What is a Qualified Domestic Relations Order (QDRO)?

Whether you’ve been married five years or 25 years, divorce presents many challenges - including financial issues. This is likely a difficult time as you navigate uncharted waters.

Friends and family may try to give you helpful information, but having a trusted attorney, tax professional, and financial advisor are essential to protect what you have and help you make informed decisions.

Throughout divroce, it’s important to keep track of how legal processes work. This can be incredibly overwhelming. Life may seem a bit unpredictable and frightening as you contemplate the next chapter in your life.

Typically, an attorney will be representing you to ensure your best interests are protected and all the necessary legal paperwork is processed. No matter how qualified and professional your attorney is, it’s incumbent upon you to understand your legal rights and requirements before your divorce settlement is finalized. This is especially true when it comes to retirement plans.

What is a Qualified Domestic Relations Order (QDRO)?

Retirement plans, such as 401k’s, require additional court paperwork and proceedings for allocation between the divorcing parties. For financial institutions to carry out these instructions, they require a legal order called a Qualified Domestic Relations Order (QDRO). This requirement is essential for protecting your financial assets. Without obtaining a QDRO, you may have some serious consequences after the divorce that may negatively impact your finances.

Why a QDRO is Needed?

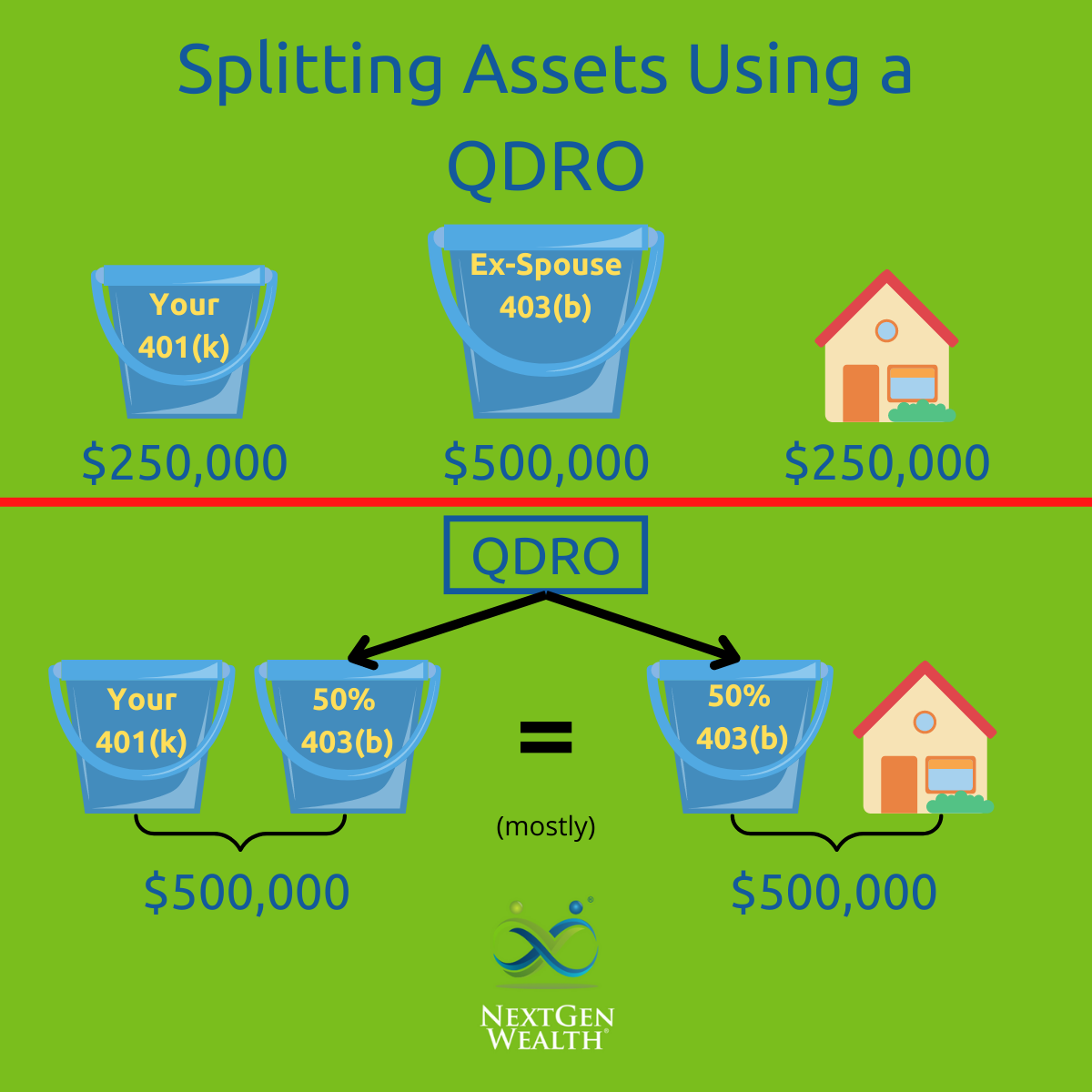

The QDRO is a court order or decree that divides retirement accounts between the divorcing couple. The designated allocation isn't always a 50-50 split. There are multiple reasons for this including custody of children, who keeps the house, and alimony agreements.

For example, you have the following assets: house valued at $250,000, your 401(k) valued at $250,000, and your ex-spouse's 403(b) valued at $500,00. Your ex-spouse is awarded the house. In order to make things "equal," you are given $250,000 of your ex-spouse's 403(b).

How Do I Get My Money?

In order to receive the $250,000 from your ex-spouse’s qualifying retirement fund, you’ll need a QDRO. Without it, a distribution to satisfy the split could have serious tax implications. Without a QDRO, the custodian of the account won't release those funds to you regardless.

The QDRO establishes both the legal right and the terms for the division of qualified retirement funds.

Qualifying retirement plans are those defined contribution plans governed by ERISA, the Employee Retirement Income Security Act of 1974. Individual Retirement Accounts (IRAs) are not covered by ERISA and do not need QDROs for division between divorcing spouses.

How to Obtain a Qualified Domestic Relations Order

When it comes to obtaining a QDRO, your attorney will probably complete the initial form. The “plan participant” is the reteirement account owner, and the “alternate payee” is the spouse.

Separate QDRO for Each Account

