(k), contribution limits were increased. This made earlier Keogh, SEP IRAs, and SIMPLE plans less desirable. Also, EGTRRA allowed for Roth 401(k) contributions as well.

The new limits allowed up to 100% of salary deferrals by the employee and up to 25% of salary contributions by the employer. This meant a self-employed person could potentially put much more away for retirement.

How Solo 401(k)s Work

A Solo 401(k)s works very similarly to employer sponsored 401(k)s. The biggest difference is Solo 401(k)s are for self-employed individuals. IRS rules specify Solo 401(k)s cannot be used if you have employees.

Contribution Limits

Contribution limits on Solo 401(k)s are the same as traditional 401(k) plans.

The annual employee contribution limits for 401(k)s are $22,500 for 2023. Total employer and employee contributions cannot exceed $66,000 (2023). For employees over 50 years of age, they have the option of contributing up to an additional $7,500 to their plan.

When you are self-employed, you are both the employer and the employee. As the employee, you can contribute up to 100% of your salary or $22,500. Then you can contribute an additional 25% of your salary as the employer – up to the maximum defined contribution plan limit of $66,000.

If you are a full-time employee covered by your employer’s 401(k) plan, you can still contribute to a Solo 401(k) through a side job. Unfortunately, this does not raise the total contribution ceiling on your separate 401(k) plans. The annual contribution limit is set across all your plans, not for each individual plan.

Eligibility for a Solo 401(k)

If you are self-employed and don’t have any employees, there are very few restrictions on Solo 401(k)s. There is no age restriction or restriction on the level of income you need to start one. As soon as you add an eligible employee, you must make certain the 401(k) plan meets ERISA rules.

Note: Solo 401(k)s can cover a spouse if they’re an employee in the business as well.

Differences Between Traditional 401(k)s and Solo 401(k)s

The biggest distinction between a 401(k) for a single person and a company with multiple employees is the plan must conform to ERISA standards if there are employees. In other words, you aren’t going to need protection from yourself (or at least we can only hope!). Once you add employees, then you must meet ERISA standards or enroll in a safe harbor plan.

Tax Advantages of Solo 401(k)s

Just like other retirement account types, your Solo 401(k)s gives you the option to contribute to a traditional or Roth account. Technically, the Roth account is a “sidecar” account attached to your main 401(k). This gives you a little more flexibility in terms of how and when your income is taxed.

Which should you choose?

As always, it depends. Tax now or tax later, the IRS always gets their cut. However, Roth contributions can be helpful if you’ll run into issues with required minimum distributions (RMDs) or anticipate to be in a higher tax bracket in retirement.

On the other hand, if your income is reaching into the higher tax brackets now, you may want to take the tax deduction now and defer paying taxes until you withdraw in retirement.

Covering Your Spouse on your Solo 401(k)

You cannot contribute to a solo 401(k) if you have an employee, but fortunately, the IRS does allow one exception: if your spouse also earns income from your business.

If your spouse does work for your business, this can effectively double the amount you can contribute to your solo 401(k) plans as a family.

How does it work?

Your spouse can make elective deferrals to their own 401(k) as an employee of your company. Their contribution limit would be the same $22,500 and can also include an additional $7,500 if they are 50 years or older. As the employer of your own company, you can then make a profit-sharing contribution to your spouse of up to 25% of their compensation.

Solo 401(k) vs. SEP IRA

The main advantage a Solo 401(k) offers over a SEP IRA is the contribution limits. For Solo 401(k)s, as the employee, you can contribute up to $22,500 or 100% of your compensation plus 25% of compensation as the employer. The SEP IRA allows up to 25% of compensation. Both are limited by the annual defined contribution limit of $66,000.

SEP IRAs do not offer the $7,500 annual catch-up contribution like Solo 401(k)s.

Reporting and Paperwork

You will need to file some paperwork to start a solo 401(k). The IRS requires owners of Solo 401(k)s to file an annual report (Form 5500-SF), but this is only if you have $250,000 or more in the total value of your assets at the end of any given year.

How to Open a Solo 401(k)

Solo 401(k)s can be opened with many custodians or financial advisors. You will need an Employer Identification Number (EIN) to open your account.

You will need to fill out an application for your account, and your advisor should provide a plan adoption agreement for you to sign and complete as well. After the paperwork is squared away, you are ready to start setting up and making contributions to your account.

Like a traditional 401(k) you will be able to access all types of investments which can include:

- Index funds

- Exchange-traded funds

- Bonds

- Mutual funds

- Individual stocks

Prior to the SECURE Act, a Solo 401(k) had to be implemented by December 31 of the tax year to be able to accept contributions for the year.

You can now establish a plan up until the tax filing date of the business, including extensions, and will be able to treat the plan as if it has been established on the last day of the prior year. Your new plan can now accept contributions for the prior tax year.

This time extension only applies to plans funded via employer contributions, such as the profit-sharing component of the Solo 401(k). Employee contributions via salary deferral won’t be able to be made for the prior tax year in this situation.

Is a Solo 401(k) Right for You?

This is only one piece of your financial puzzle. A Solo 401(k) can be an excellent tool for building your retirement portfolio. Factors like your income level and business structure are key considerations.

The real question is what your overall goal is and whether the Solo 401(k) will be able to get you there. If you plan to have employees later or have a high income, a SEP IRA may suit your needs perfectly. However, you may find a Solo 401(k) is the right tool for you.