Each retirement account requires a QDRO and should be included to present to the judge. QDRO forms contain information regarding how the accounts are being divided, for example a 50-50 split.

If both spouses have qualifying retirement accounts, they should be listed. Only qualifying retirement plans, such as 401k's, are covered by QDROs. Individual Retirement Accounts are not included in this paperwork. Each qualifying retirement plan owned by the divorcing parties needs a QDRO. And all paperwork must be completed as required.

Before the judge or a retirement plan administrator approves a QDRO, certain information must be provided. When completing a QDRO form, you’ll need to include the names of the plan participant and alternate payee along with information about the division of the plan, which as mentioned is usually a 50-50 split.

Other relevant details like type, amount and frequency of payments to the alternate payee is also necessary. Often retirement plans have their own QDRO forms. Your attorney will need to complete the plan-specific form in these circumstances.

Finalized in Court

Once the QDRO form is completed, your attorney will submit the paperwork to the judge for signature. The court order will state that a qualified domestic relations order is being established in compliance with your state's domestic relations law and Section 414(p) of the Internal Revenue Code.

After the judge signs off, the QDRO paperwork is submitted to the individual plan administrator. Once the retirement account administrator accepts the court order, it’s considered “qualified”.

As a special note, it can take months for an administrator to approve the QDRO, and in some cases this process can take up to 12 months. You may find it beneficial to submit your QDRO to the plan administrator for pre-approval prior to submission to the judge for signature. This may help speed up the process for final approval by the retirement company.

Other Designated Payee

Though the ex-spouse is normally the designated alternate payee, there are situations when the QDRO is established to benefit someone else. Most often, this would be to guarantee child support payments through the retirement account.

In this scenario, a trustee — usually the ex-spouse — is appointed to receive the payments on behalf of the minor child. The money is to be spent to provide for the welfare of the child. In many ways, it functions like a regular QDRO. The trustee receives the checks and the money is taxed as investment income without any early withdrawal fees.

Though it may seem like considerable detail, it’s important that the QDRO form be completed accurately to avoid any unwanted consequences down the line. Having a tax professional review the document after your attorney completes it may be a good idea —especially with multiple retirement funds or in complicated divorce cases.

Since calculating retirement fund amounts can be challenging, having a financial advisor review the QDRO form before it’s given to the judge may also be beneficial. A divorce can have a significant impact on your future retirement planning and making informed decisions is critical for your financial well-being.

Remember the old adage — “measure twice cut once” — in this situation. Divorces are often stressful, and you may overlook important details that your financial advisor catches.

Once You Receive a Qualified Domestic Relations Order

Once you receive a QDRO, you can withdraw money from the retirement account. It’s important to consider the different options in planning for your financial future though.

Lump sum or Rollover

You can withdraw the money as a lump sum. You’ll pay taxes on the lump sum as income, but you will not be subject to early withdrawal tax penalties. Another option is to roll the retirement account over into a new or existing retirement account. By rolling over the retirement funds, you avoid any income taxes. This is typically the best option.

Depending on your circumstances, a lump sum is most useful if you need the money to live on after the divorce. Taxes aside, this may be a necessary choice. A consultation with a financial advisor may give you other options to help preserve your assets as best possible.

Leave it Where It Is

In some instances, you may choose to leave your portion of the retirement fund with the current retirement plan. If that’s the case, you’ll draw up a QDRO that specifically states the account is indefinitely split. You’ll be able to make contributions to the retirement fund until you’re prepared to begin distributions.

Given the options — and your unique financial situation —consultations with a tax professional and a financial advisor prior to completion of a QDRO are recommended. As you can tell, financial planning after a divorce and preserving your assets can seem a bit daunting.

Speaking to a professional prior to the divorce settlement can help avoid common pitfalls and make sure you have a solid roadmap for your personal financial goals. Once your divorce is finalized, updating your estate plan is a critical next step.

Tax Considerations

As mentioned previously, you won’t have to pay early withdrawal fees when accessing retirement money under a QDRO. Typically, the IRS imposes a 10 percent penalty on early withdrawals from retirement plans before age 59½.

There are exceptions to this law, such as receiving a distribution following a divorce. Because of the protection of the QDRO, as a plan participant you won’t have to pay any tax penalties when transferring the money to your ex-spouse.

If you don’t have a QDRO, you’ll be taxed on the money in your retirement fund that’s awarded to your ex-spouse. The money will be considered a taxable distribution, and you’ll also have to pay the 10% early withdrawal penalty. That can be a hefty sum of money, depending on the amount of money within your retirement account.

If you’re going through a divorce and have a retirement fund, filing for a qualified domestic relations order should be a priority and completed before the divorce settlement to avoid any tax consequences.

Limitations of a Qualifying Domestic Relations Order

There are limitations to QDROs. Once the order is established, the terms are set. For example, the plan will not distribute increased benefits to you above the defined allocations. So if you agreed to 40% of the retirement account, the plan administrator will not give you 50% down the line.

Also, you’re not entitled to any benefits or options not currently included in the retirement plan. As the alternate payee or plan participant, you can’t designate a different alternate payee, such as a child or grandchild either.

As with all legal documents, make sure to fully understand the paperwork before signing or agreeing to the contents. Divorces can be unsettling and it’s easy to overlook things, especially when feeling inundated with documents pertaining to legal processes. Having a sure footing when moving forward with a QDRO can save you headaches down the road.

Options Other Than a Qualifying Domestic Relations Order

Qualified domestic relations orders can be time-consuming. The paperwork, legal process and approval by the plan administrator can be a lengthy ordeal. Based on your personal circumstances, other options may be preferable.

For example, in lieu of a portion of a retirement account, other assets can be negotiated during the divorce. Other investments, including real property like a house, can be agreed upon other than a retirement fund. And a QDRO wouldn’t be necessary. This can work out to the benefit of both parties in the divorce.

Additionally, the judge presiding over your divorce may decide to let each of you keep your individual retirement plans. This can occur when the plan amounts and earnings are similar during the marriage.

It’s important to determine whether you need a QDRO based on all of the available financial information and in discussion with your attorney about your divorce settlement negotiations.

Working With a Professional

Setting financial goals and planning for retirement are challenging undertakings for many. Going through the often stressful and emotionally charged process of a divorce can make understanding and plotting your financial future even more difficult. It’s hard to focus on some of the “nuts and bolts” of your life when everything may seem in upheaval.

That’s why working with a financial planner may make life easier for you. Knowing that a trusted advisor is looking after your best financial interests can make the period during and after a divorce less burdensome for you. The financial planning process helps keep you on financial track and aims to protect your assets so that you can enjoy your future.

If you’re going through a divorce or need help with financial planning, feel free to reach out and we would be more than happy to help.